You don't have to pay 1% to get direct access to Dimensional Funds (DFA funds)

Low Cost DFA Approved AdvisorsI love Dimensional Funds, they are a great asset manager & pioneer in the financial industry. The question is: Are you paying too much for your advisor & access to DFA?

Your current Advisor is hoping you don’t run this analysis!

Please watch the brief video below. It might save you $6k to $20k per year! We work with Clients on a national basis. Take action & schedule a free 2nd opinion below! We will show you the data!

Many Advisors are living in the past and still charge 1% on the first $1 to $3 million! If you have $1M to $10M+, it is time to reconsider your strategy. Fees matter!

Does your current advisor provide asset management, tax strategy & detailed financial planning in your base fees or is this extra? We provide all of this and more. $2M is at 0.45% per year, $3M at 0.40%, $5M at 0.36% per year! This can save you 40% to 50% over your current fees!

Does you advisor have extreme tilts to value, small cap or international? Has this worked or is it a red flag?

Can you afford a high cost advisor in a high cost state like CA, NY, NJ and other coastal areas? Fees matter.

If you use a CPA over very small Advisor, do you have direct access to DFA or do you have another layer of fees with a TAMP (like Loring Ward, Carson Wealth, Edelman Financial or Matson Money) to get access to DFA? This might cost you 40% more in fees.

Bottom line: you might be paying 30% to 50% more in fees. We work with Clients on a national basis. If you have over $300k in a portfolio (including your 401k), take action and get a free 2nd opinion and find out!

