I recently did a presentation for a board meeting and I thought I would share some of the key thoughts and slides. If you find this of value, please share with your friends and family. It is amazing how many people need help and are paying way too much in total fees. I regularly see brokers and banks charging total fees of 2% to 2.5% (Advisor fees and investment fees)! Shocking!

- Markets have been more volatile in 2018. This is normal and to be expected. 2017’s low volatility was abnormal.

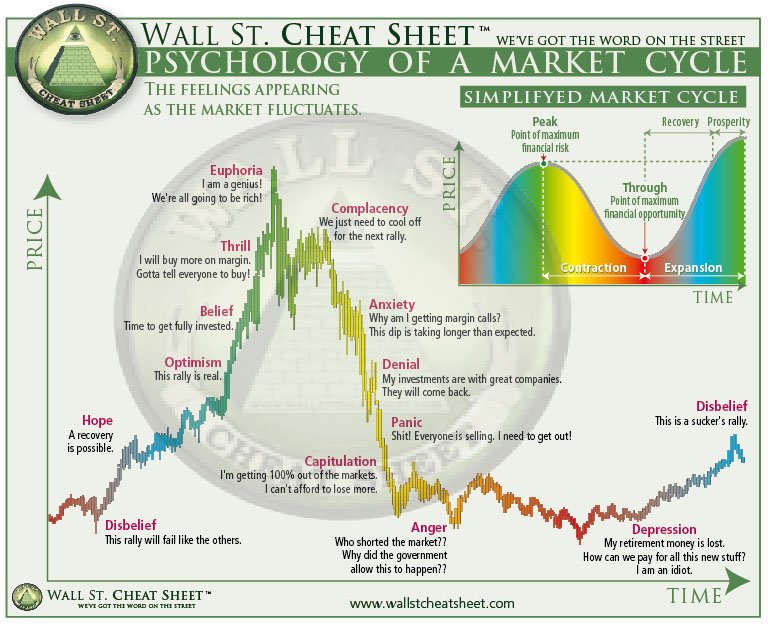

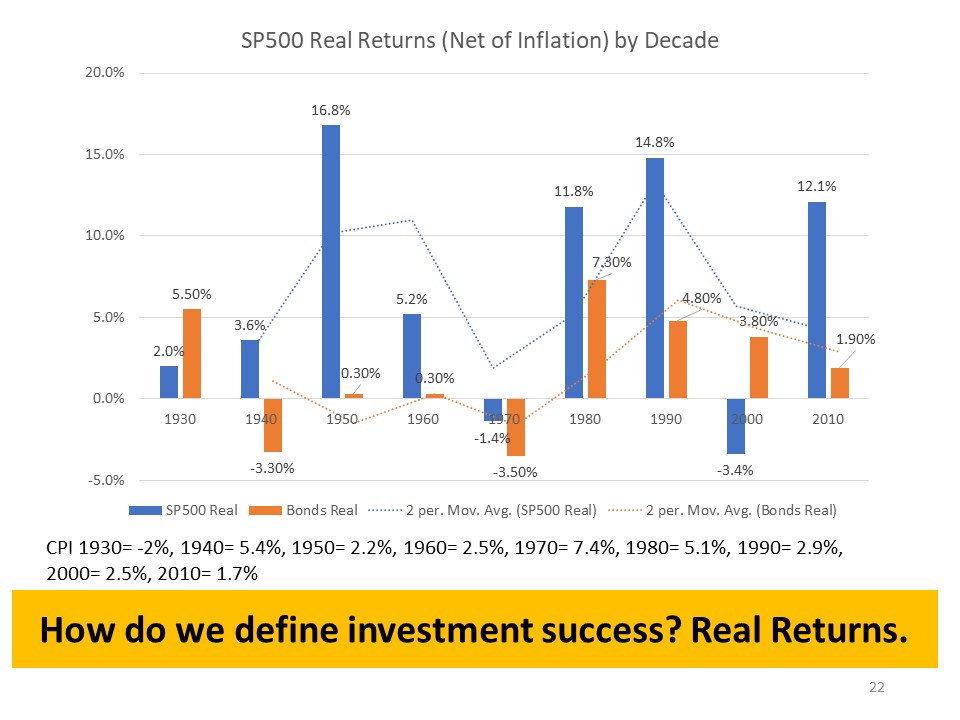

- How do we survive the short-term to win in the long-term? We win with long-term compounding of returns. Over the short-term, markets are highly emotional. Over the long-term, they are driven by fundamentals, revenue, growth, profits. Global diversification works. Philosophy, Strategy, Process and Discipline.

