The financial media loves to sell fear and greed. Dow 20,000 is irrelevant to your personal financial goals (even the Dow is irrelevant as a benchmark – it is only 30 stocks). They won’t tell you this because they want you to watch the nonsense. I encourage you to just say NO!

“If you don’t know where you’re going (don’t have a plan), you’ll end up someplace else.” Yogi Berra

In most cases, by not having a plan, the someplace else is not a place you want to be. Someplace else typically means working longer (70 or beyond), retiring with less lifestyle in retirement than you desire, running out of money or being completely dependent on others for your basic needs. Most retirees want none of these options!

Here are some things you can focus on while you are enjoying the Holidays:

- What you save (and invest) each year is more important than what you earn. Calculate your household profit margin.

- Most investors need to save 20%+ of gross income each year. This includes 401k match. (if you can save 25% or 35%, even better)

- If you hire an Advisor, they must be a Fiduciary for you 100% of the time. Fee-only and low cost. Not a broker or insurance Rep.

- Say No to “active management”. Use indexing or factor investing to enhance returns.

- Let compounding work for you over decades. Buy more stocks when they go on sale. Minimize taxes where possible.

- Track your net worth and yearly profit margin over time to see progress.

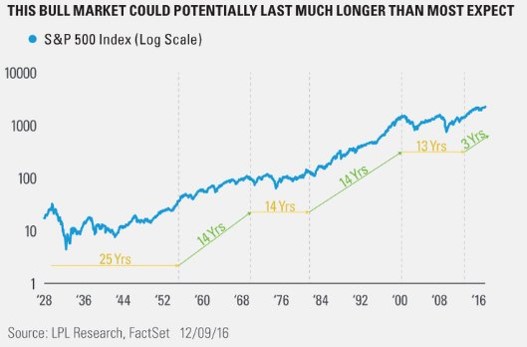

“If you think the Market is ‘too high’, wait until you see it 20 years from now” – Nick Murray

