Read This First! Financial Advisor & Planning Fort Collins

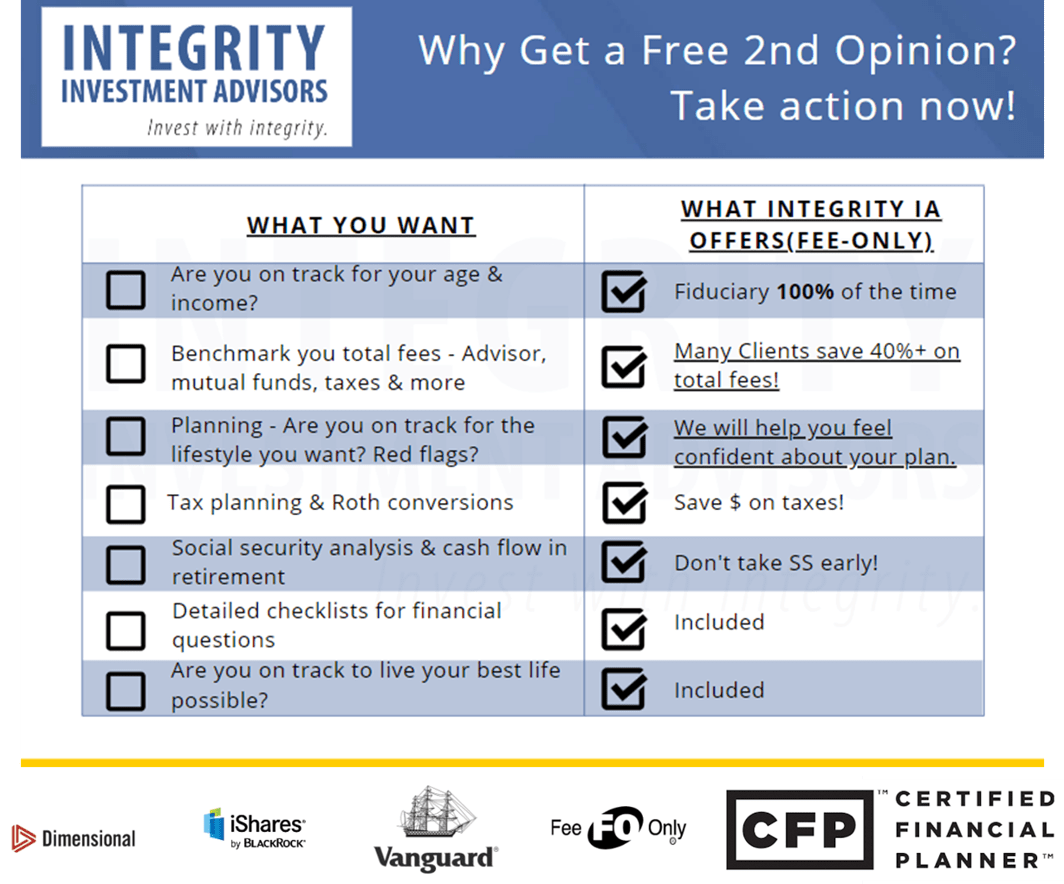

What You Need to Know Before You Hire A Financial Advisor or Planner in Fort Collins, ColoradoIs your Advisor living in the past and still charging you 1%+ in fees? Even worse, are they charging you commissions and A/ B/ C share mutual funds? Now is the time to get a free 2nd opinion & I will show you the red flags in your portfolio and strategy for Free!

I recently analyzed several new client portfolios and I continue to be amazed with the level of red flags. See below. Edward Jones & Raymond James Advisors charging 1.35% in fees and another .7% in Mutual fund fees. Total cost = above 2%! I saw a friendly CPA firm adding investment advice for 1% in Advisor fees and then outsourcing the asset management to Loring Ward and having the client pay another .9% in fees for the mutual funds! If your Advisor is an insurance agent, warning, everything looks like an insurance sale because that is how they are trained. This is crazy! There is no need to pay this level of fees. Please schedule a free 2nd opinion on the calendar below. You will wish you had done this years ago!

