It is normal to worry about your retirement and financial markets. The key is to have a plan to handle market volatility in advance. You don’t want to get emotional and and change your plan in the middle of a short-term crisis.

Here are some key thoughts: Reacting to Volatility Can Hurt Performance

- Know that market volatility is normal. See my previous blog.

- Make sure that you are not taking too much risk in your portfolio. Do you have too much money in stocks?

- If stocks were to lose 20% to 40% of their value in a short period of time, would you be willing to rebalance and buy more stocks?

- Know that any money you have invested in stocks should not be needed in the next 7 years.

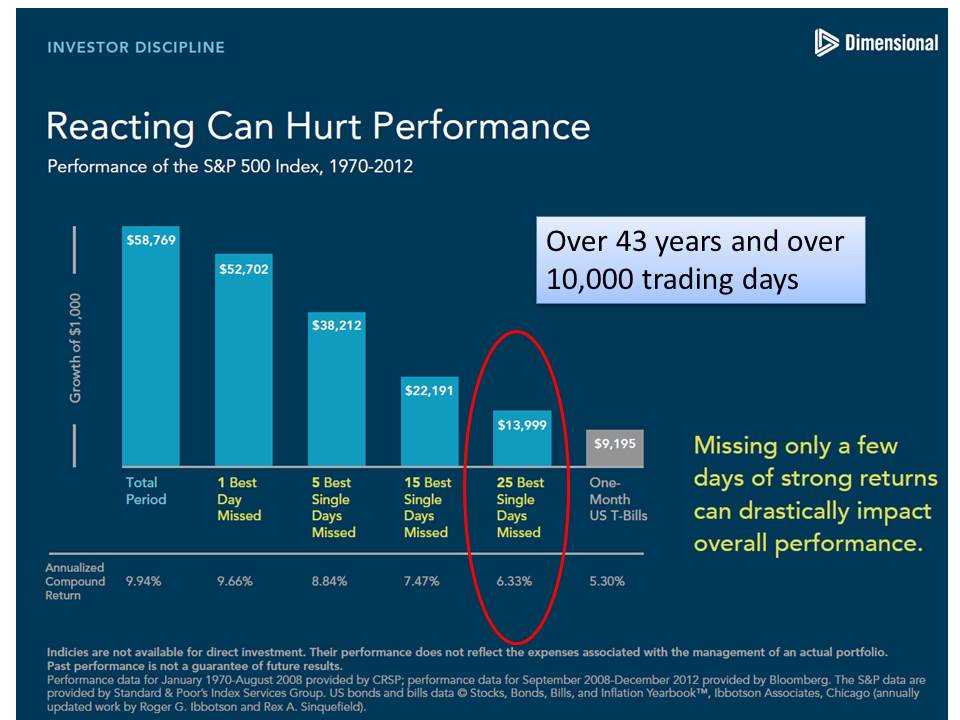

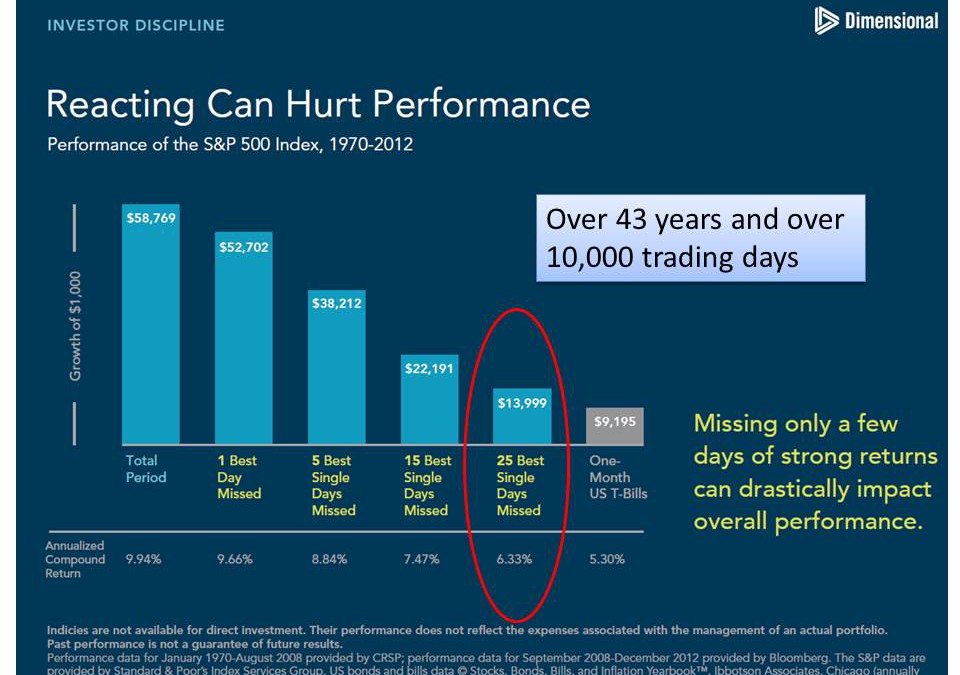

- Don’t try to time the market. If you were invested in the S&P500 over the 43 year period ending in 2012, your $1,000 grew to $58,769. But if you missed just the best 25 days out of over 10,000 days, your $1,000 only grew to $13,999.

- Stick to your plan. Avoid panicking. Rebalance on a regular basis.

If you need help, give us a call. Your retirement will thank you.

Click here to subscribe to my blog

If you have over $500k in a portfolio and would like a free 2nd opinion about your strategy, give us a call. Your retirement will thank you.

All the best,

Todd

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/