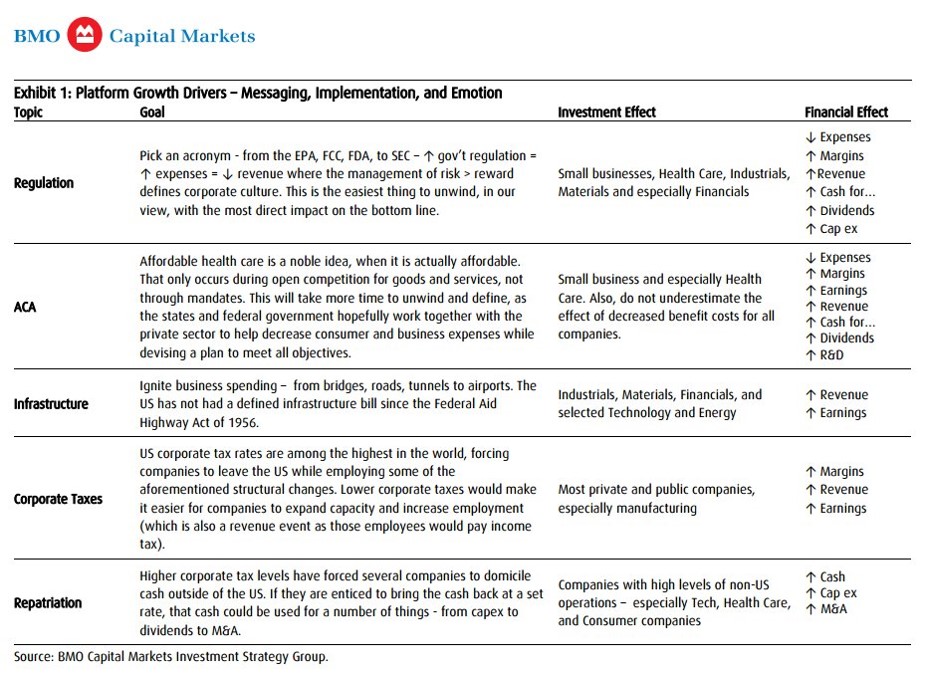

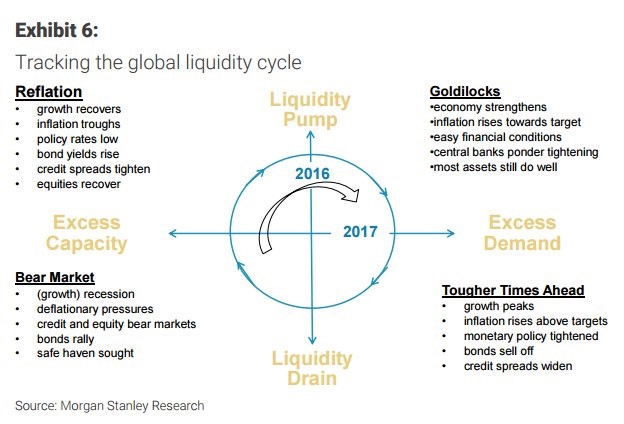

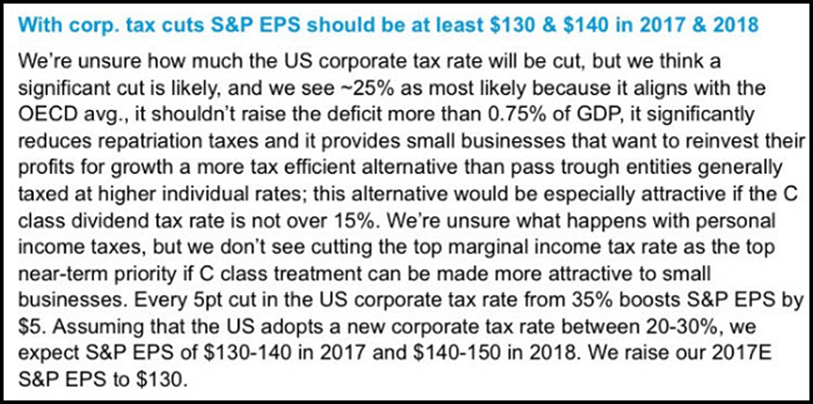

Here are some interesting slides regarding long-term investment strategy

If you want more details regarding the potential of a Trump Presidency, check out this article from the massive hedge fund run by Ray Dalio,

