Investing is very easy in a raging bull market. Everything goes up, people make money and everyone believes that they are smarter and more talented than the average investor. We all know this is an illusion. By definition, half of all investors are less than average. The same goes for financial advisors. Are you sure you have an optimal strategy and process in place?

So what should you do? Investing can be scary. Bear markets can be terrifying. It is important to understand the history of investing and control the factors that matter most. You want to focus on the probability of outcomes instead of a single event.

Your net returns will be primarily driven by the following:

1) Investor behavior (don’t you panic and sell at market lows). See this Blog — Keep Calm or Freak Out?

2) Asset allocation (your mix of stocks/bonds/alternatives). We also suggest using factors like value companies, small cap companies, companies with high profit and companies with good momentum to enhance returns over long periods of time. Most investors don’t realize that a standard 60/40 portfolio is 95% correlated to the S&P 500.

3) Fees and transaction costs (the lower the better). We believe your Advisor fee should be 0.6% per year or less on the first $1 million. You should also not be sold commission products like A share mutual funds, B share funds, C share funds or non-traded REITs. Get your Advisor to sign this Pledge in 2016! Your retirement depends on it!

4) A low cost, fee only advisor can add value net of their fees. If you do-it-yourself, please make sure you are very good at the first 3 items.

Risk happens fast! If you need help, give us a call or email. Your retirement will thank you!

Click here to subscribe to my blog or email us for a free 2nd Opinion about your portfolio

Here are some key points to consider: See the charts on our website.

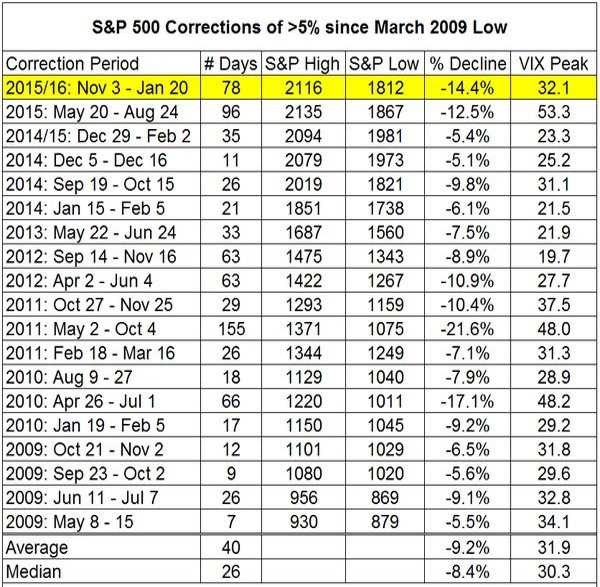

- The market is very oversold and this is perfectly normal. This is the 19th decline above 5% since 2009. Stock volatility is normal. As of 1/20/16, about 49% of the stocks are already down -20% from their 52 week highs.

