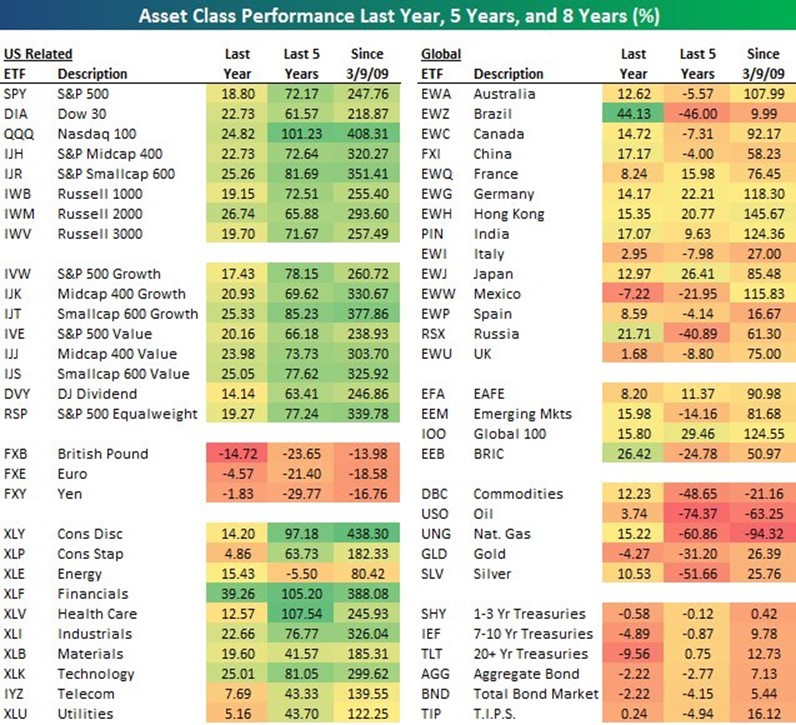

3/9/17 is the 8-year anniversary of the low of the great recession. In 2009, the SP500 closed that day at 667. Friday 4/14/17, it closed at 2,329. Up about 250% from the lows (300%+ including dividends). Now, can you calculate your investable net worth around March of 2008 for your portfolio? I encourage all clients to track their investable net worth on at least a yearly basis. The point is…. markets have had quite a run. Your portfolio should be up 2x to 3.5x+ since 2008 (depending on spending, contributions, asset allocation and if you are retired or working). Starting valuations matter. Today, both stocks and bonds are not cheap. That doesn’t mean that they have to fall but it possibly means that future expected returns may be significantly lower that historical returns (see – blog A Perfect Storm May be Brewing). Especially for bonds but also likely for stocks. We must focus on our plan, your goals/objectives and overall risk. Most investors will need to save more and work longer to maintain their lifestyle in retirement.

From A Wealth of Common Sense Blog 3/2/17

“Lately, it feels like every time I time I log into check my investment accounts the market values are higher than the previous time I looked. The stock market continues to hit all-time high after all-time high. I have to admit, it feels pretty good when things are going your way in the markets and it seems like everything you touch turns to gold.

This is easy. Everything I buy just keeps going up.

It would be nice to assume that my intelligence has risen along with my skills as an investor, but I have to admit that’s not really what’s going on here. We just happen to be in the midst of a strong bull market. So I have to remind myself. Seeing your investments rise is no way to validate your level of intelligence. In fact, it can be extremely dangerous to your wealth when the music stops playing.

Who needs an insurance policy (like bonds and alternatives) when all of my risky investments have been rising for years?

Researchers have found that the brain activity of a person who is making money on their investments is indistinguishable from a person who is high on cocaine or morphine. The brain of a cocaine addict who is expecting a fix and people who are expecting to make a profitable financial gamble are virtually the same. The danger in allowing a bull market to increase your confidence as an investor is that it can lead you to take unnecessary or avoidable mistakes to continue to get that high.

(in summary) Don’t confuse a bull market for increased brain power. And above all, it’s important to stay humble. While not always easy, humility may be one of the most useful traits you can develop as an investor during a bull market to remind yourself that the good times won’t last forever and you’re not as intelligent as rising markets may make you feel.”