Reflections on the Trump Presidency, One Month after the Election – Ray Dalio

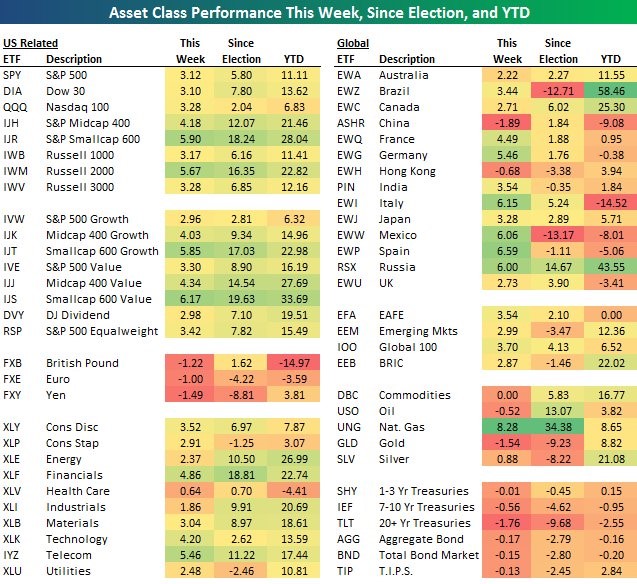

Via @Bespoke

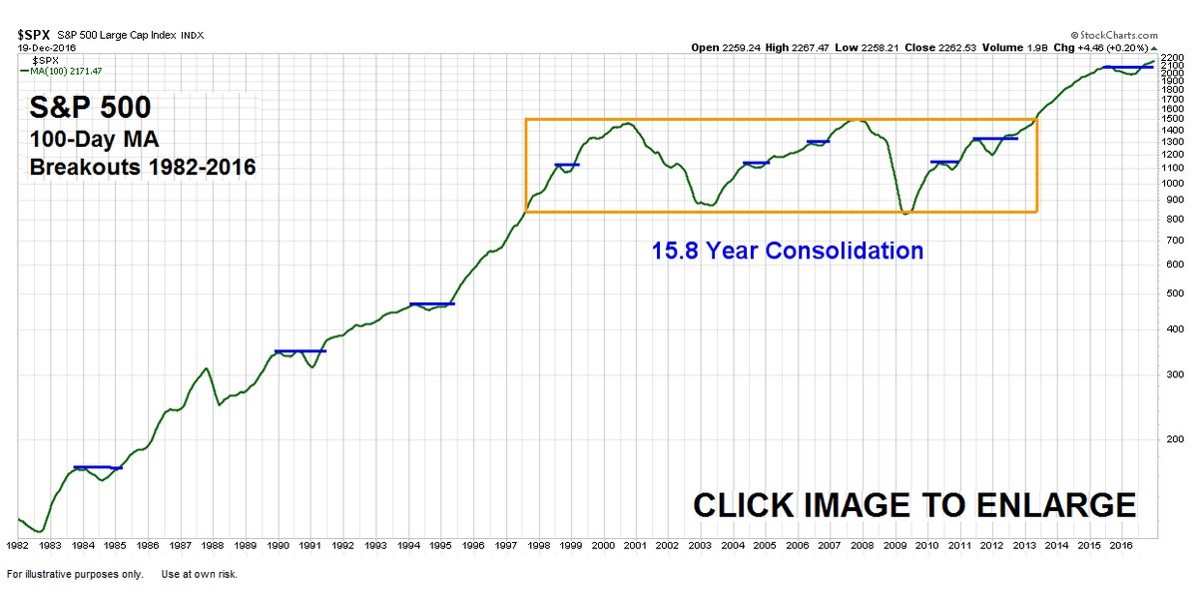

Via @CiovaccoCapital – SP500 has been consolidating for 15.8 years.

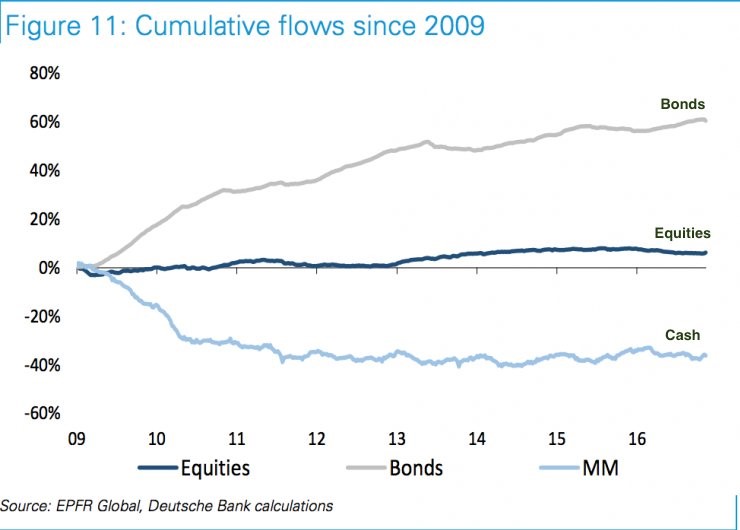

Since 2009, most of the money has flowed into bonds.

