As of last Monday (1/11/16), the average stock is already in a bear market. (photo credit Kevin Dietrich)

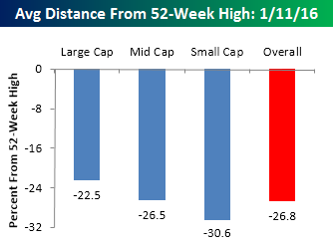

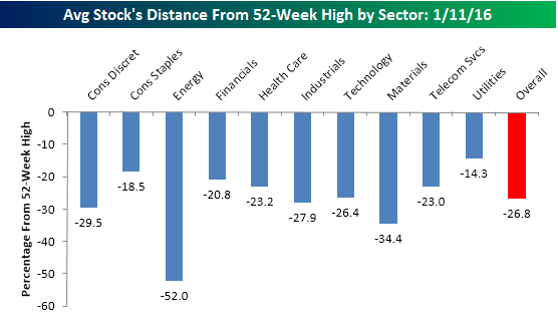

Here is some data as of 1/11:

- The S&P 500 is only down -10% from the May 20, 2015 highs of 2,135. 10% corrections are fairly normal.

- The average S&P 500 stock is down -22.5% from their 52 week highs.

- The average mid-cap stock is down -26.5% from their 52 week highs.

- The average small-cap stock is down -30% from their 52 week highs.

Click here to see the charts on our blog. (source Bespoke)

Here are some things to consider:

- Risk and return are related. Money invested in stocks can be volatile over short periods. This is why you typically get paid more for owning stocks (long-term average return of 7% to 10%per year).

- Money invested in stocks should not be needed in the next 7 years. See our blog Average is NOT Normal.

- Have a plan and stick to your plan. Successful investing is about strategy, process and discipline.

- Focus on your retirement goals and goals for your portfolio. Focus on your job, your health, your spending and your savings rate.

- Most people need a coach. Bad investing behavior is the #1 avoidable mistake for most investors. Don’t panic. Read this great blog and keep calm!

- Say NO to active managers. Say NO to market timing. Stocks are very volatile over a 1 to 5 year period.

- Hire fee-only Advisor who is a fiduciary for you 100% of the time. Not a fee-based advisor or insurance rep.

- Reduce fees, expenses and middlemen.

- Minimize taxes.

- Diversify on a global basis.

- Choose to either index your portfolio or build a more comprehensive portfolio with a company like Dimensional Funds (DFA). DFA portfolios target dimensions of higher expected returns like value companies, small cap companies, companies with high profitability and trading momentum.

- Add high quality bonds to your portfolio to reduce volatility and potentially look at hedging strategies.

In closing, here is some good advice from Burt White, CIO LPL

“It is important to remember that investing is a marathon, not a sprint. It is about endurance. Volatility has always been a part of investing and always will be. In fact, over the last 15 years, every calendar year has seen at least one pullback of at least 6% and a median correction of 14%. So while volatility is normal (and even expected), it is always nerve-wracking. These short-term market flare-ups are often quick and severe, but fueled by feelings of fear and concern over perceived risks that may not be actual threats.

We expect volatility to remain heightened for the remainder of 2016, which is common as the business cycle ages, and in turn, makes sticking to your long-term investment plans even more important to avoid locking in losses and missing out on opportunities. This current pullback, which is now approximately 5% year to date and 7% from the November 2015 highs, could continue over the short term as fear and concern trump much of the good news coming from the U.S. economy. What remains as the key to weathering these short-term bouts of volatility is a commitment to a well-formulated plan, a long-term focus, and good headphones to tune out the noise of short-term negativity.”

If you know anyone who may benefit from our services, please contact us at 303-549-4720. We help people manage investments in their 401k’s, IRA’s and taxable accounts on a national basis.

Click here to subscribe to my blog or email us for a free 2nd Opinion about your portfolio

All the best,

Todd

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/