Here is our market update for Q2 2017.

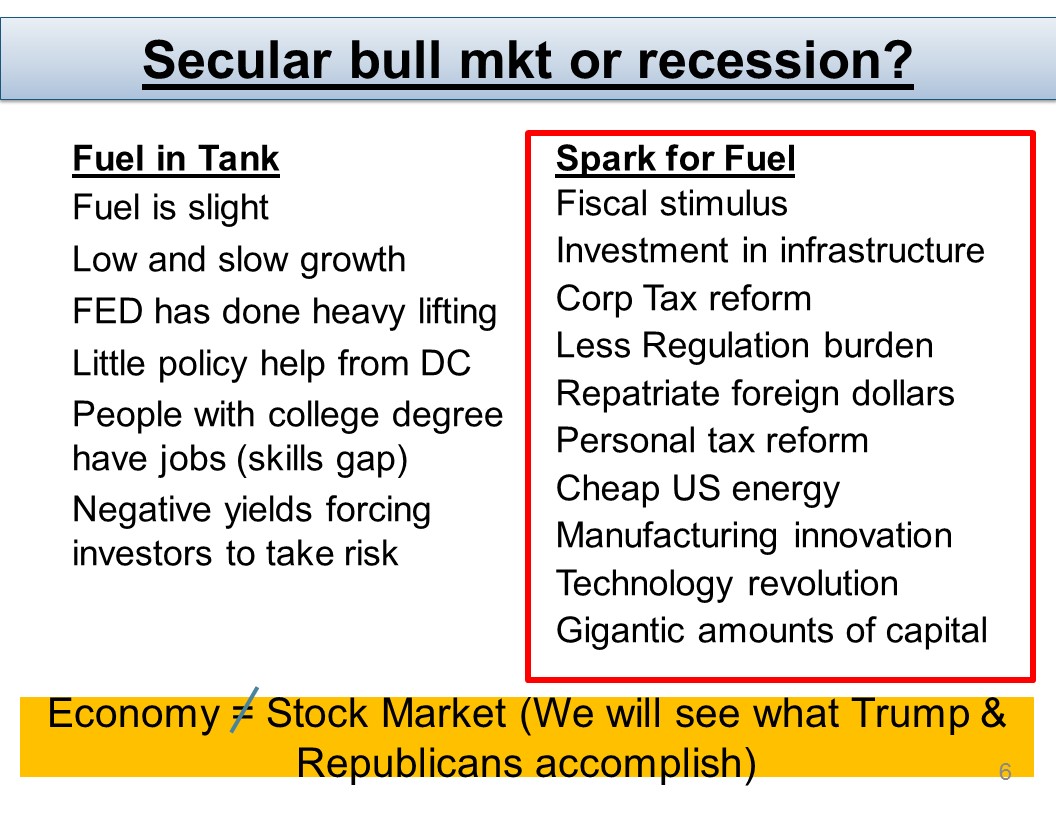

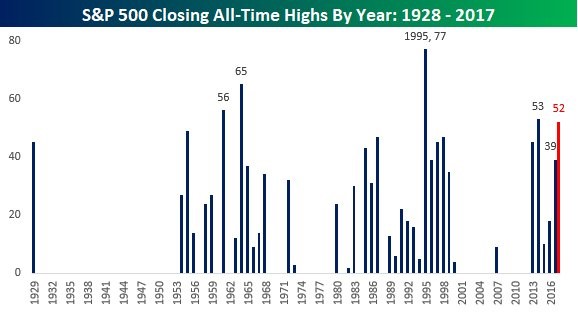

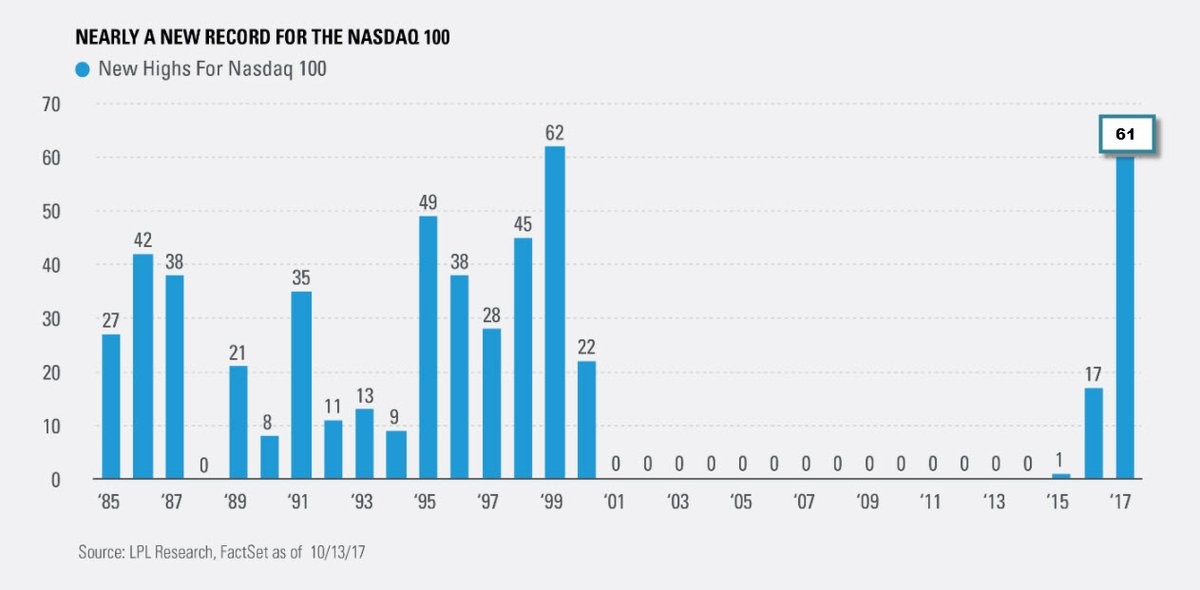

- The bull market has continued and shows little signs of slowing. Despite global concerns, hurricanes, dysfunction in Washington DC.

- Although the recent hurricanes will may slow short-term growth, they may help in future quarters with the rebuilding.

