Diversification is the only free lunch in town.

”Diversification means always having to say you’re sorry.” In other words, in order to enjoy the benefits of diversification, you need to embrace asset classes and strategies that have low correlations with each other.

If all your investments are moving the same way at the same time, then you’re either very lucky or you’re not diversified.

Most investors don’t realize that a standard 60 stocks/40 bonds portfolio is 95% correlated to stocks. When you think about downside risk, most of the risk is attributed to stocks (say 85%). Do you have a solid plan?

I recently gave a market review for a board meeting. Here are some of the key slides:

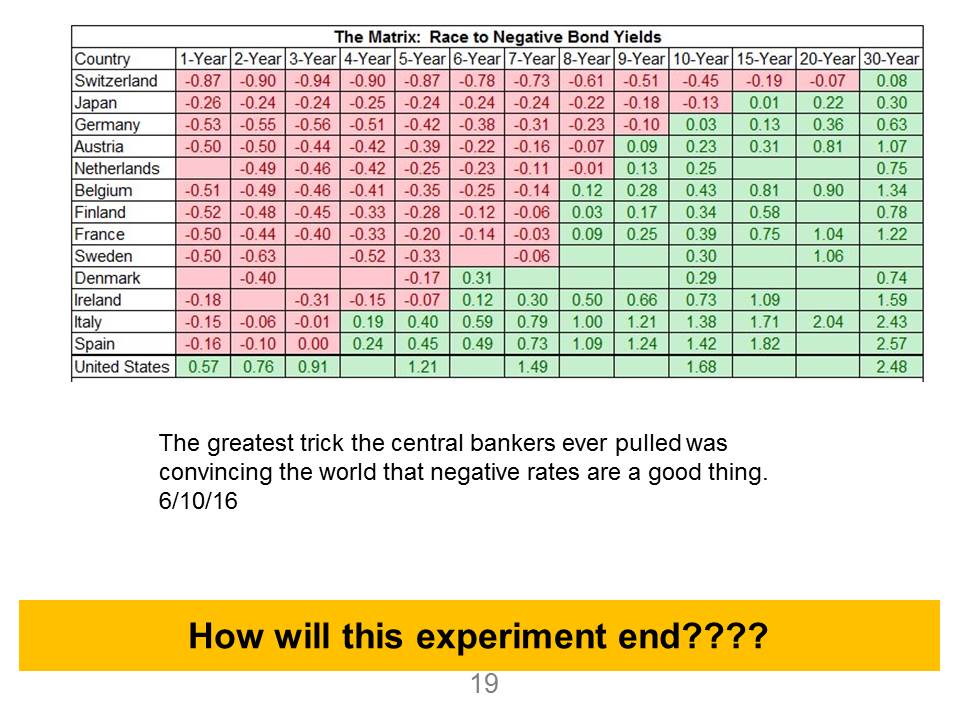

- Markets are at the higher end of valuations but given the extremely low bond yields around the globe, they may be justified at this level.

