Here is our market update for Q2 2017.

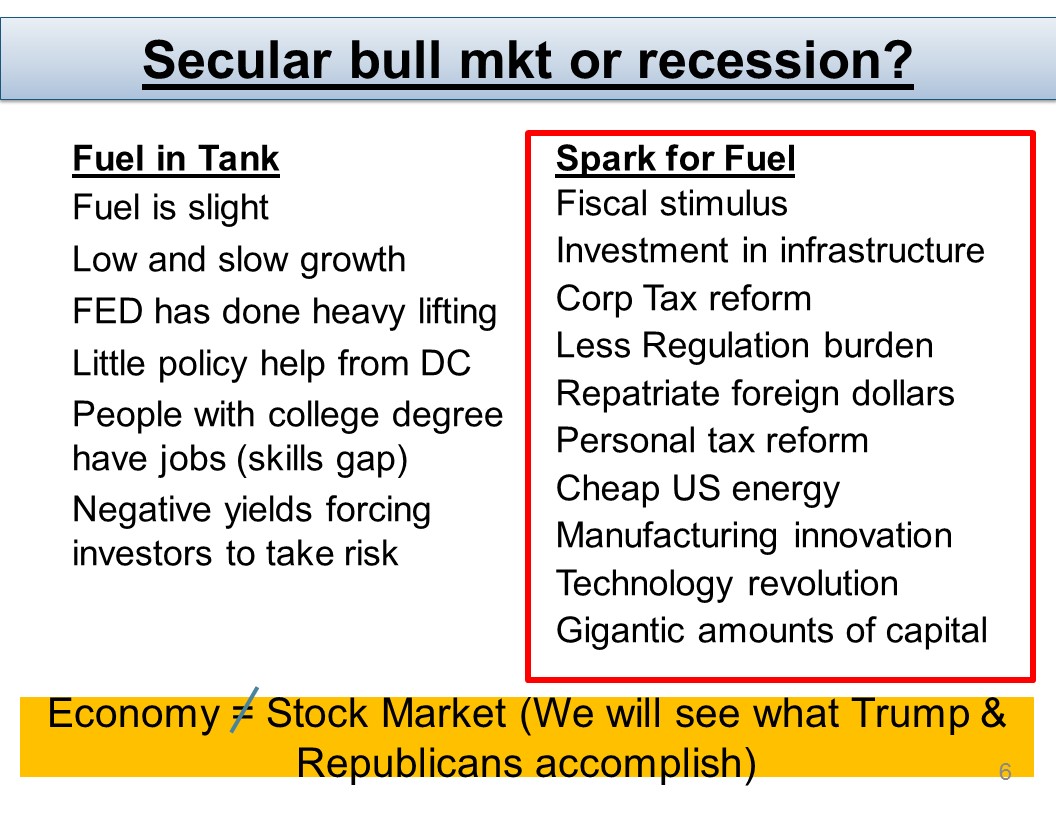

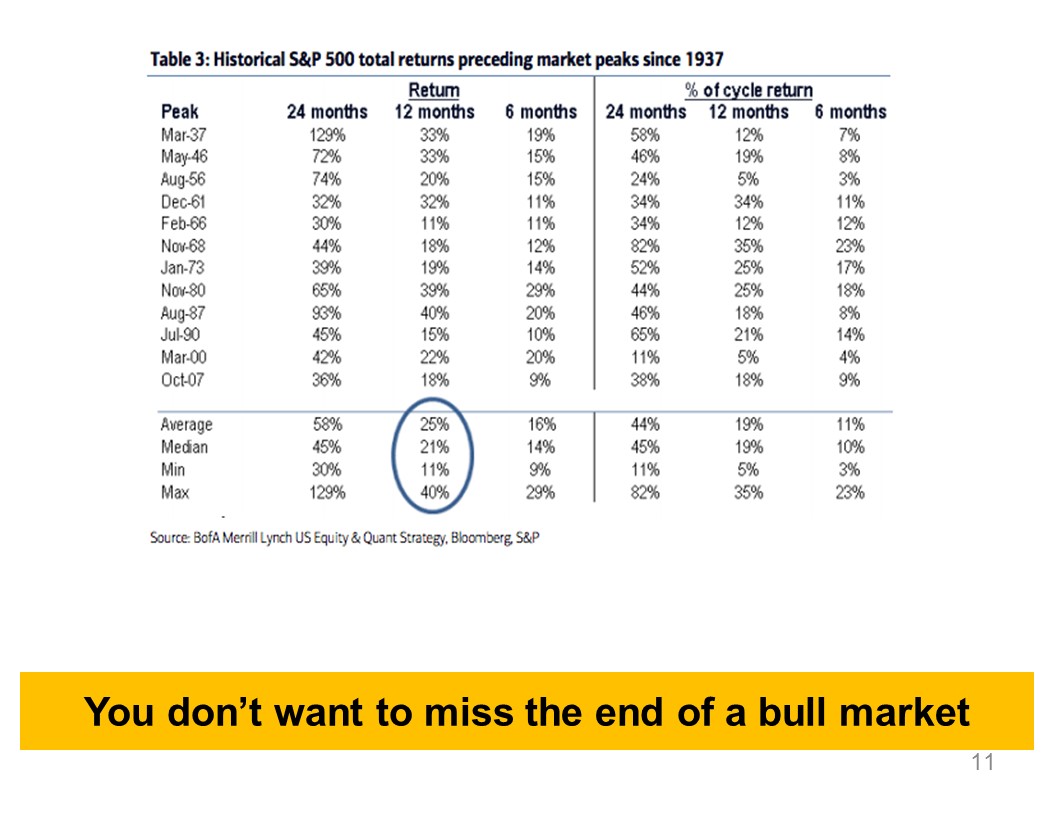

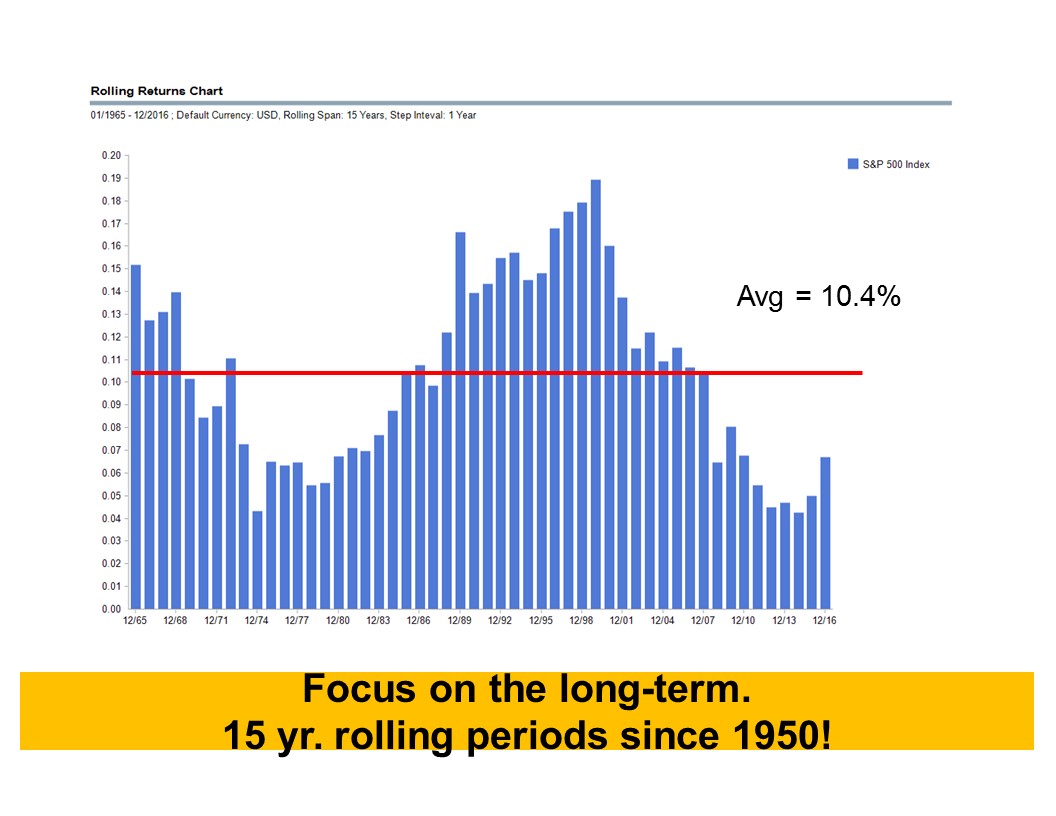

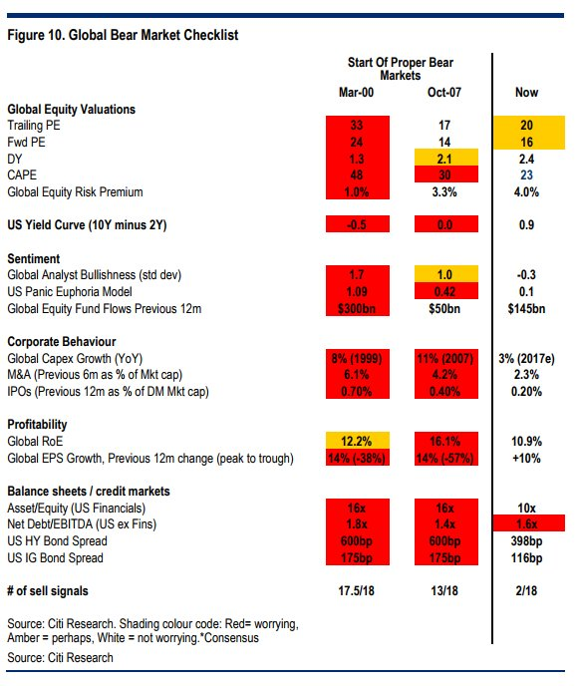

- The bull market has continued and shows little signs of slowing.

- The media remains fixated on the White House, but the market is more attuned to corporate results and central bank activity. The Q2 earnings growth estimate for the S&P 500 is a robust 6.6%, according to FactSet.

