Should you worry about market volatility and rising interest rates?

The simple answer is No. We should prepare in advance for volatility and have a long-term plan in place to help you hit your retirement goals. When you have a solid process for investing and have long-term discipline, you tend to get better results over time.

Most investors have 2 main goals for retirement:

- They want to maintain their lifestyle in retirement. Watch this video to find out more.

- They do not want to outlive their money or become overly dependent on others.

There are 3 main paths to help put the odds in your favor:

- Save more money. Most professionals should target to save between 15% and 25% of gross household income. See this video for more details.

- Invest better. Use low cost investing strategies. If you hire an advisor, only hire a fee-only advisor who is a fiduciary for you 100% of the time.

- Retire later. Many investors may end up working until age 70 or longer.

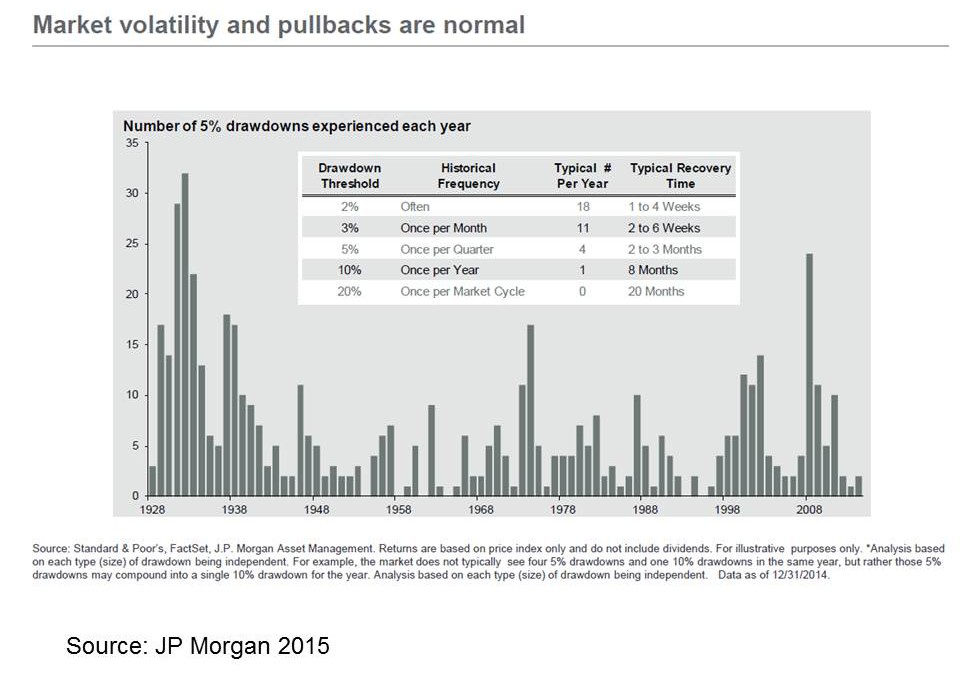

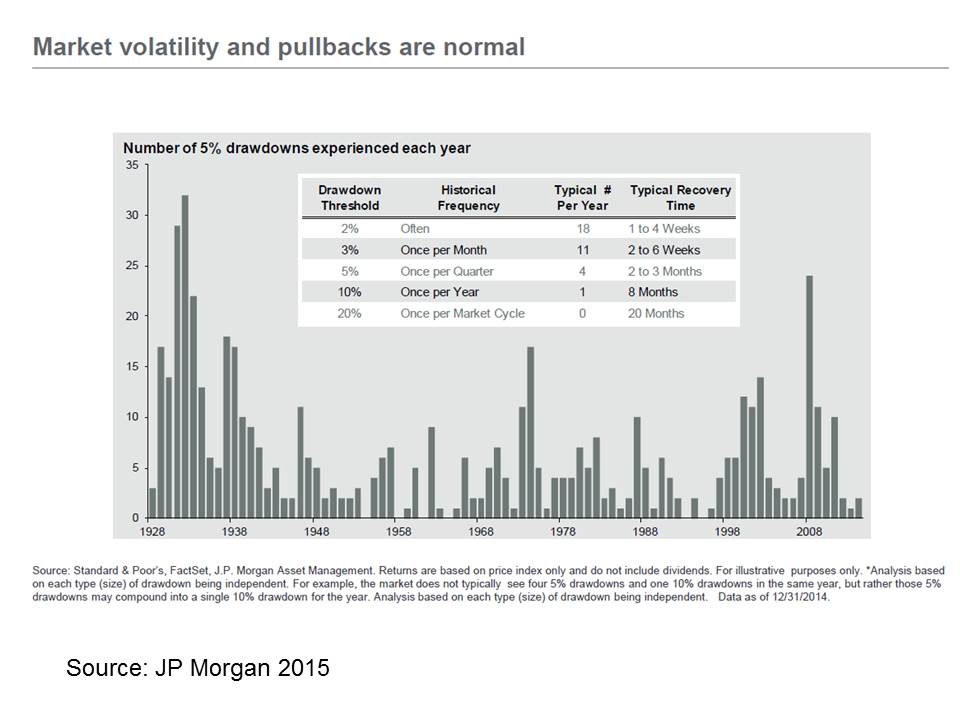

Market volatility and pullbacks in the stock market are normal. Stocks are risky and in theory, you get paid for this risk over time with potentially a better return than cash or bonds. As you can see from the chart below, we should expect a 5% pullback in stocks about 4 times a year and a 10% pullback in stocks about 1 time per year. I think that we have gone over 45 months without a 10% correction in stocks.

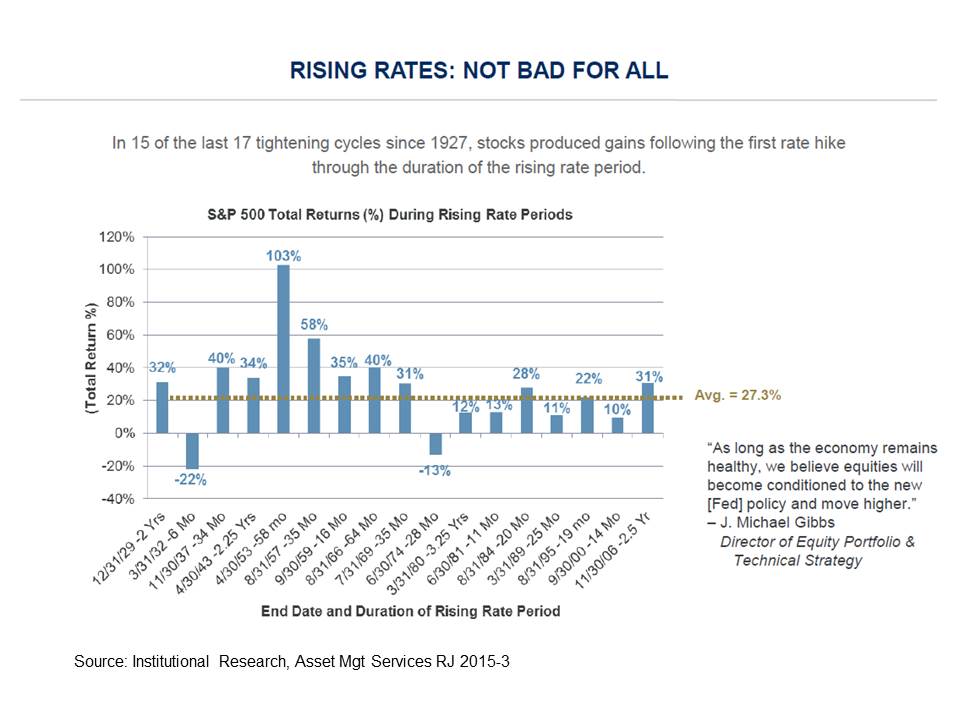

Rising rates are not always bad for stocks. In 15 of the last 17 Fed tightening cycles, stocks produced gains following the first rate hike and through the duration of the rising rate period.

If you need help, give us a call at 303-549-4720.

All the best,

Todd

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/