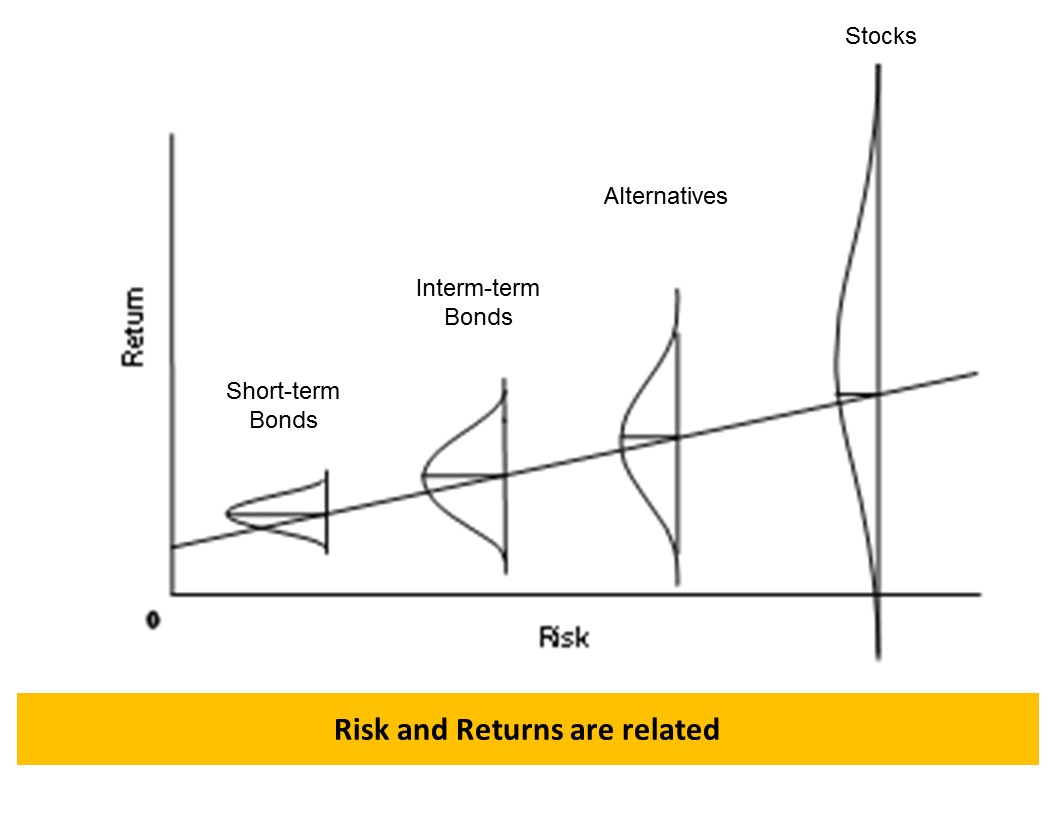

- It is important to think about RISK as a probability of returns. See chart below

- “Effective risk management requires deep insight and a deft touch. It has to be based on a superior understanding of the probability distributions that will govern future events.” – Howard Marks