- The Fed seems on track to raise by 25 bps in December

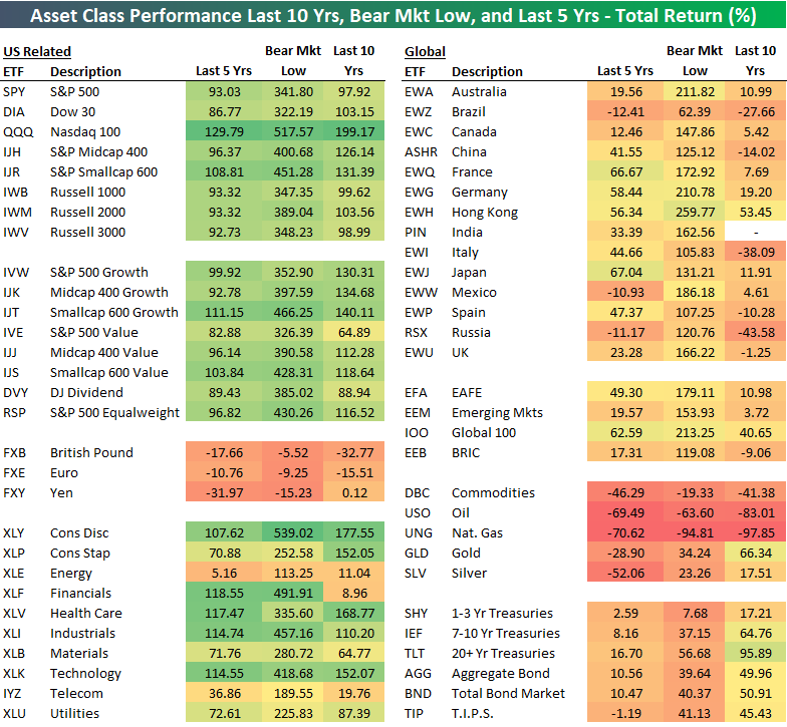

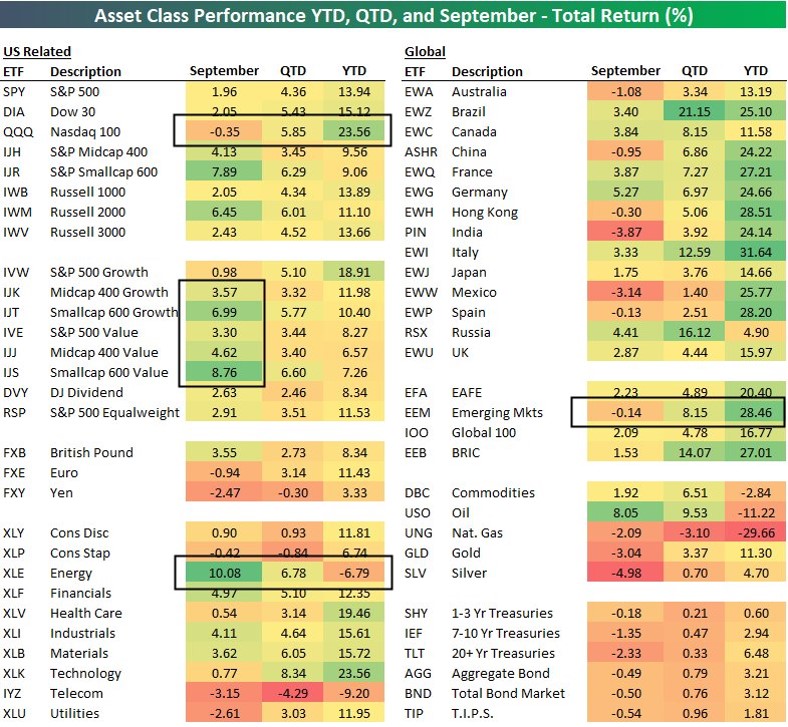

- Q3 had strong returns across the board. Let by International, Emerging Markets and technology.

