Fort Collins Fee-Only Fiduciary Advisor - Should I invest with a Dave Ramsey SmartVestor Pro?

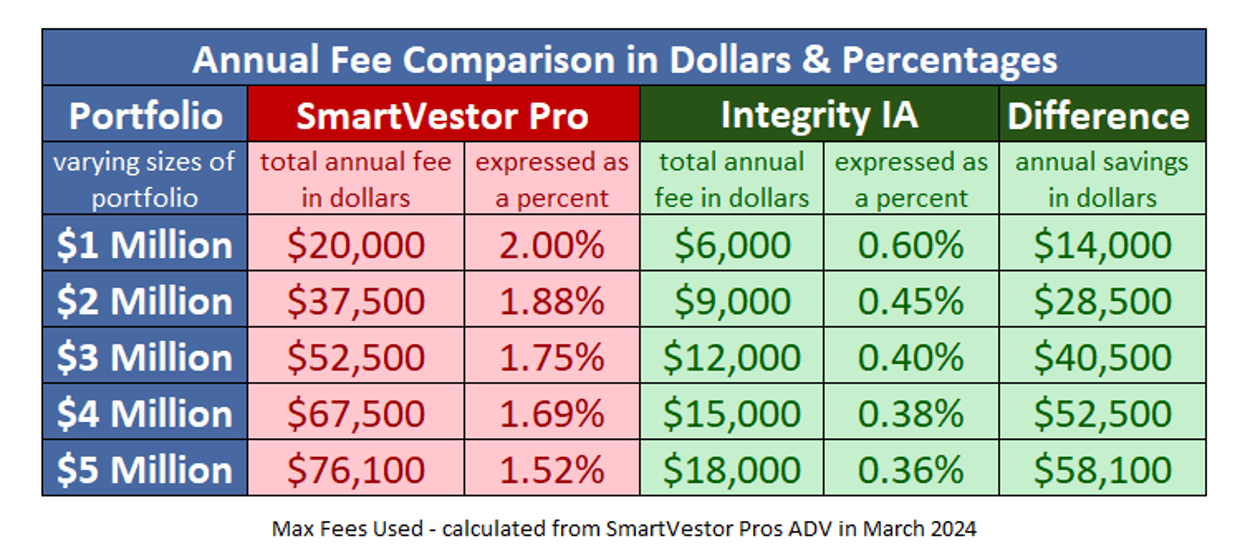

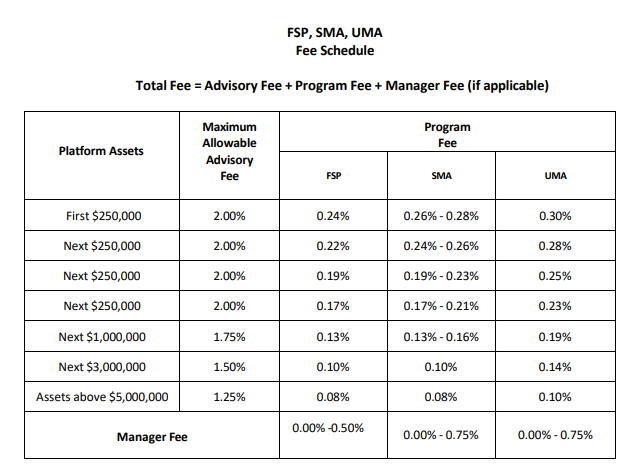

Let us show you how we help clients live the life they want!I recently listened to a podcast about Dave Ramsey SmartVestor Pro Advisors. Should I invest with Dave Ramsey SmartVestor Pro Advisors? Short answer (in my opinion): NO, we suggest you invest with a fee-only fiduciary Advisor who charges less than 1% on the first $1M and less above $1M. Dave Ramsey’s radio show is a marketing machine and Ramsey Trusted (advertising) makes about $120 million per year for endorsing SmartVestor Pro Advisors! This is Marketing & Sales! Look at the shocking fee schedule below! You can do better! Get out of credit card debt & then find a fee-only, fiduciary Advisor that charges less than 1%.

Your current Advisor is hoping you don’t run this analysis!

Please watch this brief video below. It might save you $6k to 20k per year! We work with Clients on a national basis. Take action & schedule a free 2nd opinion below! We will show you the data!

Here are some key takeaways: Should I invest with a Dave Ramsey SmartVestor Pro Advisor?

-Should you invest with Dave Ramsey SmartVestor Pro Advisors? I like Dave, he is an icon in the financial world, had a great radio show for 20 years, numerous books and now a great podcast. He has solid advice for how to get out of debt. Follow Dave’s advice to get out of debt, but but not his advice on investing with expensive sales reps!