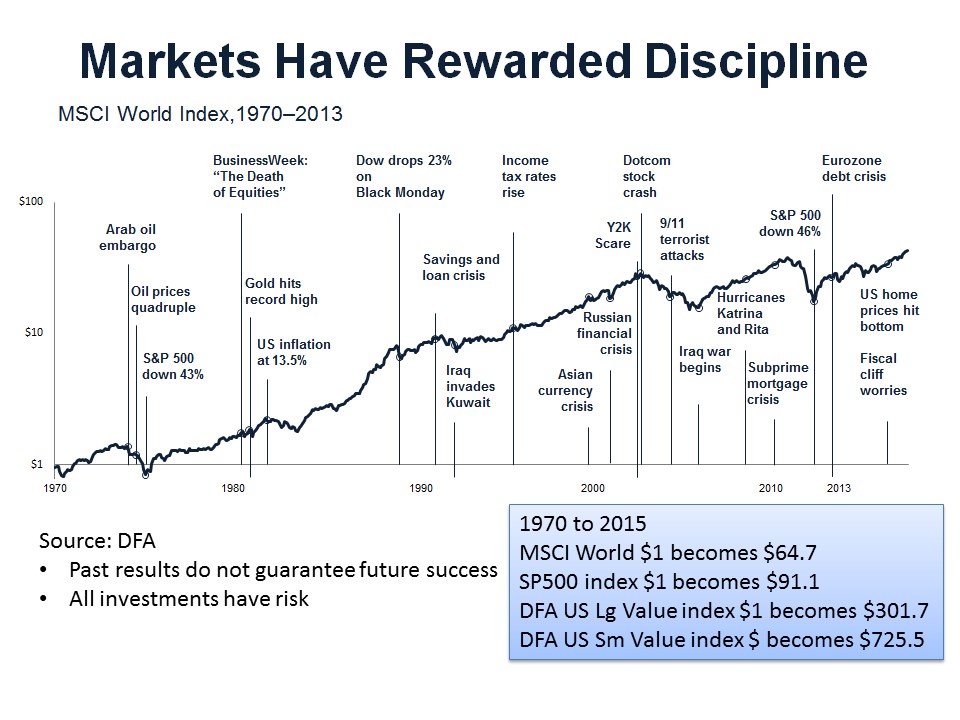

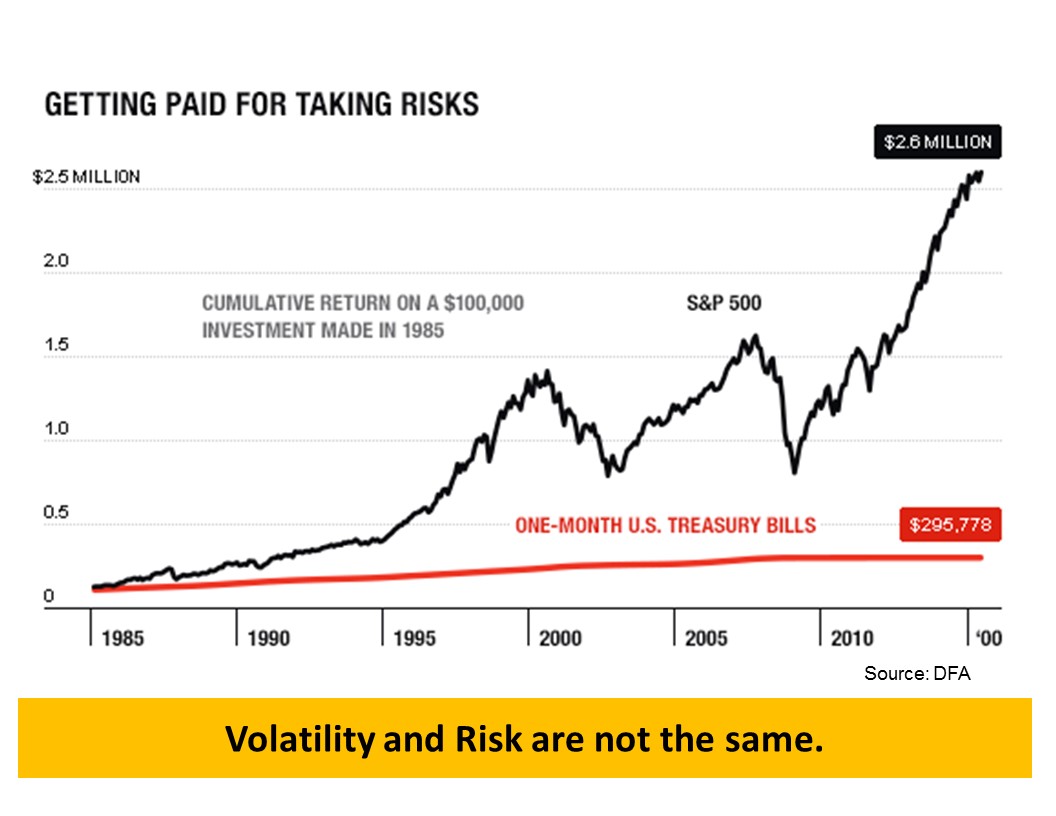

- Ben Graham’s famous observation that in the long run the market’s a weighing machine, but in the short run it’s a voting machine. In other words, in the long term the consensus of investors figures out what things are really worth and moves the price there. But in the short term, the market merely reflects consensus opinion regarding an asset’s future popularity, something that’s highly susceptible to the ups and downs of psychology. Over the short-term, markets are highly emotional. When 10,000 people panic, selling seems to snowball and the cycle of selling continues until exhausted. This behavior leads to the “equity risk premium”. You tend to earn more from stocks over long periods of time.

- We have said many times. Stocks are for your long-term bucket of retirement savings. You should be willing to hold them for at least 7 years to 30+ years. Your odds of having a positive return increase dramatically the longer you hold stocks. Markets have rewarded discipline over the long-term.

Please Remember: Past performance may not be indicative of future results. Moreover, no current or prospective investor should assume that future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in any general informational materials or educational sessions, will be profitable or equal any corresponding indicated historical performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for an investor’s retirement portfolio. Moreover, you should not assume that any discussion or information contained in this website serves as the receipt of, or as a substitute for, personalized investment advice from Integrity Investment Advisors, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing.

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/