“The essence of portfolio management is the management of ‘risks,’ not the management of ‘returns’. All good portfolio management begins and ends with this tenet!” — Benjamin Graham (asset allocation will determine returns)

“We can’t predict but we can prepare” – Howard Marks (how will we respond when stocks are down -20% to -35%? What is our plan?)

“There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.” – John Kenneth Galbraith (How much optimism is already factored into the price? Starting valuations matter. Today, both stocks and bonds are not cheap compared to history. 2nd level thinking – when is there too much optimism? How do we control risk and minimize negative outcomes?)

Sir John Templeton said, ‘Bull markets are born on pessimism, mature on optimism, and die on euphoria.’

“The stock market is the only market where things go on sale and all the customers run out of the store!” – Cullen Roche

“If you think the market’s ‘too high’ wait ’til you see it 20 years from now.” – Nick Murray

“Having, and sticking to, a true long term perspective is the closest you can come to possessing an investing super power.” Cliff Asness AQR

“Owning stocks is a long-term undertaking that doesn’t just require patience. It also requires higher tolerance for pain and uncertainty than many investors may realize.” Jason Zweig WSJ

1. What do you own?

A diversified portfolio of asset classes that I will stick with over time (matches my risk tolerance).

2. Why do you own it?

Because holding such a portfolio is the only proven road to investment success (highest probability of meeting my goals).

3. How long do you plan on holding it for?

As long as my risk tolerance and goals don’t change.

If you have a portfolio above $750k and would like to discuss your own personal “fire drill”, please give us a call or email.

