Each week we read dozens of blogs, articles, whitepapers and presentations as part of our investment process. Below are some of the most important slides, charts and commentary about the economy, markets and industry trends for Q2.

Key thoughts: (If you find this of value, please share with your friends and family. It is amazing how many people need help and are paying way too much in total fees. I regularly see brokers and banks charging total fees of 2% to 2.5%! (1% to 1.5% in Advisor fees and about 1% in investment expenses! Shocking!)

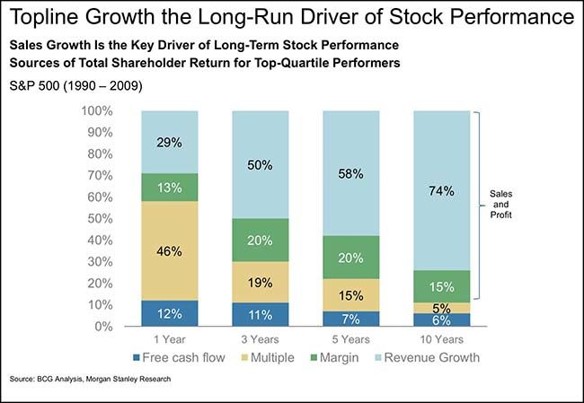

- Over the short-term, markets are highly emotional. Over the long-term, they are driven by fundamentals, revenue, growth, profits. Global diversification works. Philosophy, Strategy, Process and Discipline.

- Markets are always uncertain. This is why stocks tend to return more than cash over long periods of time. You get paid for taking risk and investing when information is uncertain and not fully known. The goal is to grow your money above the rate of inflation over time. This helps to grow your purchasing power and real wealth.

- We should expect lower than average returns moving forward – Are you planning for lower returns over the next 7 to 10 years? If you are worried about the markets, I suggest you focus on your savings rate and possibly slightly reduce stocks. Most clients in accumulation mode need to target saving 15% to 20%+ of gross family income to support their desired lifestyle in retirement. If you have a portfolio of over $500k and would like a free second opinion about your strategy and hidden fees, click here to schedule a meeting – https://calendly.com/todd-iia

- Most people need a coach. Focus on what you can control. Saving, spending, your job, your family, your health. Stay diversified and don’t chase hot returns. Be ready to rebalance when we have a -20% to -40%+ pullback in stocks.

1st half 2018 key slides and data:

- The US economy has solid growth and low inflation. Consumption has been strong and confidence is relatively high. Q1 earnings growth was around +25% and Q2 earnings growth is projected around +20% YOY. Much of these gains are from corporate tax cuts.

- Rising gasoline prices, trade / tariff skirmishes and the strong US dollar have been a damper for growth and international stocks.

- Although the trade/ tariff skirmishes are unsettling for the markets, the US is in a strong position to negotiate for more free trade and China not stealing our intellectual property. The US currently has a strong economy, stock market near all-time highs and abundant US energy reserves. There may be short-term pain and uncertainty but there also could be a long-term win for US trade policy. We will see.