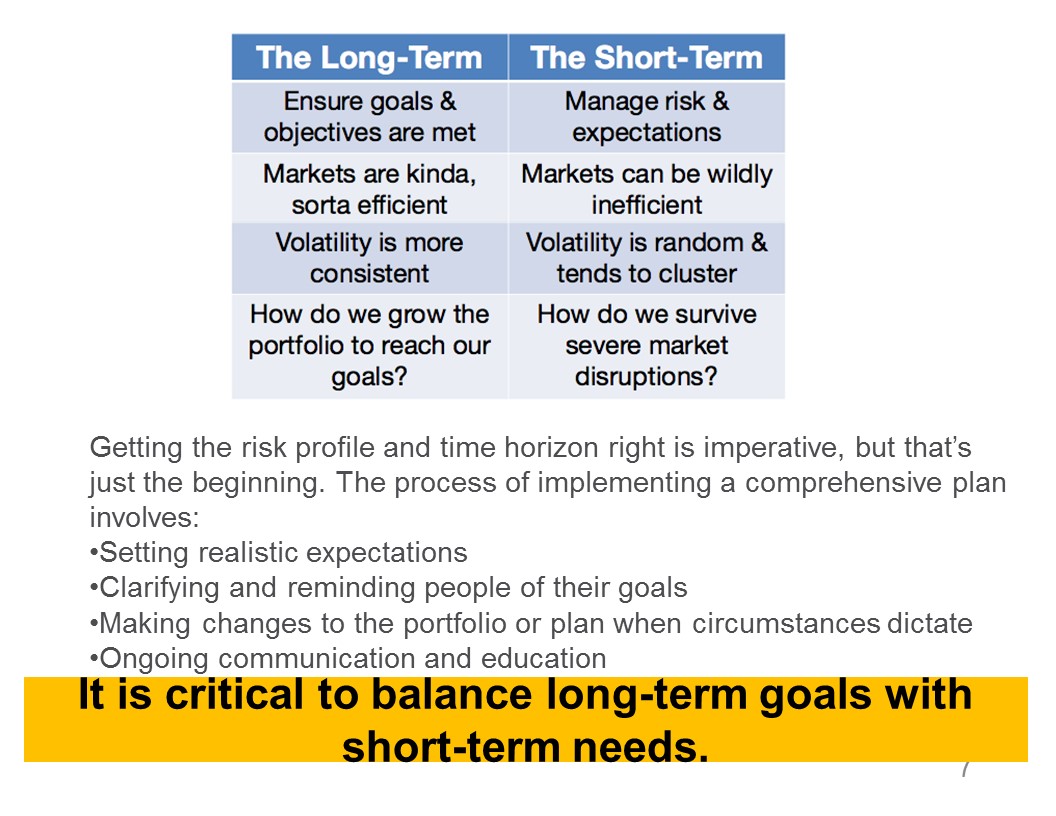

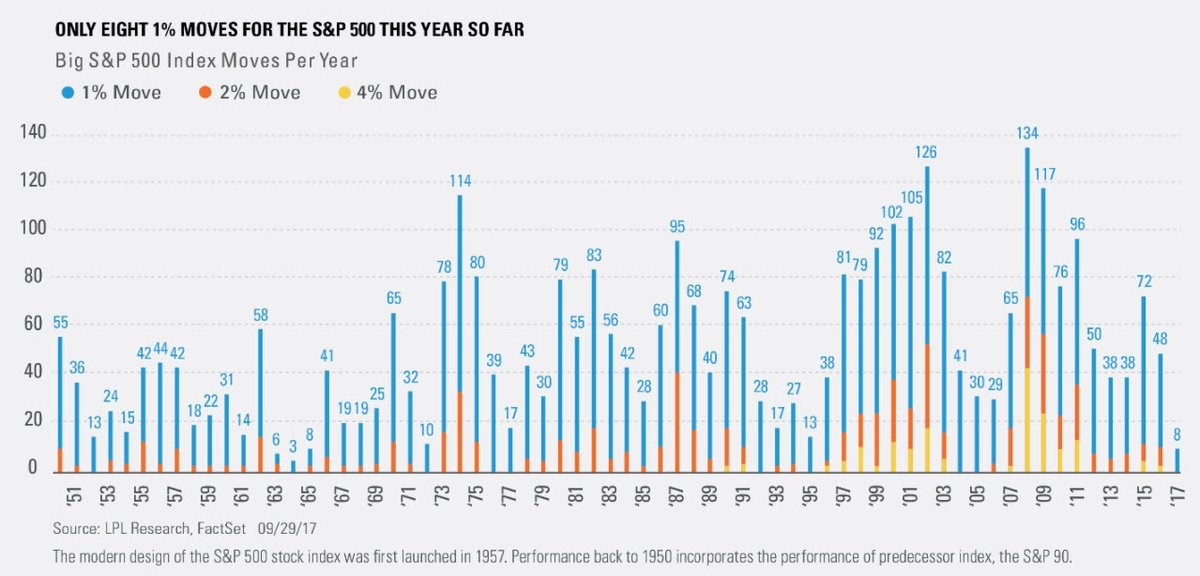

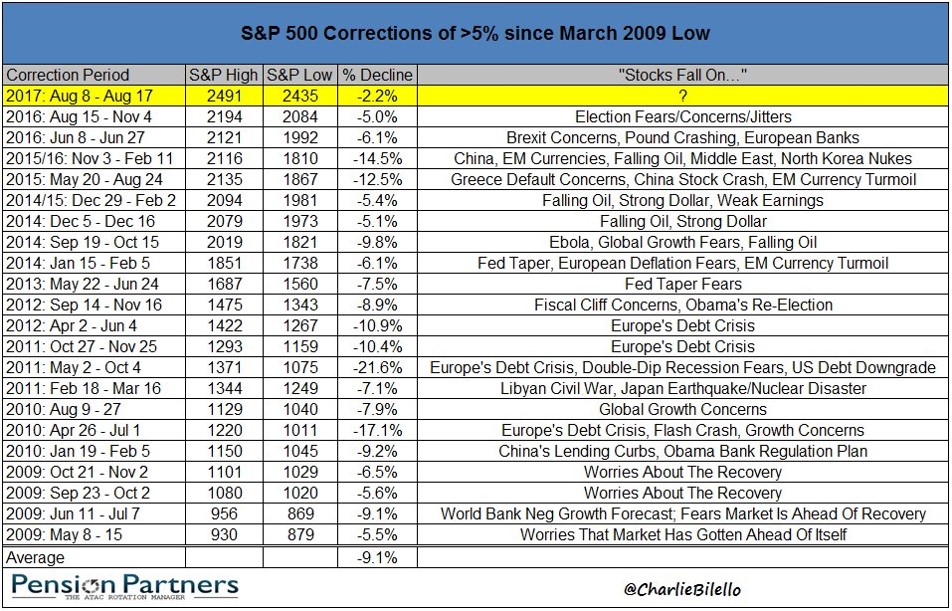

