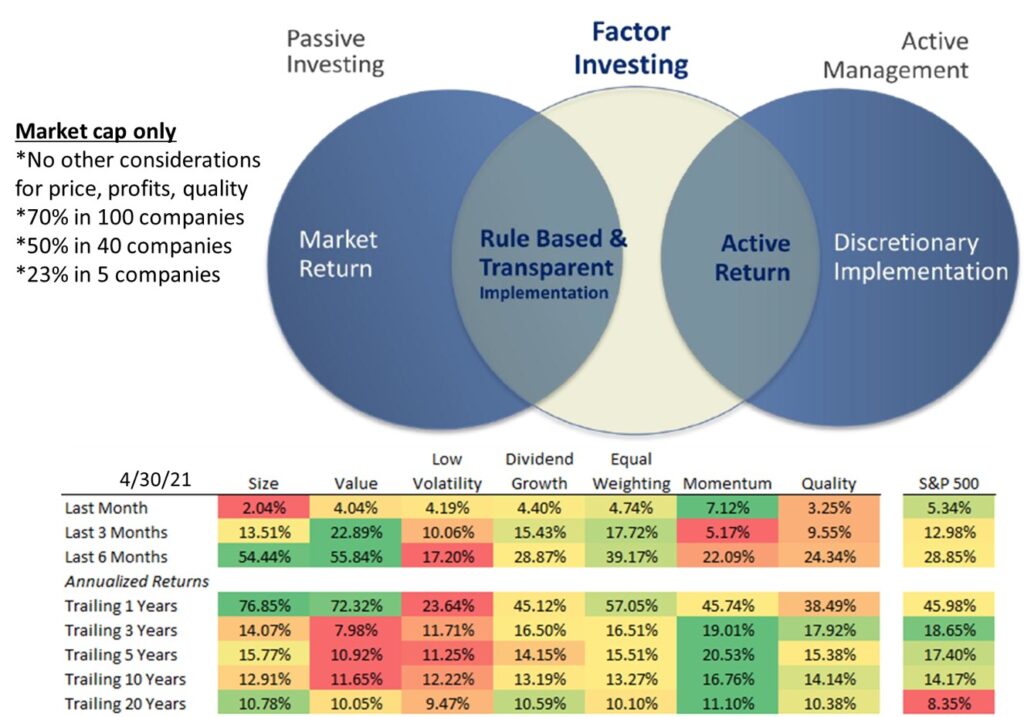

At Integrity Investment Advisors, we are huge fans of Dimensional Funds (DFA) and factor investing. We believe that over long periods of time, adding factors like value companies, smaller companies, companies with high profit and companies with good momentum can add increment returns over decades.

- See these pages:

- You don’t have to pay 1% to get access to DFA funds

- Why Dimensional Funds (DFA) vs. Vanguard funds

Dimensional is one of the first asset managers to convert mutual funds into ETFs. With the successful launch of the firm’s first three ETFs and the conversion of these four mutual funds, Dimensional becomes one of the largest active ETF issuers in the industry, with more than $30 billion in combined ETF assets under management placing the firm in the top 10% of all ETF issuers across both active and passive offerings.3

“We expect to have a full lineup of ETFs to offer clients alongside our mutual fund offerings and expanded separately managed accounts platform,” said Dimensional Co-CEO and Chief Investment Officer Gerard O’Reilly. “Our strategies offer the benefits of indexing—such as low costs, low turnover, and high diversification—paired with the advantages of flexible implementation that provide a continuous focus on higher expected returns and robust risk management.”

“For four decades, we have focused on empowering investment professionals so they can deliver their clients the best investment experience. The solutions we are bringing to the ETF marketplace will further that mission, offering more ability to customize and tailor investments to clients’ specific needs and preferences,” added Dimensional Co-CEO Dave Butler.

The new listings follow Dimensional’s successful launch of three core equity market ETFs in 2020. Dimensional investment strategies seek to harness a consistent, broadly diversified, and systematic approach that aims to outperform the market without outguessing the market. Strategies within Dimensional’s suite of ETFs have varying tilts from market weights to securities that offer higher expected returns, such as small cap, value, and high profitability4 securities.

Dimensional ETFs now provide a range of equity solutions that include marketwide, core equity portfolios with varying degrees of emphasis on drivers of expected returns, as well as component solutions, such as value and small cap portfolios. This range of strategies provides more customization in asset allocation, which can help financial professionals meet the specific investment goals and needs of their diverse investor bases.

| ETF Offering | Ticker | Total Annual Fund Operating Expenses (%)1 | Listing Date |

| MARKETWIDE | |||

| US Equity ETF | DFUS | 0.11 | 6/14/21 |

| US Core Equity Market ETF | DFAU | 0.12 | 11/18/20 |

| US Core Equity 2 ETF | DFAC | 0.19 | 6/14/21 |

| International Core Equity Market ETF | DFAI | 0.18 | 11/18/20 |

| Emerging Core Equity Market ETF | DFAE | 0.35 | 12/02/20 |

| COMPONENT | |||

| US Small Cap ETF | DFAS | 0.34 | 6/14/21 |

| US Targeted Value ETF | DFAT | 0.34 | 6/14/21 |

More information about Dimensional ETFs can be found here: https://us.dimensional.com/etfs

FOOTNOTES

- 1The “Total Annual Fund Operating Expenses” have been adjusted to reflect the decrease in the management fee payable by the predecessor mutual fund in connection with the reorganization of the predecessor mutual fund into the ETF, effective June 11, 2021.

- 2A registration statement, including an Information Statement/Prospectus, relating to the reorganization of the two non-US tax-managed mutual funds (“Converting Mutual Funds”) into newly created series of the Dimensional ETF Trust (“New ETFs”) has been filed with the Securities and Exchange Commission on Form N-14. The New ETFs will not be sold to the general public until after the reorganizations. This communication is not an offer to sell shares of the New ETFs.

- 3US-domiciled ETF data obtained from Morningstar as of 5/31/2021.

- 4Profitability is defined as operating income before depreciation and amortization minus interest expense divided by book equity. The criteria the advisor uses for assessing relative price and profitability are subject to change from time to time.

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/