- Markets are up 260% from the market lows of 2009

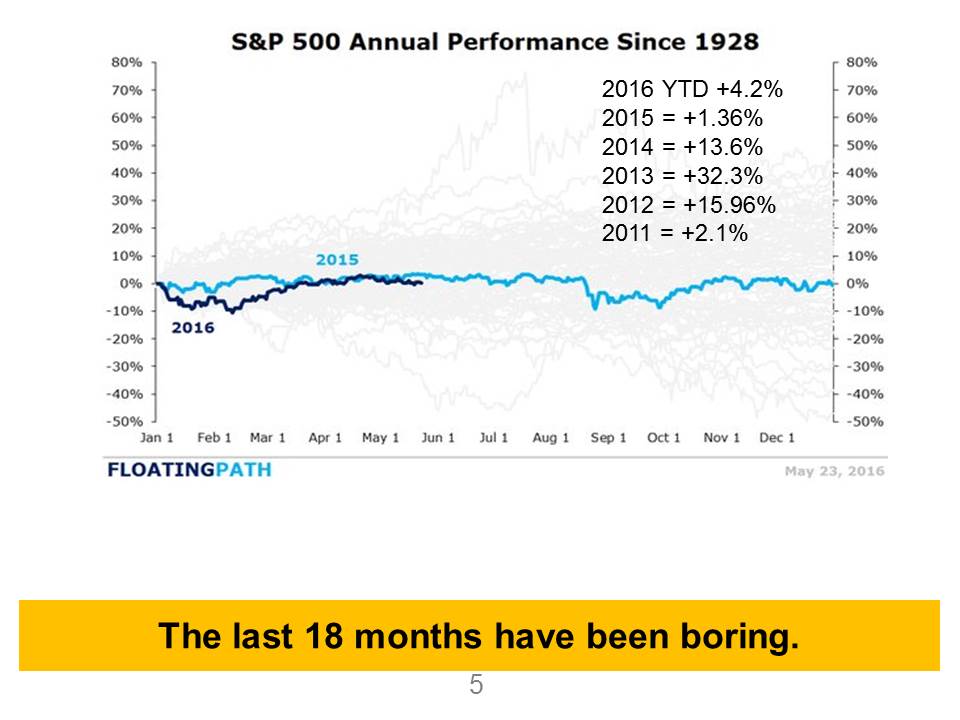

- Markets have been boring for the last 18 months

- Successful investing is about Philosophy, Strategy and Process.

- Investors may need to save more for retirement because expected future returns may be lower than historical averages. See this post — The Perfect Storm May be Brewing

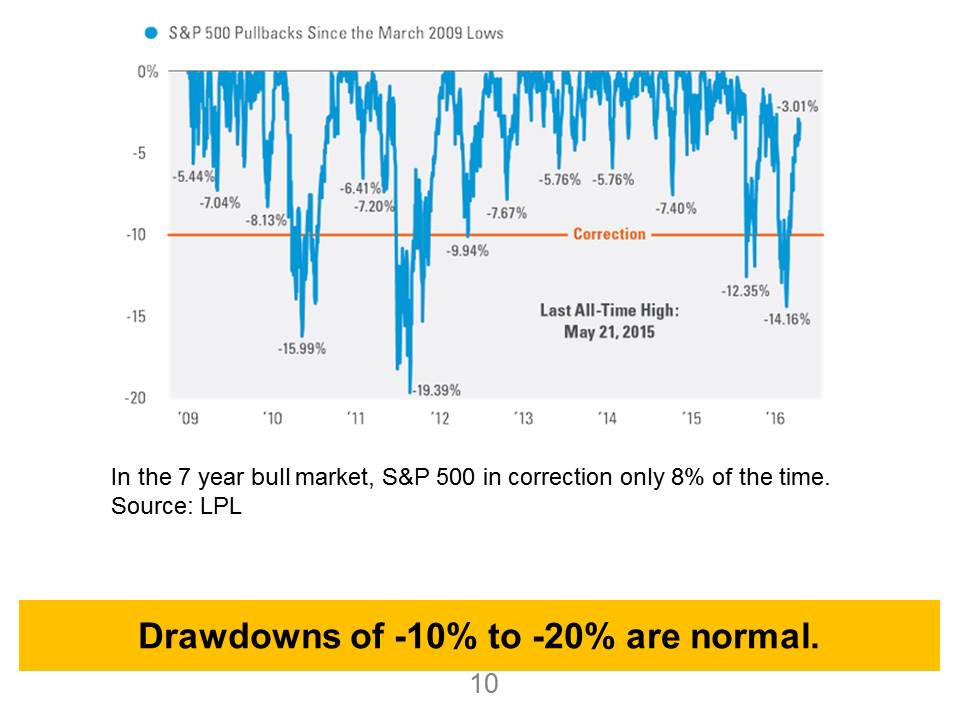

- Risk happens fast, be prepared for pullbacks of -10% to -25% for stocks. There is a lot of uncertainty in this election year. Keep Calm or Freak Out?

- It is critical for investors to only work with a low cost, fee only advisor who is a fiduciary for them 100% of the time. See The Pledge Most Advisors Won’t Sign!

Please call me (or email) if you have questions or concerns. Enjoy summer and hit the pool!

Please Remember: Past performance may not be indicative of future results. Moreover, no current or prospective investor should assume that future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in any general informational materials or educational sessions, will be profitable or equal any corresponding indicated historical performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for an investor’s retirement portfolio. Moreover, you should not assume that any discussion or information contained in this website serves as the receipt of, or as a substitute for, personalized investment advice from Integrity Investment Advisors, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing.

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/