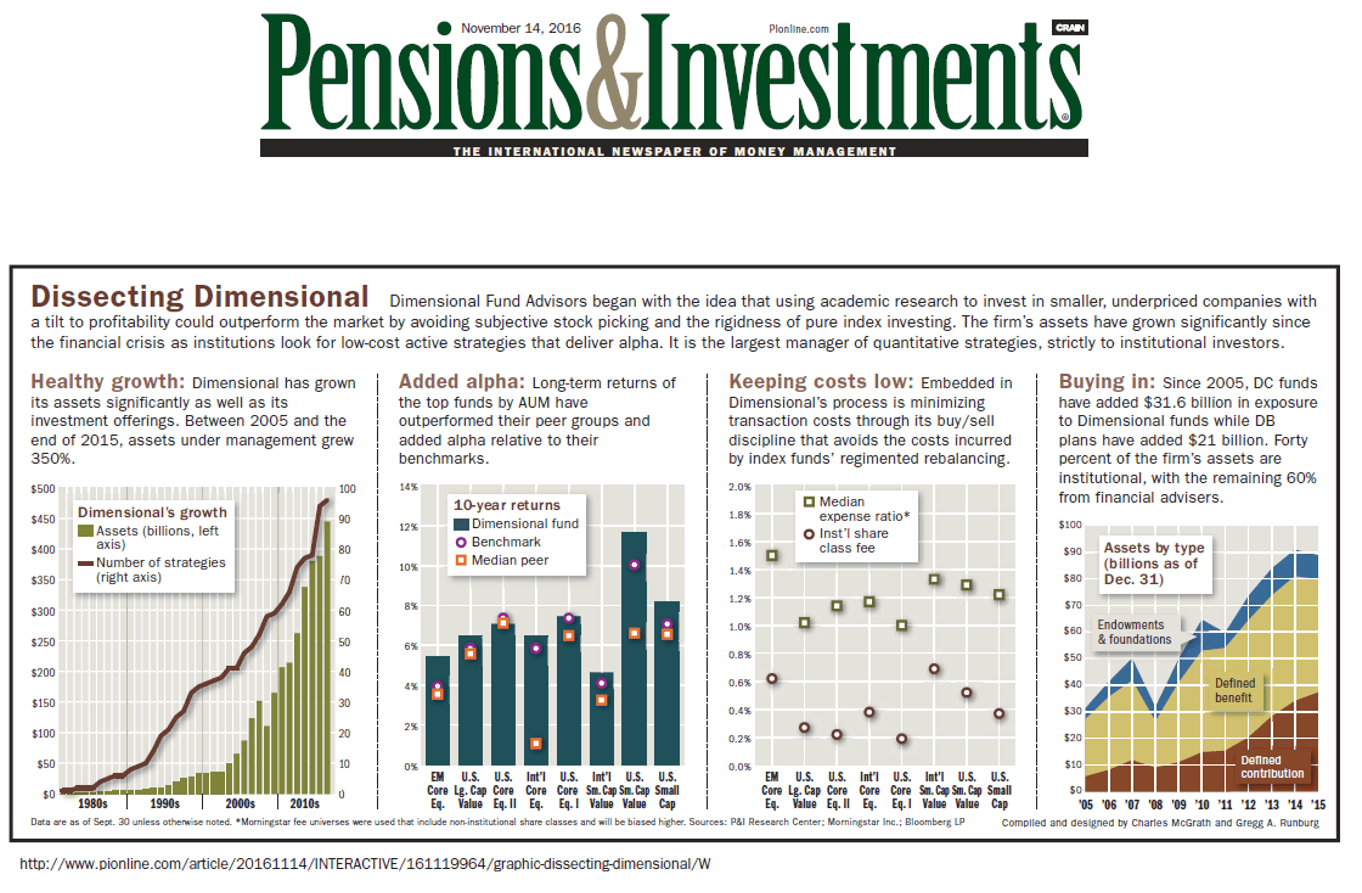

DFA funds are only available to institutional clients (pensions, 401(k), etc.) and through select Fee-Only Advisors. Integrity Investment Advisors, LLC is one of a handful of advisors to be approved to offer clients direct access to DFA funds to our clients. See our recent press release regarding our partnership with Dimensional Funds (DFA). You don’t have to pay 1% for access to Dimensional Funds (DFA).