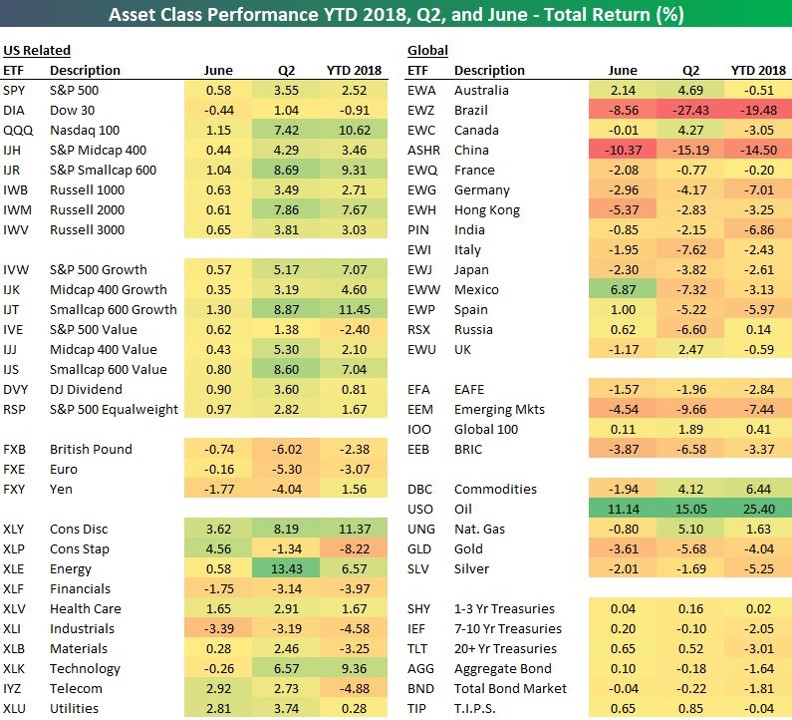

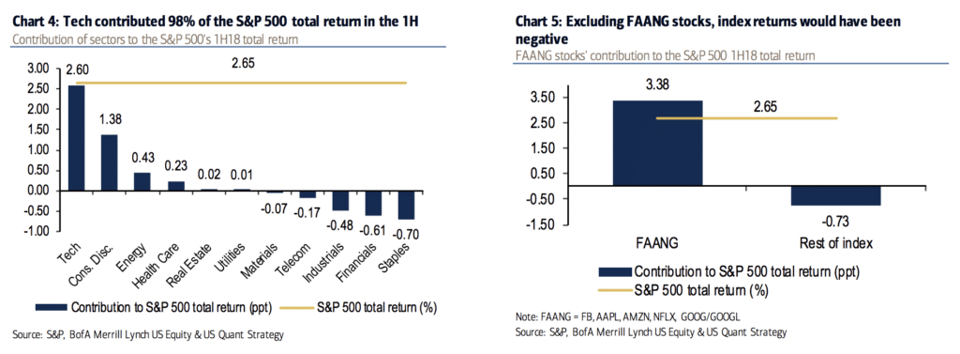

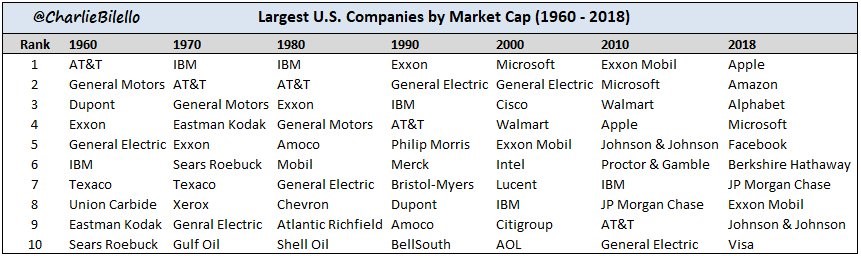

- Most of the first half gains have come from technology companies and US small cap. Bonds, International stocks, EM stocks were all negative for the first half of 2018.

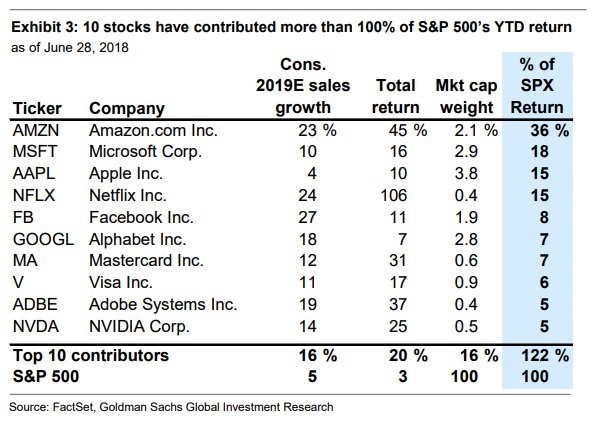

- 10 stocks in the SP500 accounted for over 100% of the first half return.

Thanks for reading.

Please Remember: Past performance may not be indicative of future results. Moreover, no current or prospective investor should assume that future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in any general informational materials or educational sessions, will be profitable or equal any corresponding indicated historical performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for an investor’s retirement portfolio. Moreover, you should not assume that any discussion or information contained in this website serves as the receipt of, or as a substitute for, personalized investment advice from Integrity Investment Advisors, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing.

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/