If Dave Ramsey really wanted to support his listeners, he would require all of his “vetted” advisors to be Fee-Only & a Fiduciary for Clients. Many of the SmartVestor Pro Advisors are “brokers” or “insurance sales reps”! You might end up with expensive A shares/ B shares / C shares or more products with hidden commissions

- Are SmartVestor Pros required to have any professional credentials or designations such as CFP® or CFA®? No.

- Are SmartVestor Pros required to serve clients as a fiduciary at all times? No.

- Are SmartVestor Pros required to do any financial planning? No. (if they do planning, what software?)

- Are SmartVestor Pros required to serve in a fee-only capacity? No.

- What does it mean to be a SmartVestor Pro?

- Is Dave Ramsey a fiduciary? No

- Is Dave Ramsey a scam? Are Smart Vestor Pros a scam?

- How much do SmartVestor Pros cost me each year? Dave Ramsey financial advisor near me

- Vanguard fees vs. Dave Ramsey SmartVestor Pro fees?

- Should I invest with a Dave Ramsey SmartVestor Pro?

- Check out our Why DFA vs. Vanguard page for a better solution.

- I agree to the SmartVestor Code of Conduct. (then be a Fiduciary 100% of the time!) I believe everyone deserves access to solid, professional investing guidance. I have earned my position as a SmartVestor Pro because of my experience in the industry and my drive to help others.

- I provide a refreshing twist on financial planning. (then be a Fiduciary 100% of the time!) I have the heart of a teacher, not the attitude of a salesman. I’m someone you can feel comfortable talking to and someone you can trust. We’ll work together to create a plan to help you reach your goals..

- I care about your future. (then be a Fiduciary 100% of the time!) I’m more than a “financial planner”—I’m someone you can relate to and share your dreams with. I fit your investments to your life, help you understand what you’re investing in and why, and encourage you to stick with your long-term goals.

- To be affiliated with Dave Ramsey, advisors in the SmartVestor Pro program pay Dave Ramsey an advertising fee.

- It is important to note that Dave Ramsey has been a vocal opponent of the fiduciary rule. He claims that it will hurt investors. He feels advisors will limit their advice because investors can now sue them.

- https://www.moneysmartguides.com/the-problems-with-dave-ramsey-investing-advice

- https://www.investmentnews.com/advisers-profit-through-association-with-dave-ramsey-but-not-by-as-much-as-in-the-past-71056

- https://www.reddit.com/r/DaveRamsey/comments/8nio22/what_are_your_experiences_with_smartvestor_pros/?onetap_auto=true