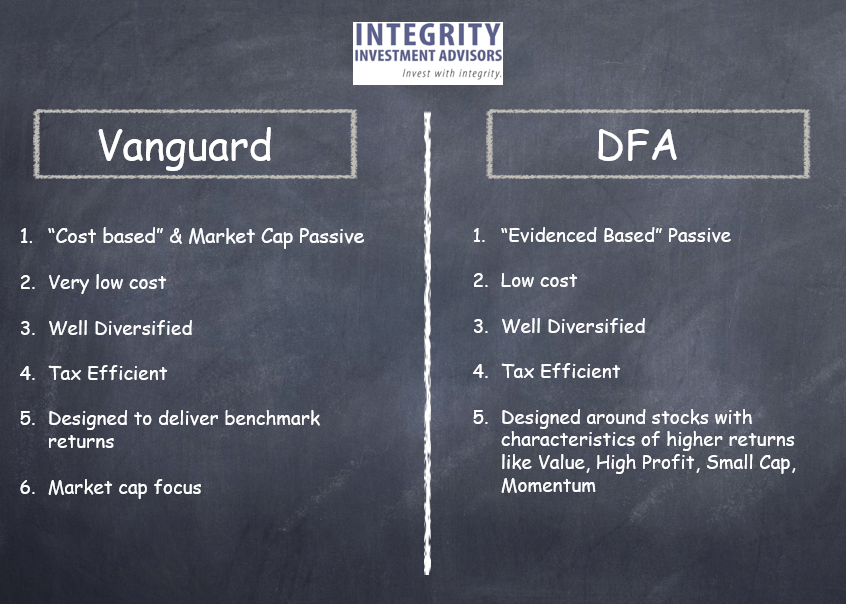

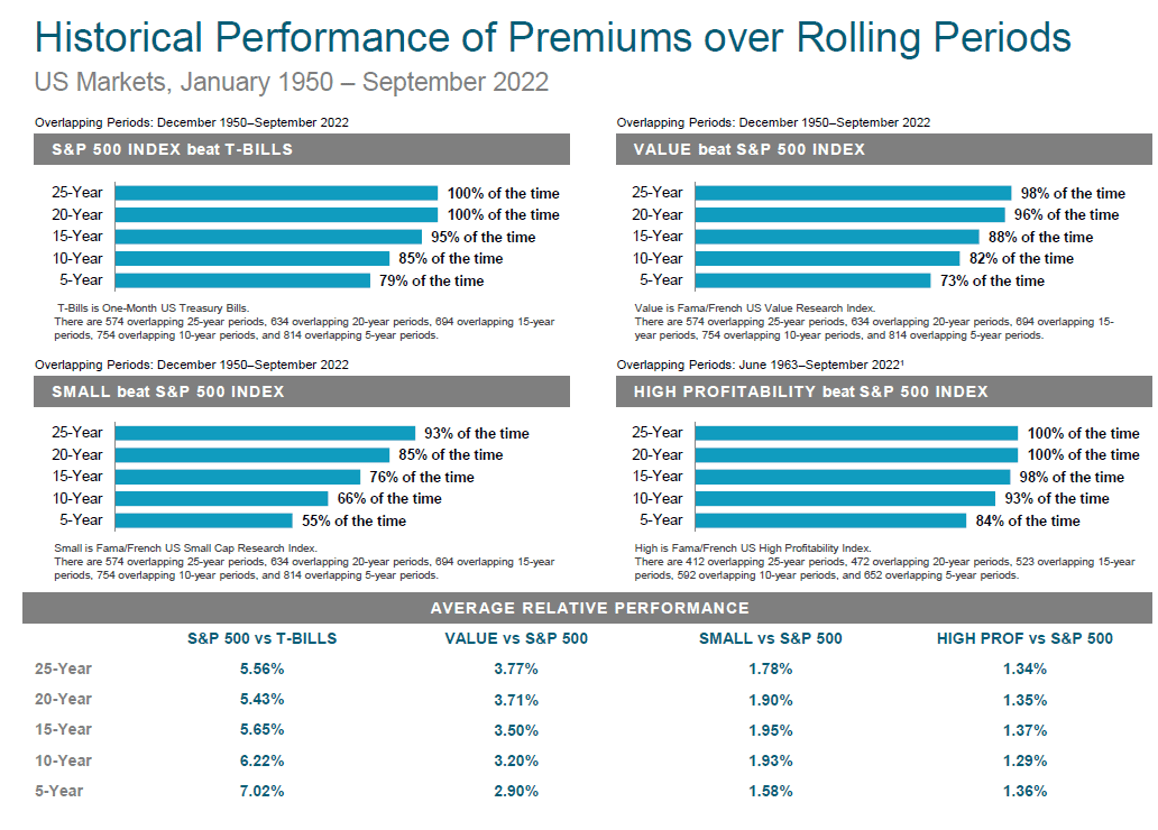

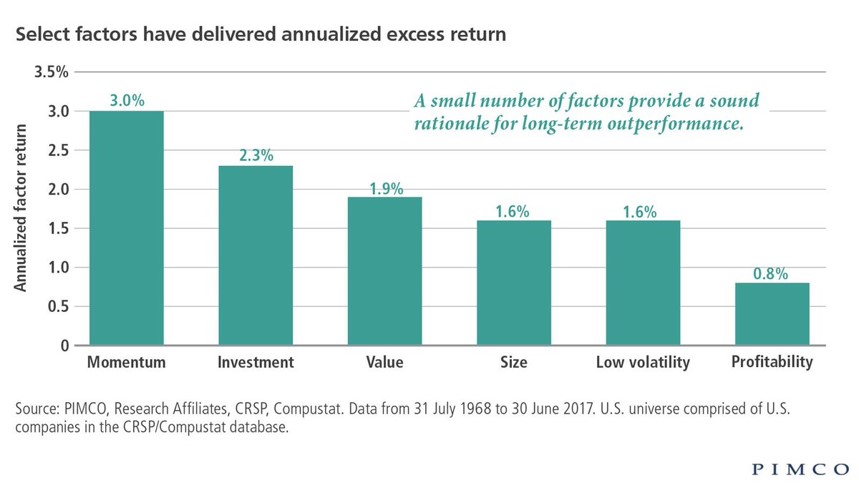

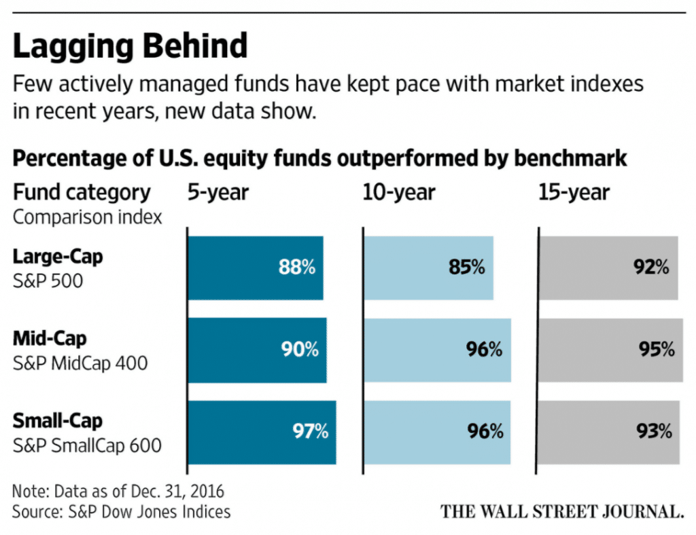

DFA funds are no-load (commission-free), low cost, very diversified, and tax-efficient. They provide a much broader and deeper coverage of the global markets than other mutual funds. DFA currently manages about $582+ Billion in assets. DFA funds focus on “factor investing”. They have enhanced the 3 factor model into the 4 factor model (market factor (beta), small cap factor, value factor and direct profitability factor). DFA also uses momentum as a trading strategy. We believe that these strategies can add additional diversification and incremental returns over decades vs. a simple indexing strategy.

At Integrity Investment Advisors, we offer direct access to DFA funds. Our fees are 0.6% on the first $1 million and fees decline above $1 million. We also invest with other companies like Vanguard, iShares ETF’s, and others. For highly taxable clients, ETF’s may offer additional tax savings. We also offer financial planning and life planning. Find out how to have the best life possible with the money you have. If you have a portfolio of over $500k and would like a free second opinion about your strategy, hidden fees and red flags, schedule a meeting below. You don’t have to pay 1% for access to Dimensional Funds (DFA).

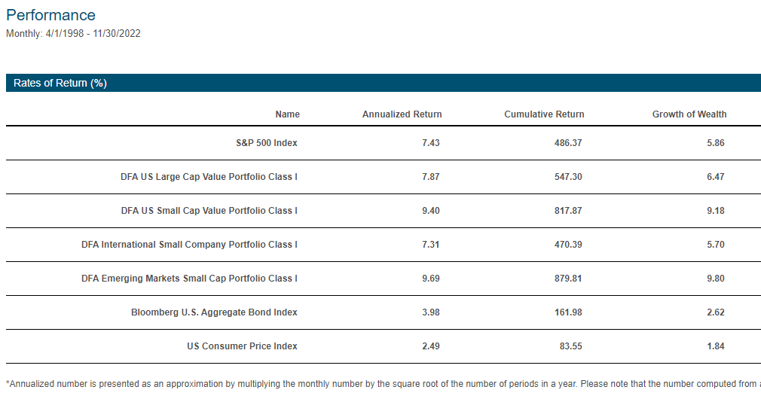

Look at the performance since 1998 (net of operating expenses for Dimensional (DFA) funds). Past performance does not guarantee future results but factors tend to work over long periods of time.

Here are some other items to review:

- Why DFA vs. Vanguard – Why Dimensional Funds (DFA) vs. Vanguard Funds

- 10 Steps to Become a Better Investor

- Are you planning for lower returns over the next 7 to 10 years?

- The Pledge Most Advisors Won’t Sign!

Click here to subscribe to my blog or email us for a free 2nd Opinion about your portfolio.

Thanks for reading.

Low cost DFA advisor, direct access to Dimensional Funds, you don’t have to pay 1% for access to Dimensional Funds (DFA). Do TAMP’s add an extra layers of fees? Loring Ward, Carson Wealth, Edelman Financial, Matson Money

Please Remember: Past performance may not be indicative of future results. Moreover, no current or prospective investor should assume that future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in any general informational materials or educational sessions, will be profitable or equal any corresponding indicated historical performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for an investor’s retirement portfolio. Moreover, you should not assume that any discussion or information contained in this website serves as the receipt of, or as a substitute for, personalized investment advice from Integrity Investment Advisors, LLC and Integrity Investment Advisors, LLC is not providing services in jurisdictions that the firm is not registered or acting under an exemption to registration. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing.

Like What You've Read?

If so, click here to sign up for our blog to get timely and valuable information about the markets. Your retirement will thank you!

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/