- The Fed stayed on course: It raised short-term interest rates 0.25% late in June and reiterated an expectation of one to two more hikes over the remainder of the year. Bonds still managed modest gains in this environment. It also announced plans to begin slowly shrinking its bloated balance sheet by letting an increasing amount of bonds mature without replacing them. Overall, this creates a mild headwind for stocks.

- Global expansion is on firm ground and the odds are low for a recession in the next 12 months.

- For the second quarter, international stocks did better than US stocks. We will see if this trend continues.

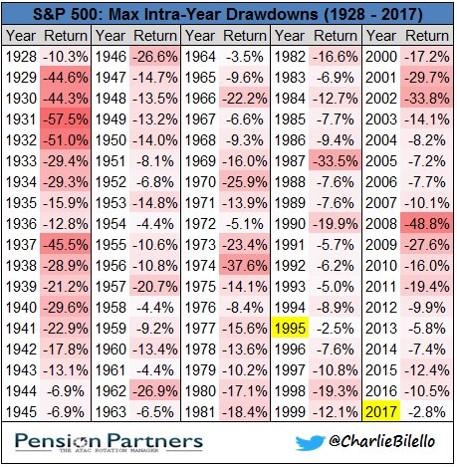

- In the last year, we have had 42 new highs on the S&P500 and we have not had a 5 % correction in 262 trading days (as of 7/12/17). We believe that the markets are due for more volatility and this would be perfectly normal.

