by Todd Moerman | Mar 7, 2020 | Manage Risk

As markets sell-off because of fear of COVID-19 & potential Global slowdown, what should you do with your portfolio? Are you prepared for volatility? We recommend that you should always manage and be aware of the downside risk in your portfolio (most investors...

by Todd Moerman | Feb 25, 2020 | Manage Risk

As markets sell-off because of fear of the Coronavirus & potential Global slowdown, what should you do with your portfolio? Are you prepared for volatility? We recommend that you should always manage and be aware of the downside risk in your portfolio. It is...

by Todd Moerman | Feb 12, 2020 | Manage Risk

Covid-19 has exposed the College Crisis. Years of price increases, lack of ROI and many students stuck in low paying jobs even with a college degree! If you have kids, you have probably wondered “How are we going to pay for college?” The costs and consequences have...

by Todd Moerman | Oct 25, 2019 | Manage Risk

With markets near all-time-highs, it is important to think about how we manage risk, our expectations about future returns and how we plan in advance for recessions. Please see the below video. You can pause the video to look at the details. In the video, you will see...

by Todd Moerman | Sep 13, 2019 | Manage Risk

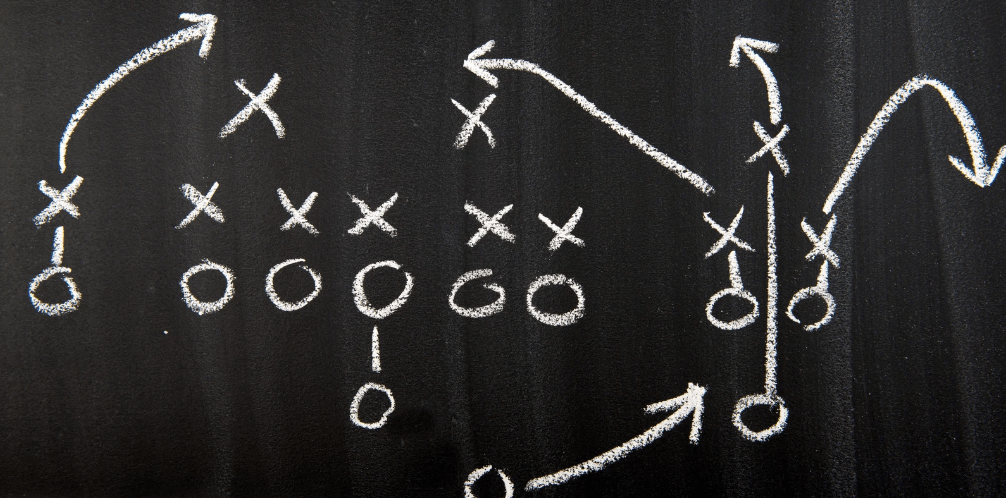

As we move into September and the start of football season, it is important to focus on your investing Game Plan. Please see the below video that addresses some recent questions from Clients – if you have questions about the next recession, expected losses, current... by Todd Moerman | Jul 24, 2019 | Manage Risk

Happy Summer! With markets at all-time highs, it is important to recalibrate, check our emotions and evaluate our overall risk levels. The key is to have a long-term plan. Focus on your goals, your lifestyle in retirement and how much risk do you need to take to hit...

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/