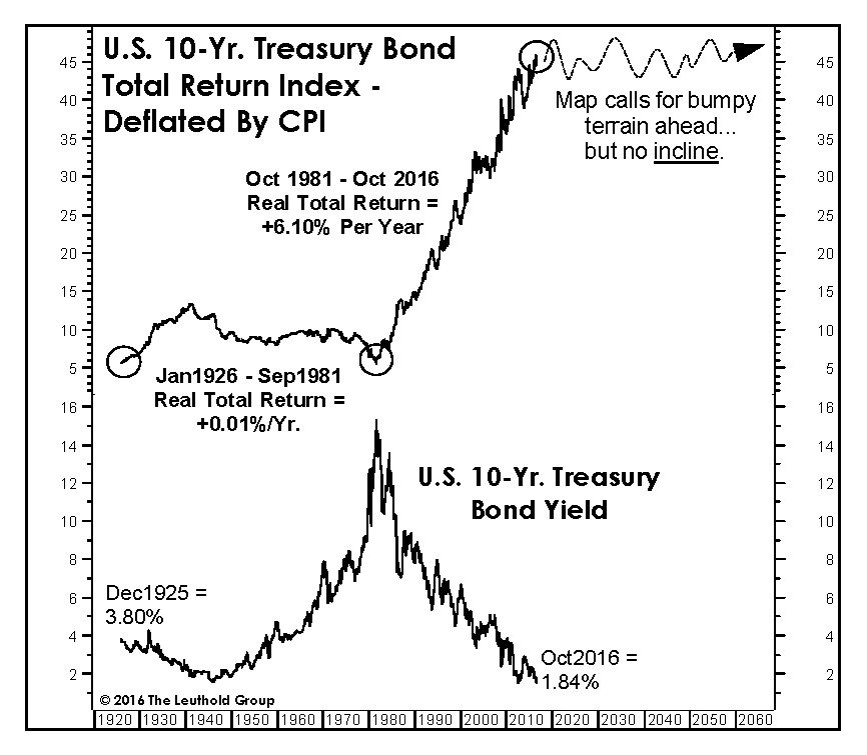

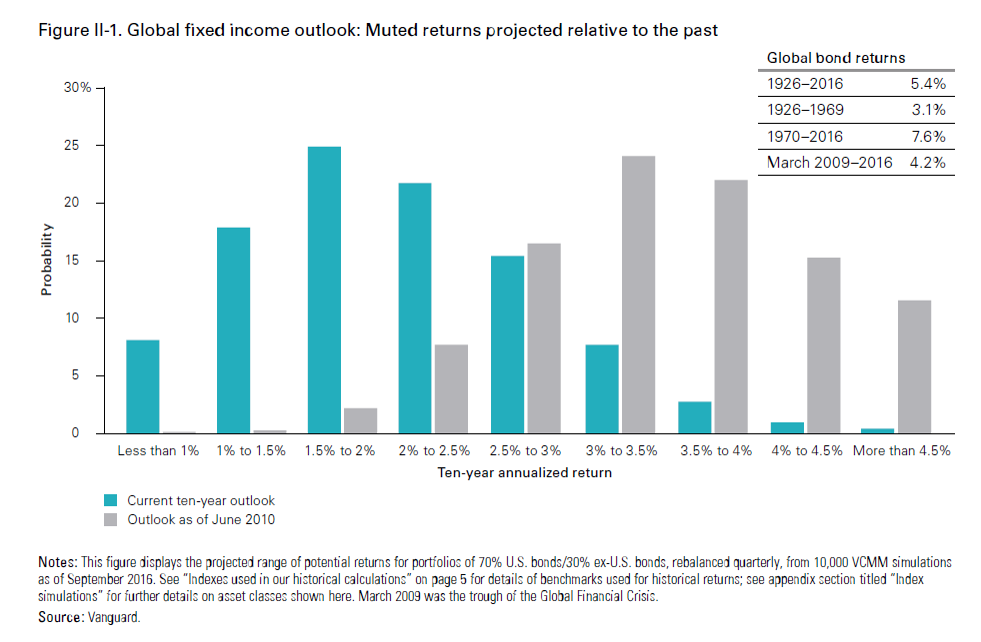

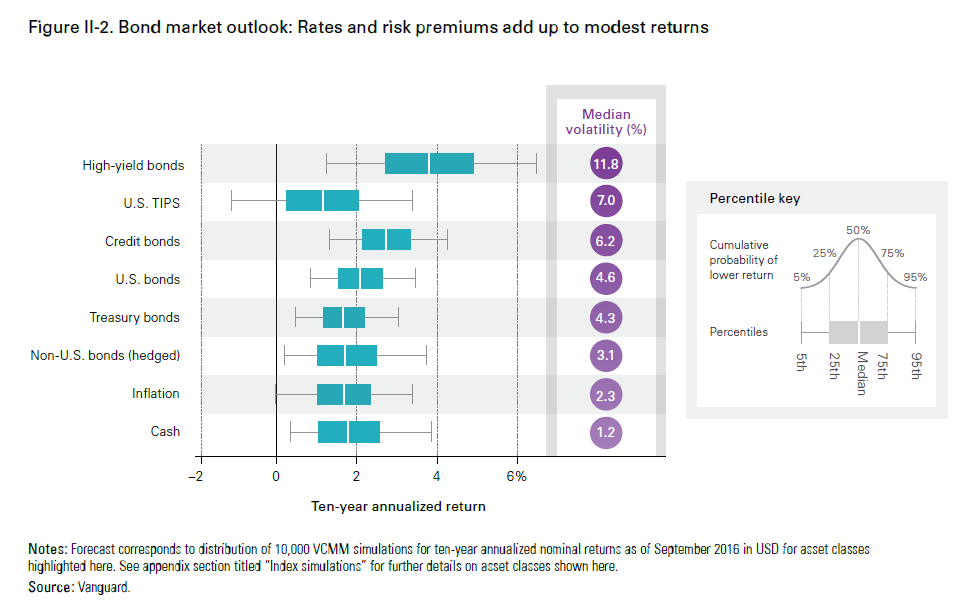

The real return of bonds (net of inflation) will be muted over the next 10+ years. However, it is still VERY important to manage risk. Via @LeutholdGroup

