I believe your lifestyle in retirement depends on it. Many investors don’t fully understand the power of compound interest and the devastating effect fees can have on your portfolio over time. I recently reviewed a portfolio for a potential client. The fees they pay their current Advisor are 50% higher than the fees for my firm. As their account grows, their fees will be 75% higher than my fees. When you put this into dollars and cents, it is estimated that these excess fees will amount to over $185,000 over the next 18 years. This may be enough to send their child to college in 2032.

I urge you to take a serious look at your portfolio. Fees and expenses are not “couch money”; this is your future retirement! If you currently use a big bank (like Wells Fargo, Bank of America, JP Morgan) or a brokerage firm (like Merrill Lynch, Morgan Stanley, UBS, Ameriprise, Edward Jones, Raymond James or Fidelity), the odds are very high that you have too many fees and too many middlemen in your retirement. The math doesn’t work and your retirement will be less than you deserve. We give free 2nd opinions for portfolios over $400k.

I suggest the following:

Just say NO to active management.

- Reduce fees in your portfolio. Our Advisor fee is only 0.6% on the first $1 million and our fees decline above $1 million. We also use low cost institutional mutual funds.

- Get a free 2nd opinion from a fee only Advisor. Not a broker, not a big bank, not a fee based advisor, not an insurance agent.

- Make sure your Advisor is a fiduciary for you 100% of the time. This is a big deal… find out why here.

- Most people need a coach. Don’t kid yourself. Investing can be complex and big mistakes cost you a ton of money. A solid fee only Advisor is worth every penny.

- Save more than you are saving today. Some of our clients save 20% to 40%+ of gross income per year in all of their accounts.

I strongly suggest that you watch this compelling video by Sensible Investing TV. Their documentary “How To Win the Loser’s Game” is amazing. Don’t take my word for it, listen to great investors like Jack Bogle (Vanguard), Charles Ellis (Yale), Ken French (Dartmouth), Eugene Fama (Nobel Prize – University of Chicago), Bill Sharpe (Noble Prize- Stanford), Harry Markowitz (Noble Prize), Rick Ferri, William Bernstein, David Booth (Dimensional Funds) and many others.

How to Win the Loser’s Game – copyright Sensible Investing #HowToWin

In summary, I suggest that you have 2 main choices:

1) If you want to manage your own investments, you can simplify your life and index your portfolio on a global basis. This can be done with 1 to 4 funds. For example: Vanguard Moderate Life Strategy Fund (60% stocks/ 40% bonds) VSMGX. Indexing like this is a good strategy but it also has some minor flaws. Following a purely market capitalization weighted strategy can have drawbacks and market inefficiencies. Make sure you have very strong discipline to stay the course in challenging times. Most investors do not.

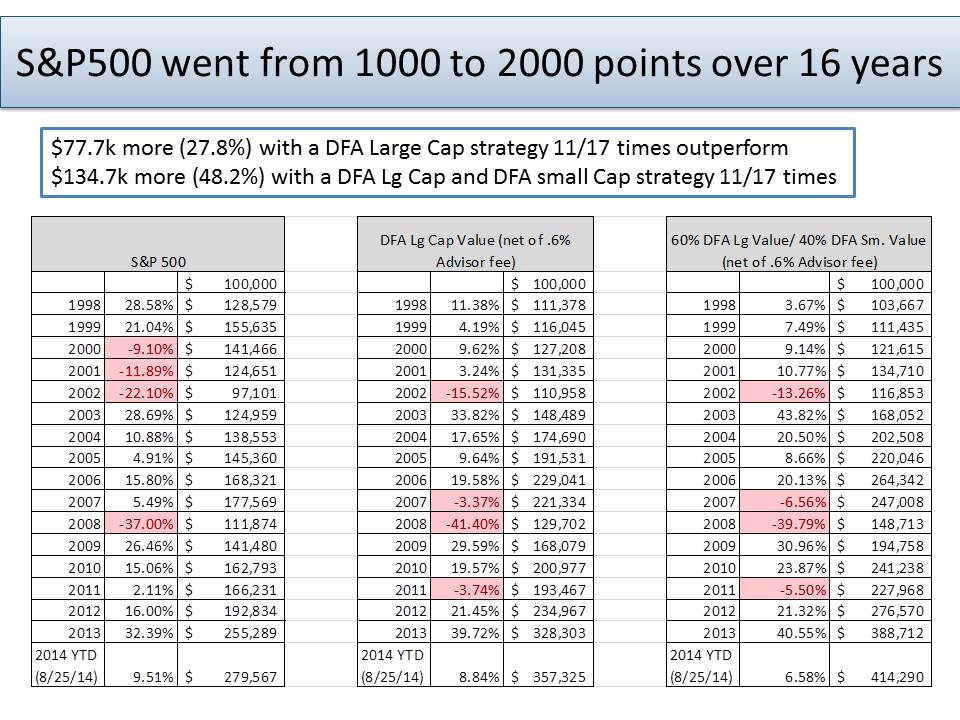

2) If you hire a DFA approved advisor, you can build a portfolio that attempts to do better than an index by targeting dimensions of expected returns. These dimensions or factors are value companies, small cap companies, companies with direct profitability and using momentum as a trading strategy. At my firm, we lean toward option 2 and work with a company called Dimensional Funds (DFA) to target these dimensions of expected returns in a robust and efficient manner. Find out more why we use DFA vs. Vanguard Funds. Below is a comparison of the S&P 500 index over the last 16 years. Over this time period, the S&P 500 went from 1,000 points to 2,000 points. As you can see, a DFA approach with Large Cap Value would have resulted in 27% more money and a strategy with 60% Large Cap Value and 40% Small Cap Value would have resulted in 48% more money. These results are net of my 0.6% Advisor fee.

* Past results do not guarantee future success.

If you need help, give us a call at 1-303-549-4720. Your retirement will thank you. Click here to subscribe to my blog

Please Remember: Past performance may not be indicative of future results. Moreover, no current or prospective investor should assume that future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in any general informational materials or educational sessions, will be profitable or equal any corresponding indicated historical performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for an investor’s retirement portfolio. Moreover, you should not assume that any discussion or information contained in this website serves as the receipt of, or as a substitute for, personalized investment advice from Integrity Investment Advisors, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing.

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/