What you need to know before you hire a financial advisor or financial planner in Colorado (we work with clients nationwide)

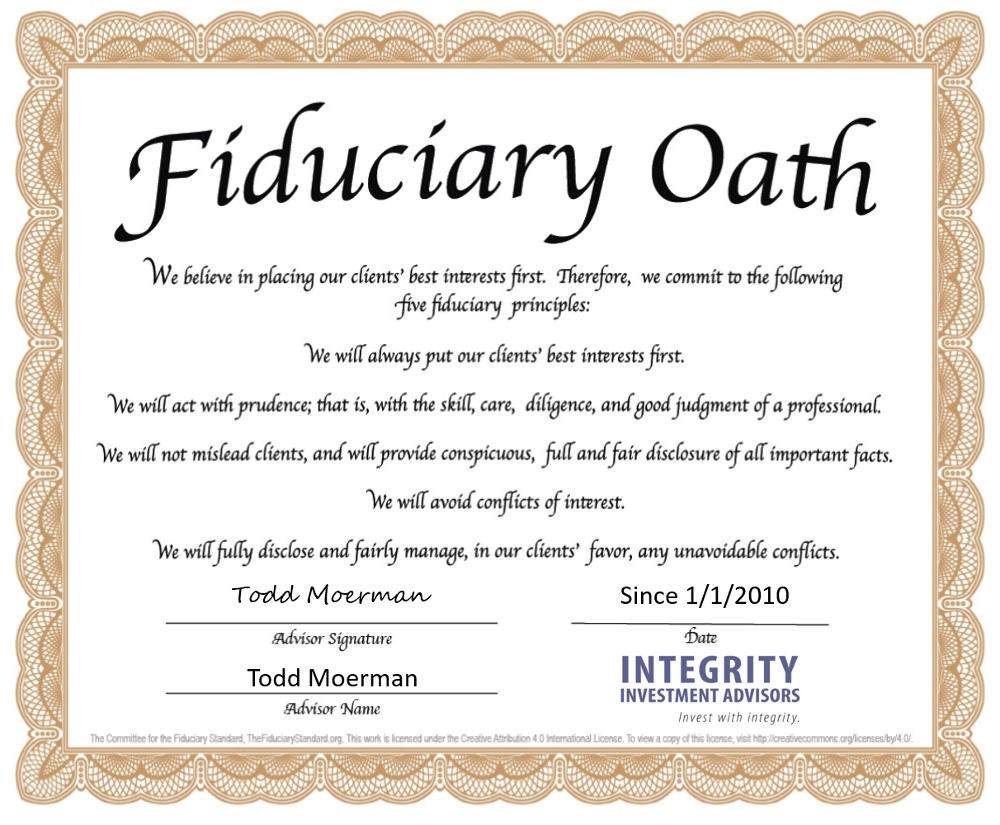

If you live in Colorado, picking the best financial advisor or financial planner can be a very challenging task. It is confusing and mistakes can be VERY expensive. I urge you to “Trust but Verify” that your current advisor and your current strategy are optimal for your retirement goals. If your financial person claims to be an “advisor”, have them sign the “fiduciary oath”, make sure they charge less than 1% and use low-cost ETF’s/ funds.

Warning: If you have been sold red flags such as annuities, whole life insurance, non-traded REIT’s or commission products like A shares, B shares, or C shares, I strongly suggest you look at your total expenses and seek professional help. Don’t let an “insurance Sales Rep” be your “wealth manager”!

Here are some tips to help you pick the best financial advisor in Fort Collins or nationwide. If you are considering using a traditional stock broker like Wells Fargo, Merrill Lynch, Morgan Stanley, JP Morgan, Chase, Edward Jones, Raymond James, Ameriprise, LPL, Carson Wealth, Edelman, Fisher Investments, Creative Planning, Dave Ramsey SmartVestor Advisors, Northwest Mutual or your local bank, I encourage you to really take a hard look at the total fees and commissions. If you have over $500k in a portfolio, your total fees and expenses should be under 1%. Times have changed and you no longer need to pay 1% of your assets for financial advice. I see many portfolios with total fees of 1.5% to 2.5%+ per year. In my opinion, that is way too much to spend. We recommend that your fees be 0.6% or less on the first $1 million and decline above $1 million. It depends on the complexity of your portfolio for your goals and objectives.

- Financial Advisor near me. Financial Planner near me.

- Fort Collins fee-only Advisor. Fort Collins fiduciary Advisor. Financial Planning Fort Collins. Taxes Fort Collins.

