Here is our market update for Q1 2016.

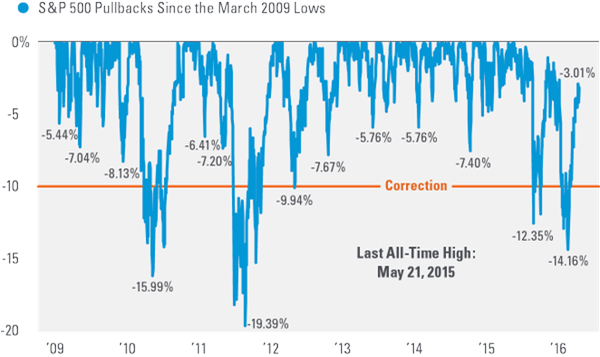

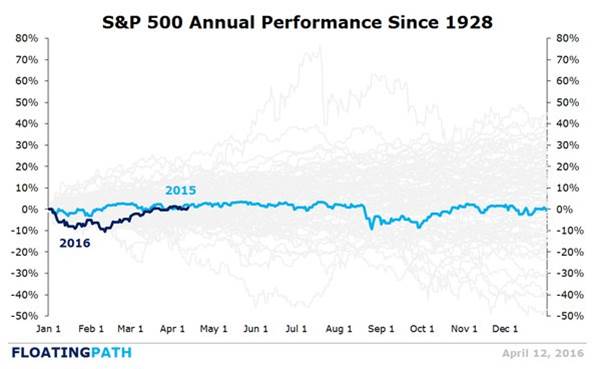

- Markets continue to see increased volatility and we expect this to continue. In Q1, markets were down -10% to -14% in mid-quarter.

- It is important to have a plan and stick to it. Stock volatility is normal.

- Quite a run. Since the February 11, 2016 lows, over just nine weeks, the S&P 500 has gained 14%. The rally has been driven by a number of factors, chief among them better U.S. economic data, higher oil prices, the Federal Reserve Bank’s (Fed) slower rate hike timetable, increased confidence in China, and more stimulus from overseas central banks. These factors have enabled stocks to trade more on fundamentals than fear, pushing the S&P 500 to within 2.4% of its all-time high.

- It is important to continue to focus on your household savings rate. Target to save 20% of gross household income each year from all sources (including company 401k match).

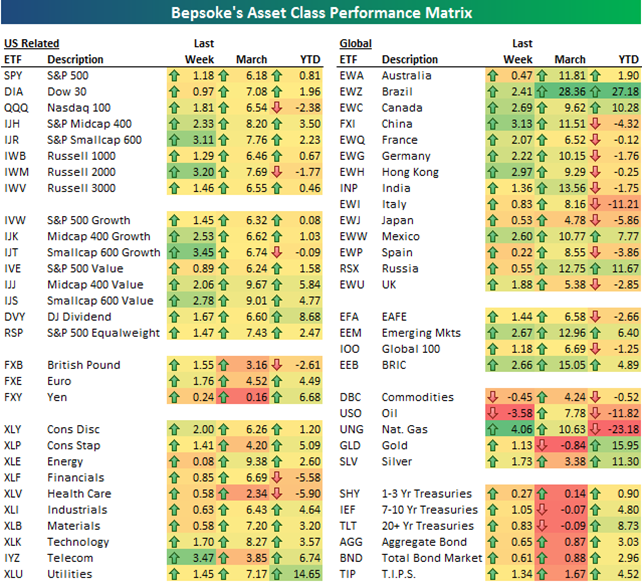

- We believe that it is important to focus on what you can control in life and investing. For investing, this is building low-cost globally diversified portfolios that target the higher expected returns of value companies, small cap companies, companies with positive momentum and companies with high profitability. These factors don’t work all of the time but over 7 to 10 year rolling periods, they tend to add incremental returns.

- There is never a good time for a less than optimal portfolio. If you need help, give us a call or email.

- Click below to download our slides for Q1 2016

QMR_Q1_2016 and market outlook PDF

See our previous blogs:

Click here to subscribe to my blog or email us for a free 2nd Opinion about your portfolio.

Thanks for reading.

Please Remember: Past performance may not be indicative of future results. Moreover, no current or prospective investor should assume that future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in any general informational materials or educational sessions, will be profitable or equal any corresponding indicated historical performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for an investor’s retirement portfolio. Moreover, you should not assume that any discussion or information contained in this website serves as the receipt of, or as a substitute for, personalized investment advice from Integrity Investment Advisors, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing.

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/