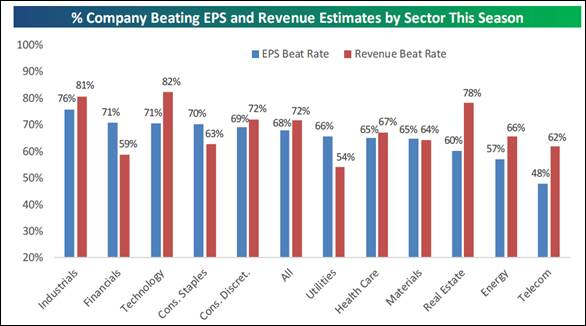

- Where are we in the business cycle? See charts below. Company revenues and profits have been good. Operating profits are up 17% YOY with tax reform

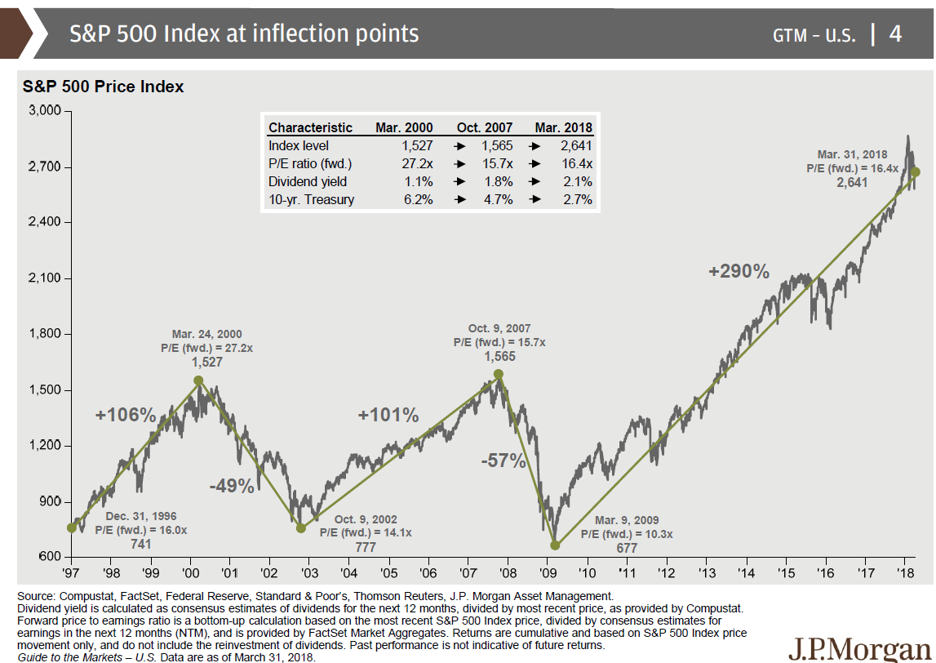

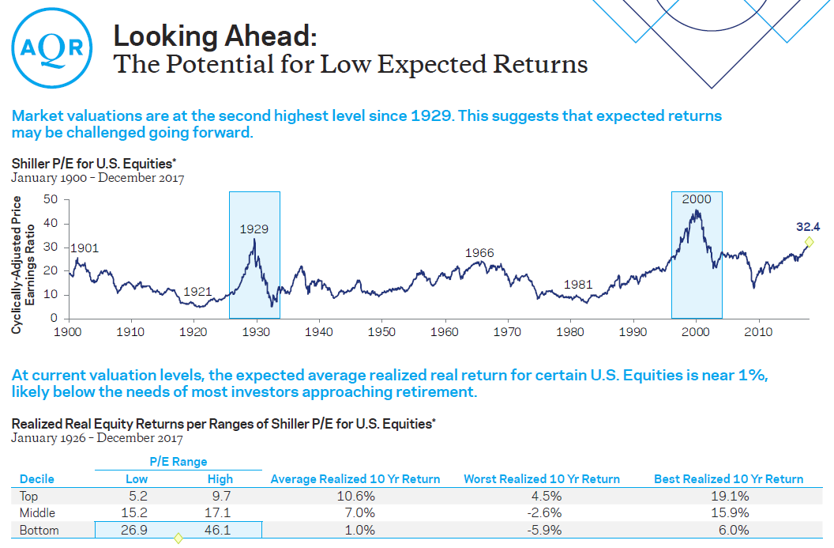

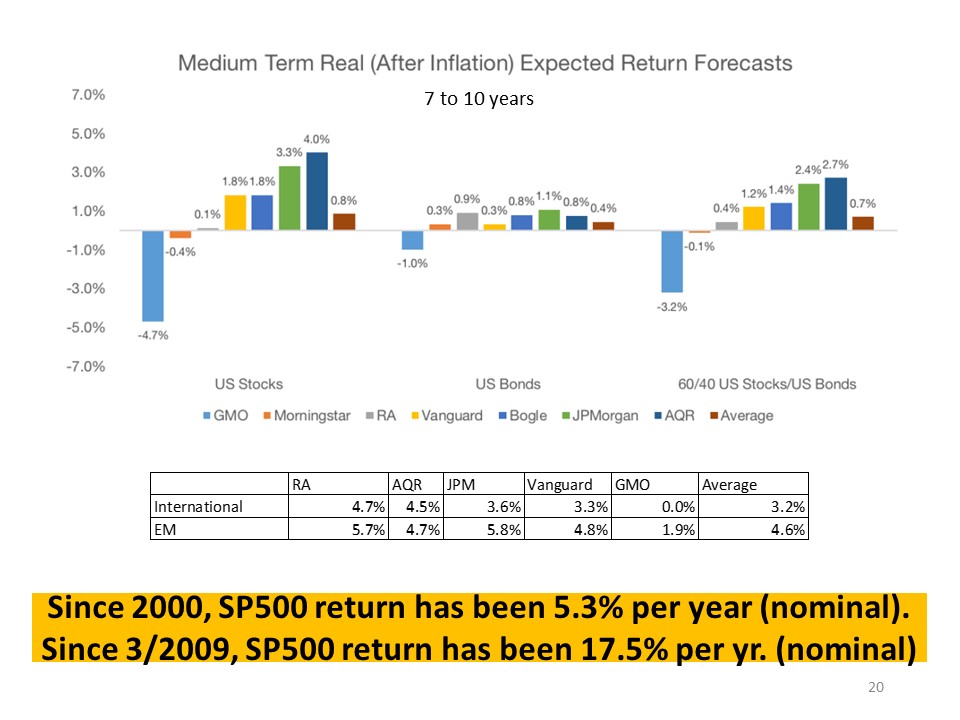

- Many pundits see much lower returns from today’s valuations. That would make sense. The SP500 is up 17% per year since 3/2009. See slides below. For most people, this means that you will need to save more to reach your retirement goals. For our clients, we use detailed planning software to help clients align their money with their retirement lifestyle and goals. This project will let you know if you are on track. Are you saving enough? What are the chances you will run out of money? How can we optimize your retirement lifestyle? Click here to watch the video and find out more.