- Understand how you pay for financial services. Many investors don’t realize that the cost of investing has dramatically declined over the last 10 years. You no longer have to pay 1%+ for an advisor and there are many low-cost ETF’s/ funds. There are 3 primary ways to pay for investing services:

- Commission-based Financial Advisor – This type of advisor is typically a broker or financial advisor and they sell you products for commissions. These can be stocks or mutual funds with A shares or B shares or C shares. The investments can also be some sort of insurance product or non-traded REIT. The commissions can be from 1% to 5.75%+. Some insurance products and non-traded REITs can be much higher. This person is held to “suitability standard of care”; to do what is “suitable” for other similar investors. Make sure you check your statement for your investment objective & risk tolerance. Sometimes these are coded to “aggressive” when you are a “conserevative” investor.

- Fee-based Advisor – This type of advisor sometimes works on commission and sometimes charges you a fee. This relationship is very confusing for investors. This person is held to a “suitability standard of care”: to do what is “suitable” for other similar investors.

- Fee-only Advisor – This type of advisor works on a fee-only basis 100% of the time. There are no hidden commissions or fees. This person is held to a “fiduciary standard of care”. By law, this advisor is obligated to put the client’s interests first at all times and disclose any conflicts of interest. (This is what you want)

- Soon, it may be illegal for your advisor to overcharge your retirement accounts (IRA/401k). Don’t wait for the Government to finalize this new law, take action by having your advisor sign this pledge!

- Understand what services you need to pay for. Many investors are not aware of how they pay for financial services. This has serious implications and can drastically reduce your retirement nest egg. Do you need portfolio management? Do you need financial planning? Do you have solid goals for retirement? Can you maintain your lifestyle in retirement? When is the optimal time to take Social Security? Typically, annuities are not an investment strategy. Social Security is your first and best annuity.

- If you have less than $400k, just use Vanguard and save 12% to 20% of your gross income each year (including 401k match). – You work hard for your money and your family. 65% of retirees who did not prepare adequately for a comfortable retirement did not realize this until they had already retired. A $400k nest egg will only generate about $16k per year in retirement spending. Check out the Vanguard LifeStrategy funds. Very low cost and good diversification. We encourage you to take action.

- Find out if you have significant problems with your strategy or portfolio sooner rather than later. When it comes to retirement planning, a solid retirement will not happen by chance and there are no quick fixes. It takes years of planning, preparation and discipline to hit your goals. These checklists may help to save your retirement!

5 Free Checklists That May Save You Thousands – Really! (download checklists for tax savings, funding child’s college, taking care of aging parents and more)

Financial Advisor near me, Financial Planner near me – Fort Collins, Colorado 80528, 80525, 80521, 80524, Fee-only financial advisor near me

Read this — The Pledge Most Advisors Won’t Sign!

- Watch this video – Can You Maintain Your Lifestyle in Retirement?

- Watch this video – The Most Important Decision of Your Financial Life

- 7 Steps to Get Your Financial House in Order in 2017!

Stockbroker conflicts cost Americans billions

Wall Street Gears Up to Fight New Retirement Rules

Please Remember: Past performance may not be indicative of future results. Moreover, no current or prospective investor should assume that future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in any general informational materials or educational sessions, will be profitable or equal any corresponding indicated historical performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for an investor’s retirement portfolio. Moreover, you should not assume that any discussion or information contained in this website serves as the receipt of, or as a substitute for, personalized investment advice from Integrity Investment Advisors, LLC or NoCo Investment Education. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing.

Find the Best Financial Planning Fort Collins, CO

Find the Best Financial Advisors Fort Collins, CO

Wealth Management Fort Collins, CO

Fee-Only Financial Planning Fort Collins, CO

Highly rated financial advisors Colorado

Top financial advisors Fort Collins, CO, Fee only financial planner fort collins, retirement planning

Financial Advisor near me, Financial Planner near me – Fort Collins, Colorado 80528, 80525, 80521, 80524, Fee-only financial advisor near me. Compare our services to Michael Tarantino, OakTree, IFAM Capital, Cosner Financial, Trail Ridge Investment Advisors, Theory Financial, Navigation Wealth Management, Old Town Wealth Advisors, Edward Jones, Merrill Lynch

Fee-Only Compensation for Financial Planning – Fort Collins, Colorado

This model minimizes conflicts of interest. A Fee-Only financial advisor charges clients directly for his or her advice and/or ongoing management. No other financial reward is provided, directly or indirectly, by any other institution. Fee-Only financial advisors are selling only one thing: their knowledge. Give us a call to find out more.

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/