- https://money.com/save-like-dave-ramsey-just-dont-invest-like-him/

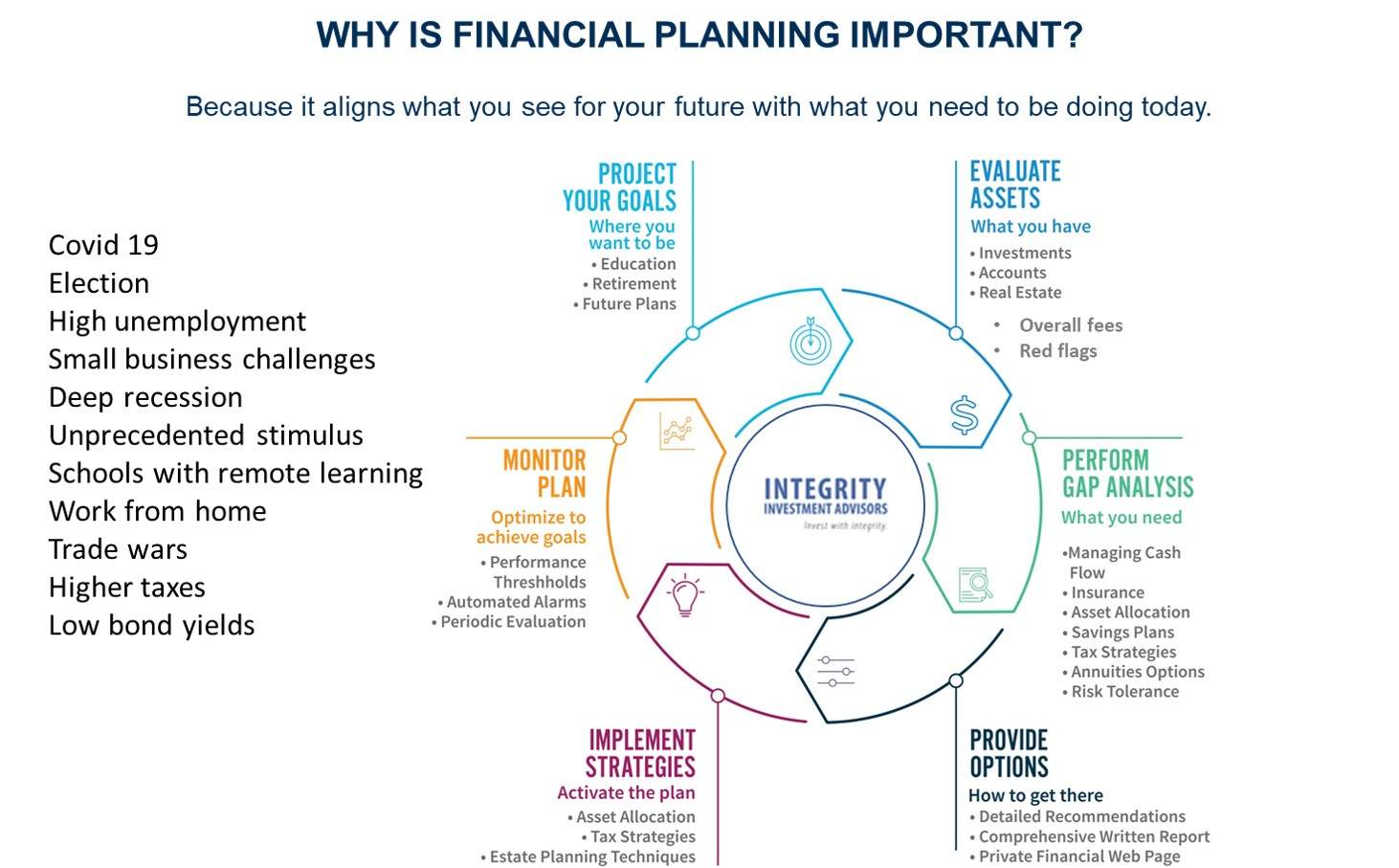

When I started my firm in 2010, we started with the vision of competitive fees for the scope of work. We work with clients to educate them about investing best practices and help them align their money with their values. We help clients reduce the middlemen (and middlewomen) in the investing process so our clients keep more of their money. We help clients to make work optional.

– We are are a low-cost, fee-only Advisor. We are a fiduciary for you 100% of the time. Our fees are 0.6% on the first $1 million and they decline above $1 million. If you have over $300k in a portfolio (including 401k), schedule a meeting below.

Now is a great time to get a free 2nd opinion via Zoom meeting (see calendar below)! We will give you objective feedback, identify red flags and give your confidence about your future path. It is important to find out if you have areas that can be improved. We help clients make work optional & live the best life possible.

Ready to see if we’re a good fit? Schedule a free meeting below. We will show you your total fees & red flags.

According to Google & Chat GBT, here ” are some common complaints against SmartVestor Pro advisors, a network of financial advisors recommended by Dave Ramsey’s organization, were as follows:

- High Fees: Some clients have complained about the high fees charged by SmartVestor Pro advisors, which they believe are not in line with the level of service provided.

- Poor Investment Performance: Some clients have expressed disappointment with the performance of their investments, claiming that they have not achieved the expected returns.

- Pushy Sales Tactics: Some customers have reported feeling pressured by SmartVestor Pro advisors to invest in their recommended products.

- Lack of Communication: Some clients have complained about the lack of communication from their SmartVestor Pro advisor, which has left them feeling uninformed about their investments.

- Misrepresentation of Services: Some clients have complained that SmartVestor Pro advisors misrepresented the nature of their services, which led to unexpected results.”

Check for yourself and do your own research. Should I invest with a Dave Ramsey SmartVestor Advisor? SmartVestor Advisors near me – Fort Collins, Colorado? Are SmartVestor Advisors too expensive?

We strongly recommend that if you hire an advisor, that person should be a fee-only advisor (not fee-based) and be a fiduciary for you 100% of the time.

Fee-Only Compensation

This model minimizes conflicts of interest. A Fee-Only financial advisor charges clients directly for his or her advice and/or ongoing management. No other financial incentive is provided, directly or indirectly, by any other institution. Fee-Only financial advisors do not sell anything. They add value with their Philosophy, Strategy, Process, Transparency and Ongoing Coaching. We strongly encourage you to work with a fee-only Advisor.

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/