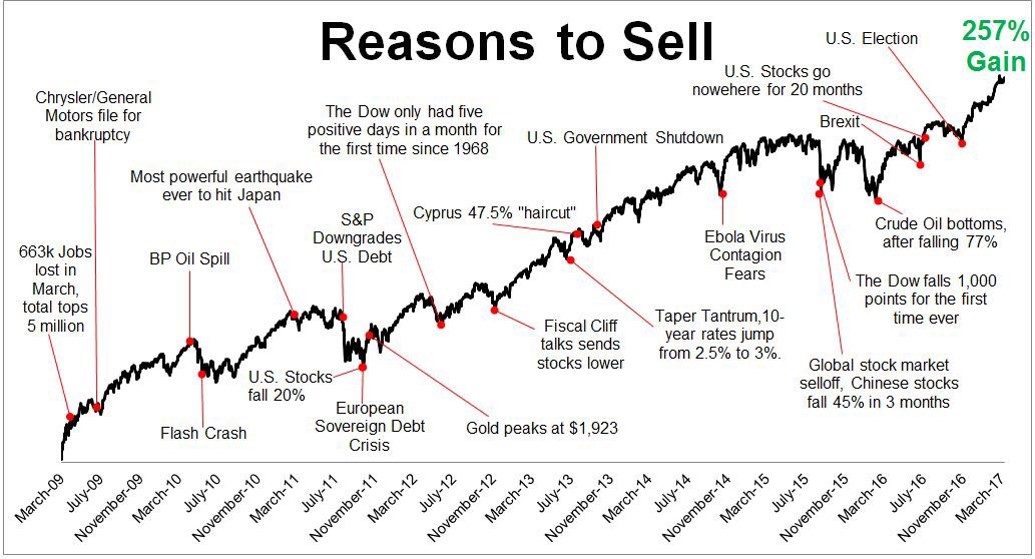

There have been many reasons to sell since 2009 but the market is up 250% +

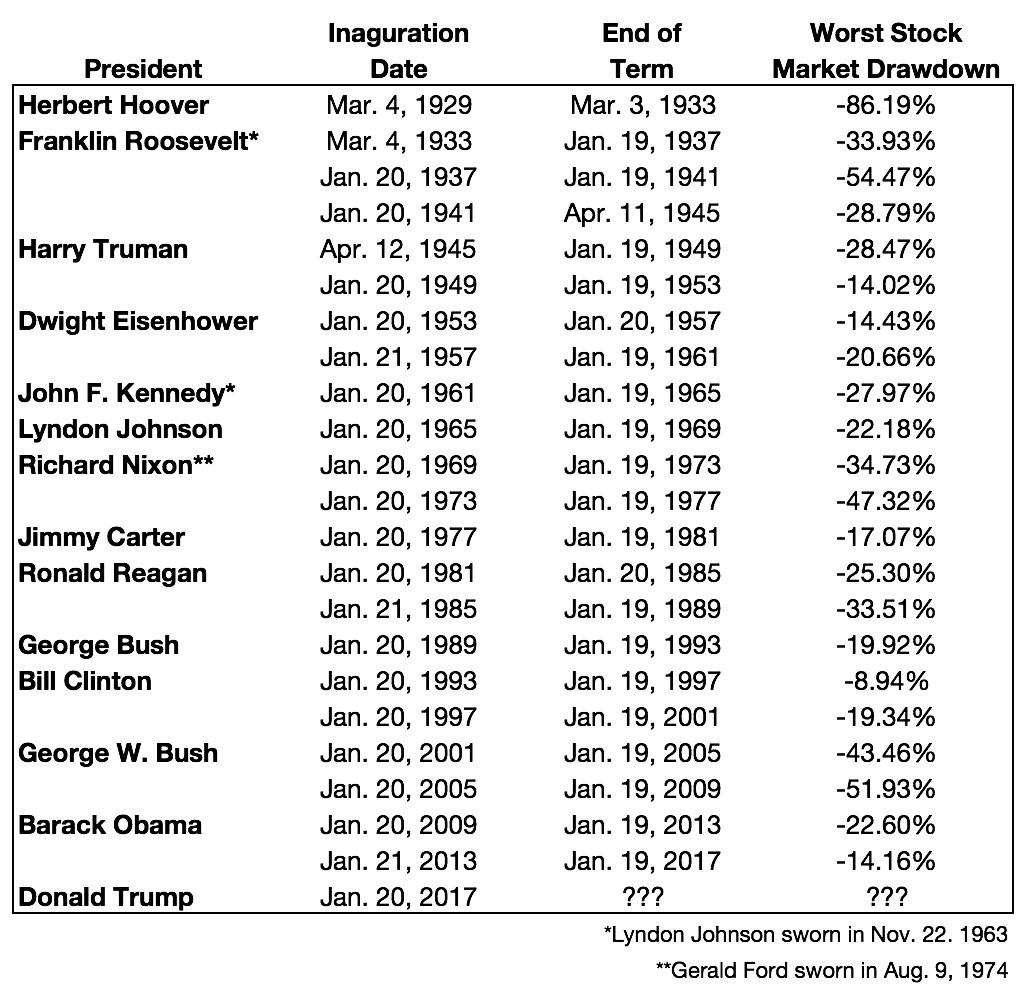

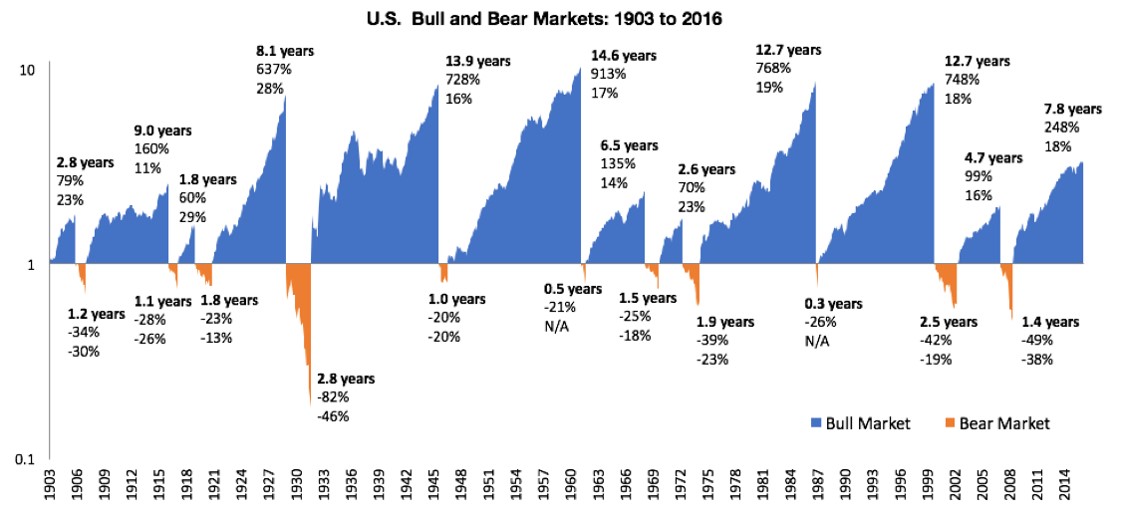

It is impossible to time the end of one of the most hated bull markets in history. Because this bull market has been a slower recovery, it may also last longer. Who knows? I think we should always be prepared for a -20% to -35% pullback in stocks (very normal – see chart below). This is why we have a short-term bucket of bonds and alternatives. These are very confusing and risky times. How do we manage the short-term bucket of investments to mitigate risk (bonds/alternatives)? How do we manage the money that is not needed for 7, 10, 20+ years (long-term global stocks with value, small cap, high profit, momentum)?

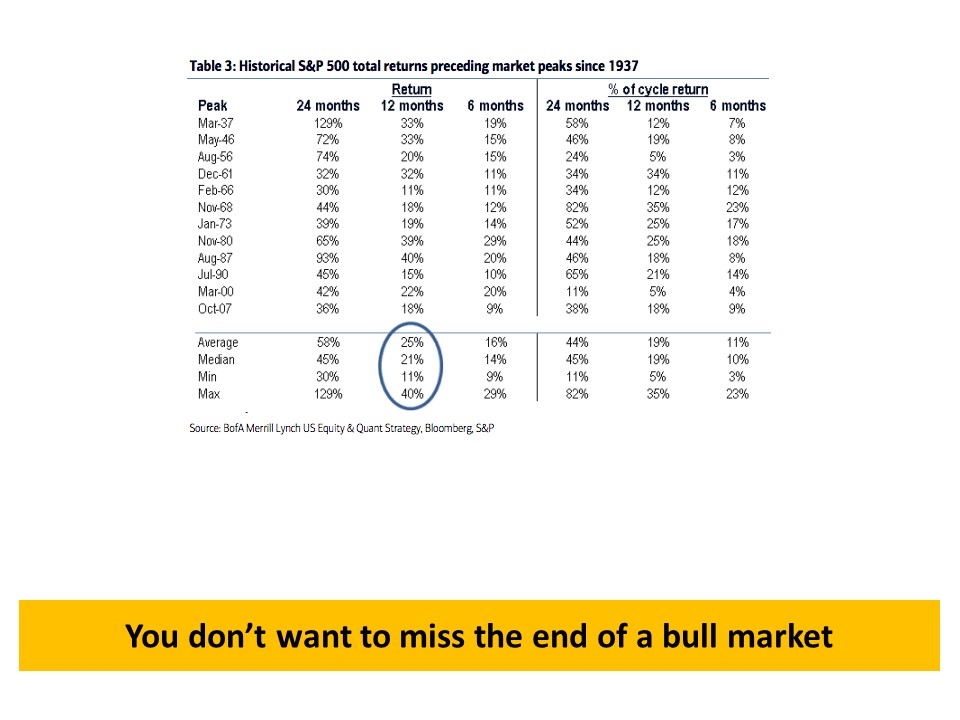

Here is an interesting piece from B of A.

- You don’t want to miss the end of a bull market, says Savita Subramanian, Bank of America Merrill Lynch’s Quant-in-Chief. It’s where some of the most explosive upside moves take place. Parabolic, skyscraper-like charts can happen just before it’s all over.

- Additionally, you need euphoria to show up – not in the form of sentiment surveys but in actual dollar volume. You need fund flows. Savita makes the case that, if history is guide, we haven’t seen the best part yet (even if it ends in tears, as usual).

- Here’s a look at the performance of stocks heading into historic bull market peaks, 24, 12 and then 6 months prior. It’s painful to miss the end of these things

Data Source for the 2 above charts: Robert Shiller’s data library. Calculations by Newfound Research. www.thinknewfound.com

Data via Pension Partners blog

Thanks for reading.

Please Remember: Past performance may not be indicative of future results. Moreover, no current or prospective investor should assume that future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in any general informational materials or educational sessions, will be profitable or equal any corresponding indicated historical performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for an investor’s retirement portfolio. Moreover, you should not assume that any discussion or information contained in this website serves as the receipt of, or as a substitute for, personalized investment advice from Integrity Investment Advisors, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing.

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/