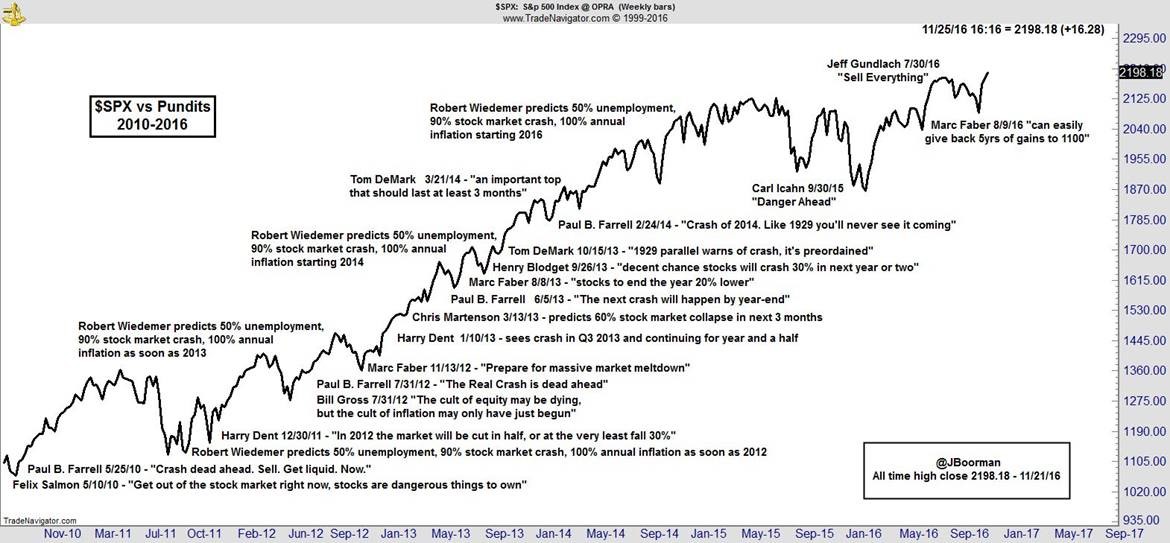

The so called “experts” have been very wrong about the SP500 over the last 7+ years.

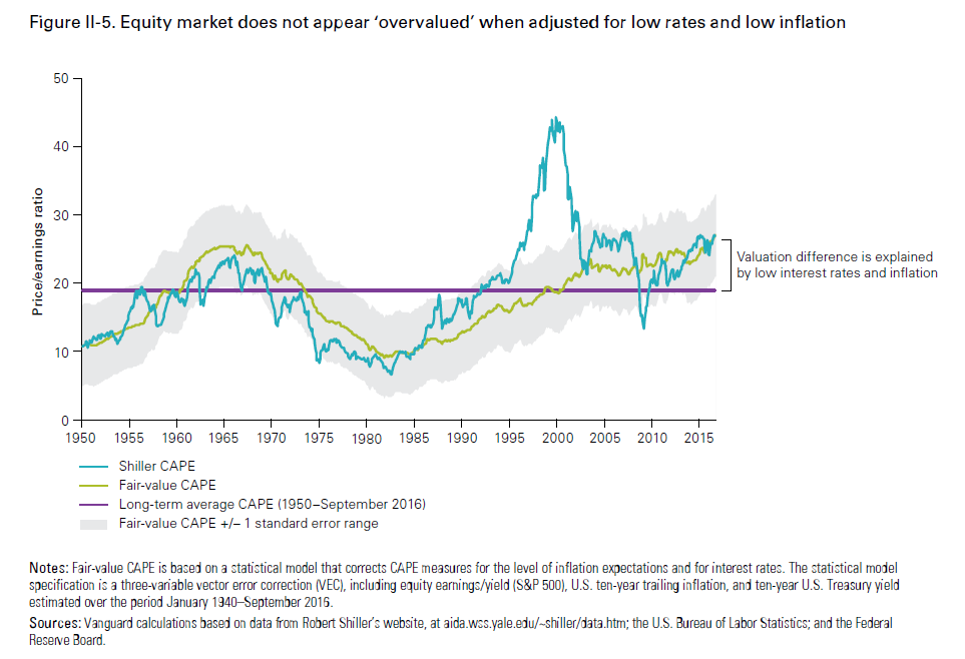

Stocks and bonds are NOT CHEAP! Thus, future expected returns may be lower than historical averages. I have written extensively on this topic in – The Perfect Storm May Be Brewing. However, as Vanguard and Barry Ritholtz have pointed out, the CAPE ration has been elevated for many years. Since 1990, the CAPE ratio has been above average 95% of the time (307 months out of 324 months) and it has gained 1,000% over that period. The CAPE ratio is not a tool for timing the market. If you are worried about it, Save More Money! Charts via Vanguard.