- We should be prepared for more volatility…. this has been one of the least volatile years on record.

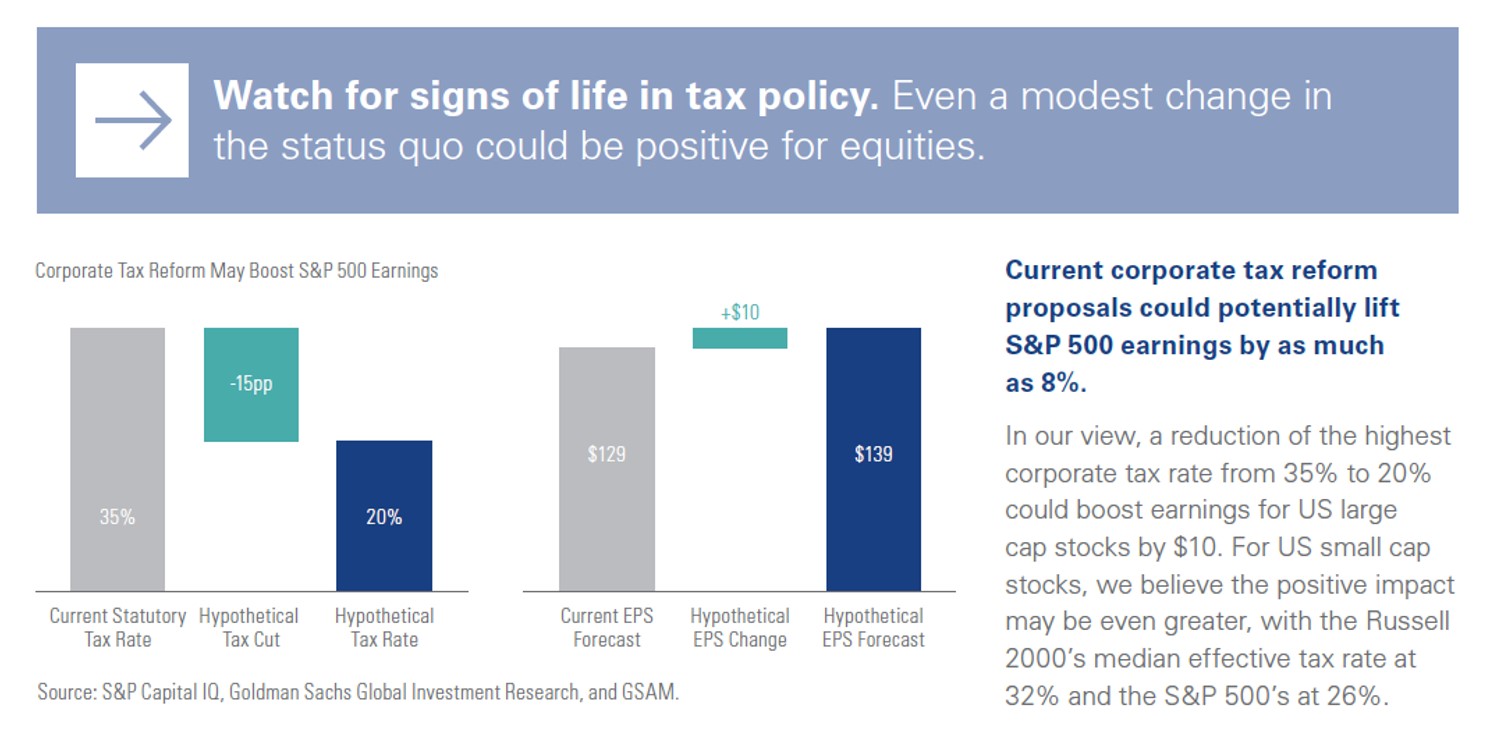

- With strong corporate earnings, full employment, less regulation and possibly tax reform, stocks may continue to move higher.

