Should I Invest with Fisher Investments?

Let us show you how we help clients live the life they want!Updated 11/1/2024 — I recently listened to a podcast about Fisher Investments. Should I invest with Fisher Investments? Short Answer…. NO! Are you concerned that you are retired and have very high stock exposure? Your current Advisor is hoping you don’t run this analysis!

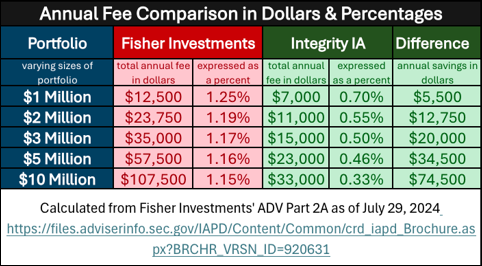

Watch the brief video above. 10 minutes might save you $6k to $20k per year! We work with Clients on a national basis. Take action and schedule a free 2nd opinion below! We will show you the data! Our fees are consistently lower than Fisher Investments for portfolios $1M to $10M+!

Here are some key takeaways: Should I invest with Fisher Investments? This information is from the Fisher ADV, firm brochure and other public sources

– Fisher Investments is a marketing machine. – The marketing program is high tech and expensive. They market on TV, radio, internet and many other sources. They have one of the best marketing programs in financial services. We have all seen the endless commercials…. “We do better when you do better”, “you get what you plan for”.

– From what I have seen from past Fisher clients, they may not always report performance vs. a benchmark (like SP500, MSCI all cap world index, technology index)! I find this AMAZING! If your Adivsor does not report 1 year, 3 year, 5 year, 10 year and inception performance, by asset class, I think you should find a new fee-only, fiduciary advisor!

– Fisher typically buys individual stocks and may be too aggressive with your risk score. How much risk do you need to take to hit your lifestyle goals in retirement? We use planning software to help figure this out. We actually model recessions for clients. Are you 60 or older and have a Fisher portfolio of 80% to 100% stocks? This could be a HUGE red flag!

– Picking individual stocks is BRUTALLY hard! We will analyze your portfolio to see if you are getting similar performance to a more diversified approach with tax efficient ETF’s. We will show you the data and we can formulate a plan to get you out of legacy holdings with minimal taxes. Schedule a free 2nd opinion below!

– Fisher Investments is based in large cities. If you live in a high cost city or state, I highly recommend NOT having a local advisor (wages, rent, taxes are very high)… fees matter and your retirement will suffer.

– Should I Invest with Fisher Investments? Troubles mounting for fisher investments – Pension and Investments

— Fisher Investments won’t take no for an answer (according to prospects and complaints to the FTC) – Investment News

- Fisher investments client reviews via BBB — Fisher Investments BBB

- Fisher Investments review updated 9/11/24 – Fisher is expensive and not recommened by the author – https://stockanalysis.com/article/fisher-investments-review/

- See this Reddit thread – Anyone using Fisher Investments and feel like it’s worth it? https://www.reddit.com/r/investing/comments/1eu180a/anyone_using_fisher_investments_and_feel_like_its/

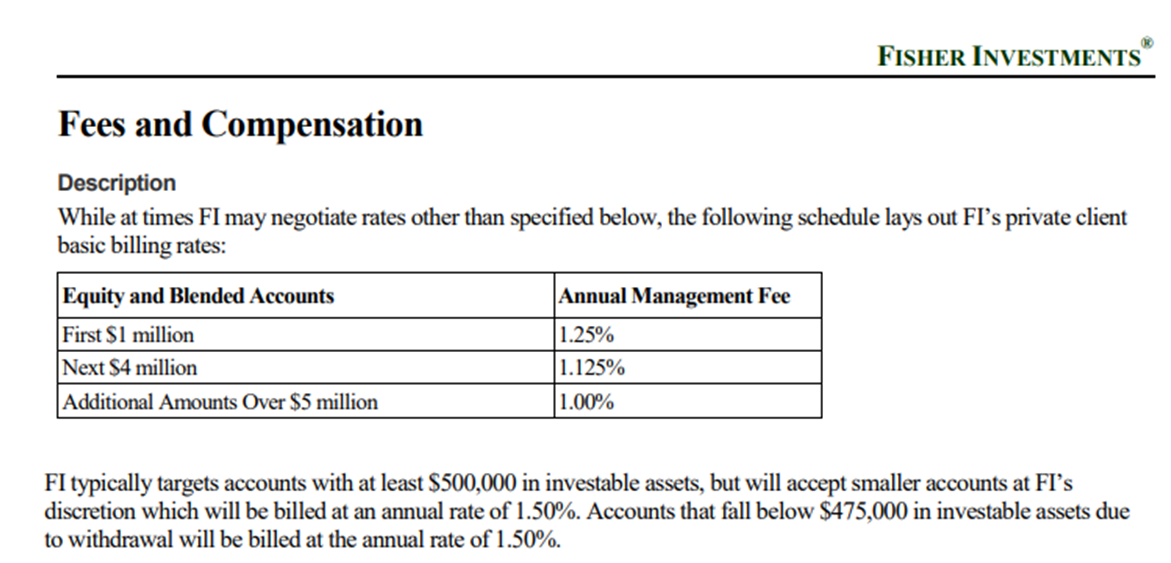

- Should I invest with Fisher Investments? How much are my total fees? Why is Fisher Investments so expensive?

- Is Fisher Investments a fiduciary? Is Fisher Investments good if I have $500,000 or $1,000,000?

- Check out our Why DFA vs. Vanguard page for a better solution.

- Should I Invest with Fisher Investments? Fisher Investments reviews

- If I have $2 million portfolio, am I paying too much for Fisher Investments?

- Why does Fisher Investments have so many individual stocks?

- Why does Fisher Investments spend so much money on TV commercials? #Fisher #FisherInvestments #KenFisher

When I started my firm in 2010, we started with the vision of competitive fees for the scope of work. We work with clients to educate them about investing best practices and help them align their money with their values. We help clients reduce the middlemen (and middlewomen) in the investing process so our clients keep more of their money. We help clients to make work optional.

– We are are a low-cost, fee-only Advisor. We are a fiduciary for you 100% of the time. Our fees are 0.6% on the first $1 million and they decline above $1 million. If you have over $300k in a portfolio (including 401k), schedule a meeting below.

Now is a great time to get a free 2nd opinion via Zoom meeting (see calendar below)! We will give you objective feedback, identify red flags and give your confidence about your future path. It is important to find out if you have areas that can be improved. We help clients make work optional & live the best life possible. Contact us for a free 2nd opinion!

Ready to see if we’re a good fit? Schedule a free meeting below.

We will show you your total fees & red flags.

Fee-Only Compensation

This model minimizes conflicts of interest. A Fee-Only financial advisor charges clients directly for his or her advice and/or ongoing management. No other financial incentive is provided, directly or indirectly, by any other institution. Fee-Only financial advisors do not sell anything. They add value with their Philosophy, Strategy, Process, Transparency and Ongoing Coaching. We strongly encourage you to work with a fee-only Advisor.

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/