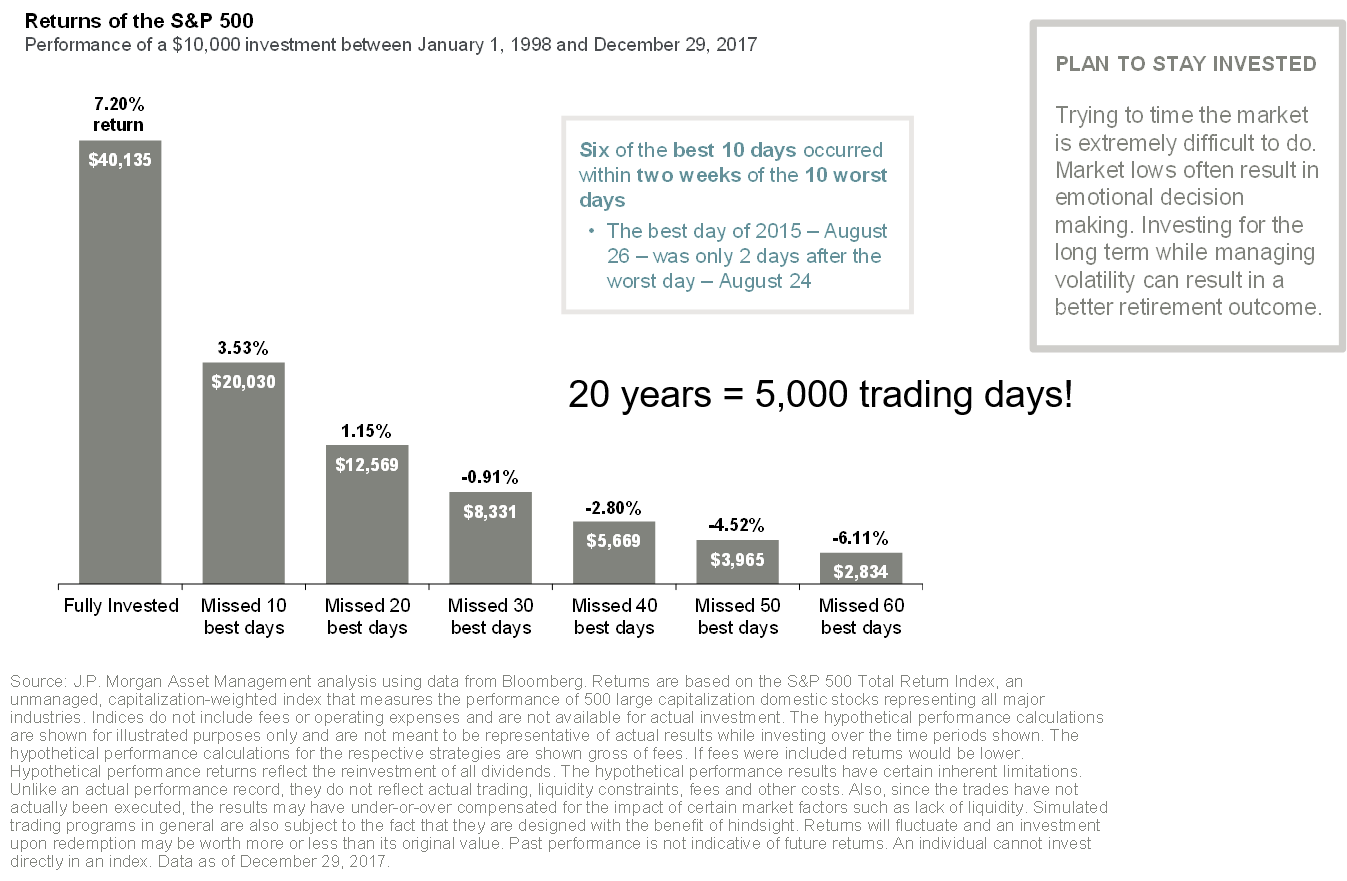

- Look at the 7 retirement principles below from JP Morgan. 1) Plan on living a long time, 2) Cash is not always king, 3) Harness the power of dividends and compounding, 4) Avoid emotional biases and stick to a plan, 5) Volatility is normal, 6) Diversification works, 7) Stay invested and don’t try to time the market. If you had missed the best 30 days over the last 20 years (5,000 trading days), your returns were negative!

- Most people need a coach. Focus on what you can control. Saving, spending, your job, your family, your health. Stay diversified and don’t chase hot returns. Be ready to rebalance when we have a -20% to -40%+ pullback in stocks.

- If you have a portfolio of over $500k and would like a free second opinion about your strategy and hidden fees, click here to schedule a meeting – https://calendly.com/todd-iia We can help you understand your total cost of investing and identify any red flags.

Thanks for reading.

Please Remember: Past performance may not be indicative of future results. Moreover, no current or prospective investor should assume that future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in any general informational materials or educational sessions, will be profitable or equal any corresponding indicated historical performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for an investor’s retirement portfolio. Moreover, you should not assume that any discussion or information contained in this website serves as the receipt of, or as a substitute for, personalized investment advice from Integrity Investment Advisors, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing.

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/