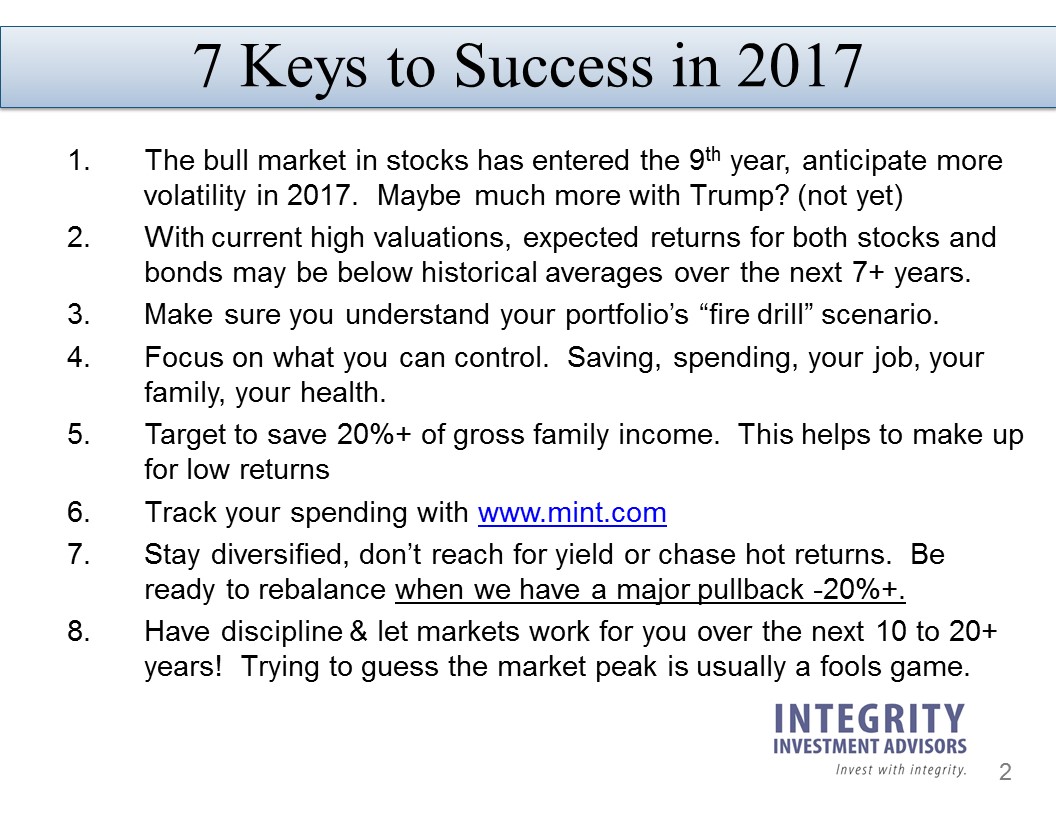

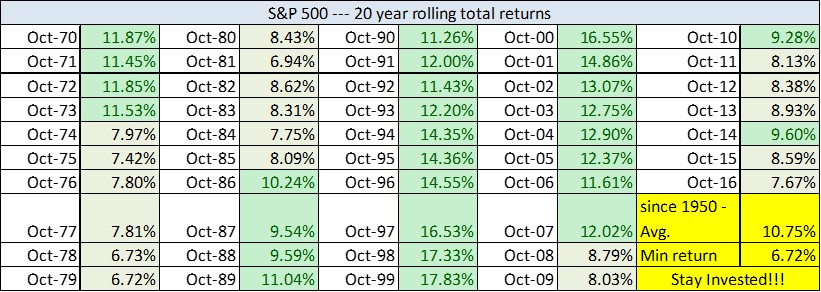

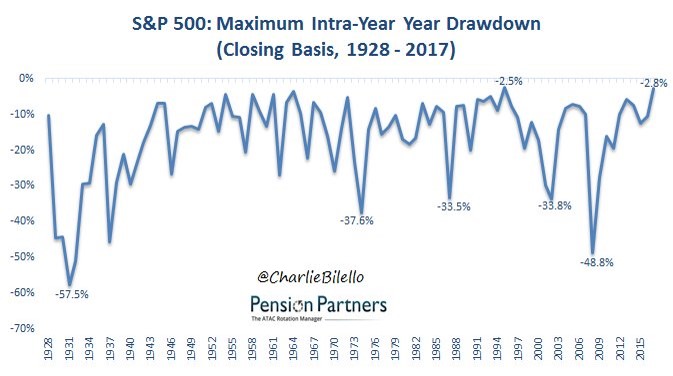

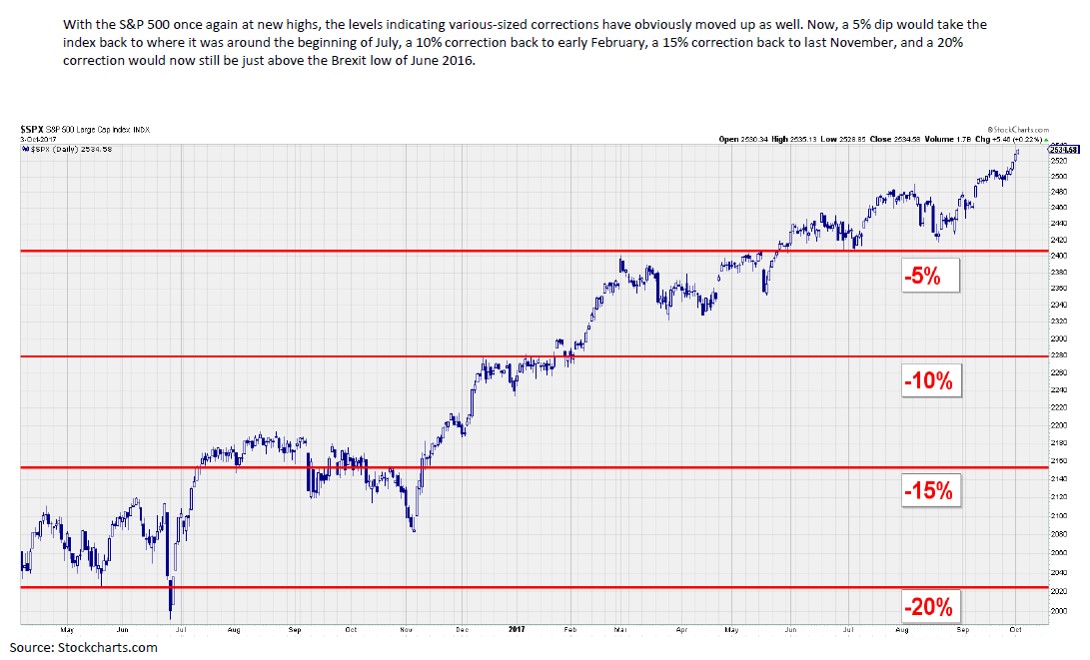

- Valuations are high (compared to history) for both stocks and bonds. This typically means that we can have a perfectly normal pullback of 20% to 40%+ or that future returns may be lower than historical returns. If this is the case, investors may have to save more (20%+) and / or work longer to maintain their lifestyle in retirement.