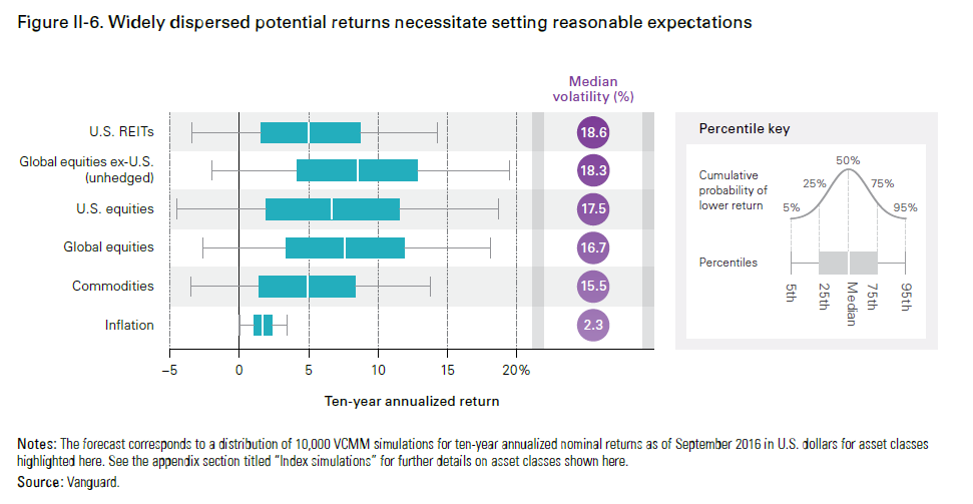

Lastly, here are some very good slides form Vanguard. It is important to think about any predictions as probabilities of an outcome. If you are worried about retirement and your portfolio, save more, reduce costs, manage downside risk and we believe that factor investing (value companies, small cap companies, companies with high profit and companies with momentum) can enhance returns over long periods of time (not every year). This enhanced compounding can have a significant positive impact over 20, 30 or 40 years. Here are a couple examples:

- 2016 YTD return as of 12/19 – SP500 (VFIAX) = +13.05%, DFA Large cap value (DFLVX) =+19.81%, DFA small cap value (DFSVX) = +29.91%

- Since 1/1/2000 to 11/30/2016 (almost 17 years!)

- SP500 index annualized return = 4.41% per year (growth of wealth 2.08x)

- Barclays US Aggregate bond index = 5.23% per year (growth of wealth 2.37x)

- DFA Large cap value (DFLVX) = 8.17% per year (growth of wealth 3.78x)

- DFA Small cap value (DFSVX) = 11.11% per year (growth of wealth 5.94x)

Warning: If you are a pure index investor (you only own the broad indexes like SP500 and Agg Bond index), you may want to rethink your strategy. Vanguard estimates that there is less than a 2% chance that the Agg. Bond index will return over 4% over the next 10 years. If you have over $750k in a portfolio and need a 2nd opinion, give us a call or email.

- The Perfect Storm May be Brewing

- Risk Happens Fast!

- Keep Calm or Freak Out?

- The Pledge Most Advisors Won’t Sign!

Click here to subscribe to my blog or email us for a free 2nd Opinion about your portfolio.

Thanks for reading. Enjoy the Holidays and Happy New Year!

Please Remember: Past performance may not be indicative of future results. Moreover, no current or prospective investor should assume that future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in any general informational materials or educational sessions, will be profitable or equal any corresponding indicated historical performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for an investor’s retirement portfolio. Moreover, you should not assume that any discussion or information contained in this website serves as the receipt of, or as a substitute for, personalized investment advice from Integrity Investment Advisors, LLC and Integrity Investment Advisors, LLC is not providing services in jurisdictions that the firm is not registered or acting under an exemption to registration. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing.

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/