Services and Fees

We are a fee-only low cost DFA approved advisor in Fort Collins, Colorado.We offer comprehensive services for Portfolio Management. We are a fiduciary to you, the Client. This means that we put your interests first. We help you simplify your financial life in an effort to optimize your financial goals. We act as a financial coach to help keep thing on track and avoid “behavior gaps”. The best financial strategy is one you can follow for an extended amount of time (good times and bad).

Services offered include:

- 100% free 2nd opinion about current investments

- Legal Loyalty to you

- Risk assessment

- Investment analysis

- Financial coaching to help avoid “behavior gaps”

- Academic approach to investing

- Portfolio design/ asset allocation

- Cost effective implementation

- Periodic rebalancing

- Institutional access to Dimensional Funds (DFA)

- Tax-efficient portfolio design

- Low Cost DFA Advisor

- Direct access to AQR flex SMA’s, long/short indexing, AQR LPs

Portfolios are structured along the dimensions of expected returns (Value, Small Cap, High Profit, Quality and Momentum)

Fees

Keep in mind that fees are important but strategy is equally important. 97% of your portfolio return will be from the dimensions of expected returns. See the Why DFA page for more details.

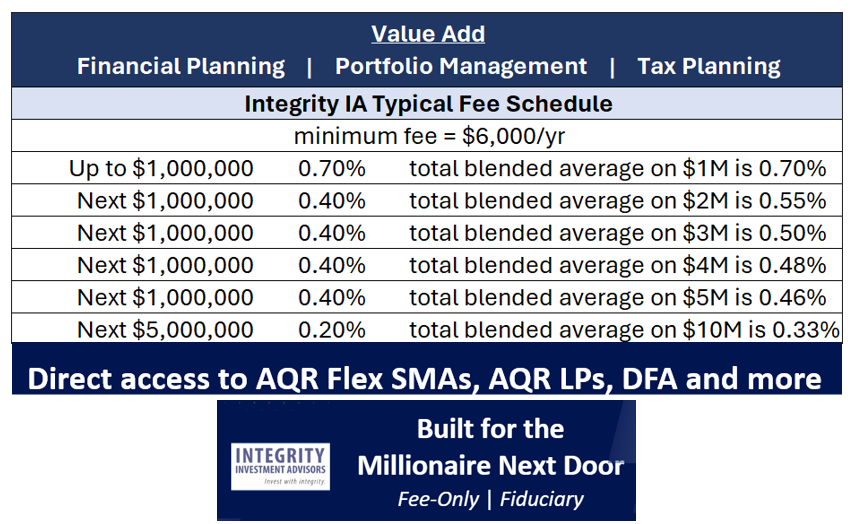

Integrity Investment Advisors is 100% fee only. Our cost-effective Portfolio Management advisor fee is 0.70% of assets under management (AUM) per year up to $1,000,000 (and .40% above $1M) subject to a $6,000 minimum annual fee. Clients have the option to pay fees separately or have fees automatically deducted from their account(s). Although Integrity Investment Advisors requires a minimum account size of $500,000 per family unit, under special circumstances, we may accept an amount less than that minimum.

Fees are billed quarterly in arrears.Employee Benefit Retirement Plan Services – Company 401(k) plans Standard 401(k) fee schedule for small to medium business 401k plans. In general, advisor fees will range from 0.80% to 0.25% of assets under management depending on complexity and scope of work.

Fund Expenses

Client accounts hold mutual funds and/or exchange-traded funds which have expenses (expressed as the expense ratio) not related to our management fee.

We recommend passive and index funds to keep expense ratios very low. Total costs may be further reduced by tax management and/or securities lending by the funds. Integrity Investment Advisors is not compensated by fund companies for recommending their products

Trading Costs

Schwab & Fidelity are the primary custodian for client accounts. Each custodian may charge transaction fees for buying and selling securities, typically $25 per trade on mutual funds (with a range of $0 to $50) and $0 per trade (with a range of $0 to $25.00) on exchange traded funds or individual stocks. Integrity Investment Advisors is not compensated by transaction fees.

Our goal is to only trade when necessary and keep transaction fees to a minimum.

PLAN A

Assets up to $1M- Billed Quarterly

- 0.70% on first million

- $6,000 yearly minimum

PLAN B

Assets exceeding $1 Million- Billed Quarterly

- 0.7% on assets up to $1M, 0.40% on assets over $1M, 0.20% on assets above $5M (depending on complexity and scope of services)

- Additional tiers based on scope of services

Custom Pricing

Tailored- Billed Quarterly

- Custom pricing based on scope of services, complexity and amount of assets

Give us a call today 303-549-4720

All Pricing Options Include:

- Custom Risk Profile

- Fiduciary Loyalty to You 100% of the Time

- Goal Based Planning

- Direct Access to DFA

- Custom Portfolio Design – NO pre-built models

- Implementation & Rebalancing

- Massive Diversification

- Tax Aware Investing

- Coaching & Education

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/