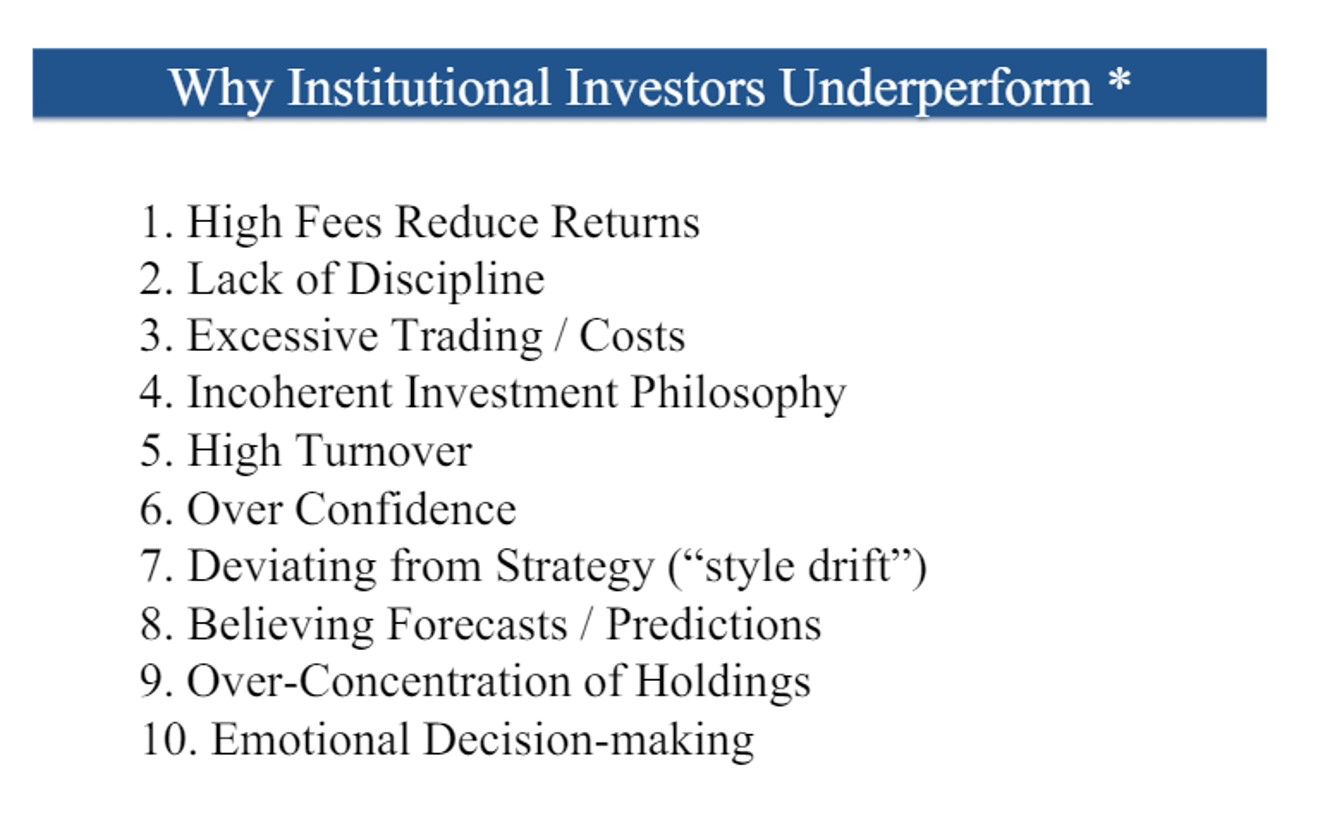

- I encourage all clients to track their net worth and yearly savings rate (household profit margin). Take a look at your net worth today and compare it to the beginning of 2009. Assuming that your net worth has increased substantially, does it make sense to reduce some of the risk in your portfolio? Managing risk is the key to long-term success. Give us a call if you want to discuss.

- As a reminder, we suggest you check to see if you were impacted by the Equifax security breach. See our blog below for tips for preventing identity theft.

- Tips for Preventing Identity Theft

- Passion, Curiosity, Grit and Resiliency

- 10 Steps to Become a Better Investor

- Risk Happens Fast!

- Keep Calm or Freak Out?

- The Pledge Most Advisors Won’t Sign!

Click here to subscribe to my blog or email us for a free 2nd Opinion about your portfolio.

Thanks for reading.

Please Remember: Past performance may not be indicative of future results. Moreover, no current or prospective investor should assume that future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in any general informational materials or educational sessions, will be profitable or equal any corresponding indicated historical performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for an investor’s retirement portfolio. Moreover, you should not assume that any discussion or information contained in this website serves as the receipt of, or as a substitute for, personalized investment advice from Integrity Investment Advisors, LLC and Integrity Investment Advisors, LLC is not providing services in jurisdictions that the firm is not registered or acting under an exemption to registration. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing.

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/