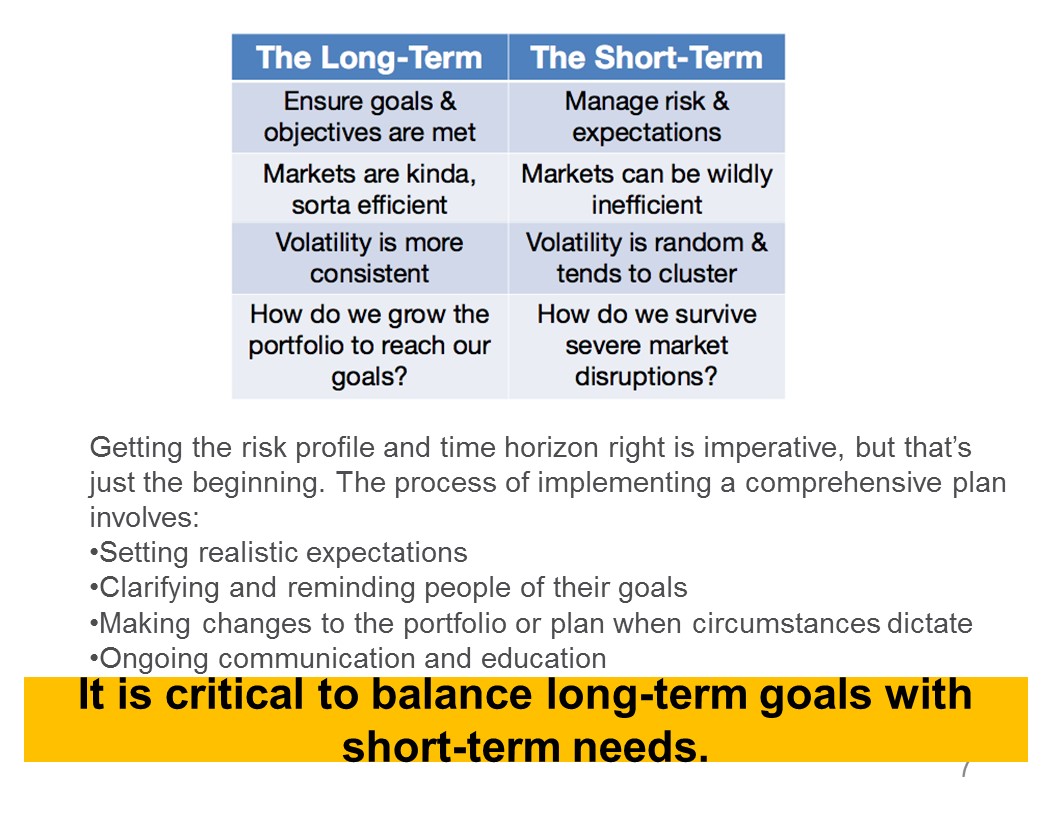

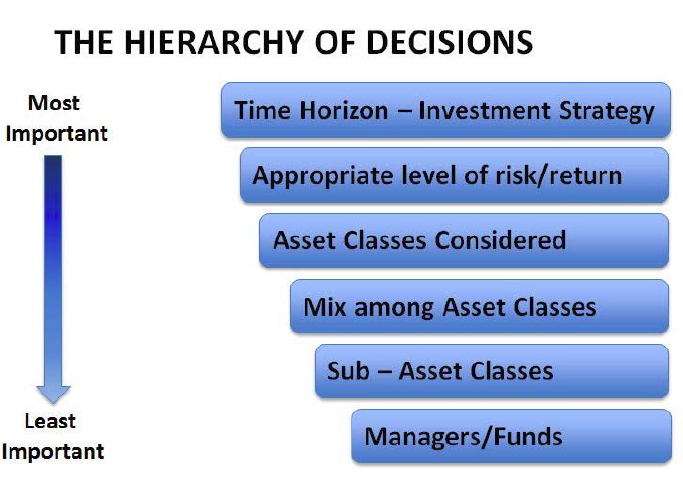

- Here are some key slides and more in the PDF below. Be sure to look at the keys to success (page 2), p. 8 why institutional investors underperform, page 19-22 – the state of the current bull market and p. 23 the timeline for FED balance sheet reductions.

- Click HERE to download the PDF

- Enjoy the rest of summer!

This has been one of the least volatile years for the stock market.

This has been one of the least volatile years for the stock market.

Click here to subscribe to my blog or email us for a free 2nd Opinion about your portfolio.

Thanks for reading.

Please Remember: Past performance may not be indicative of future results. Moreover, no current or prospective investor should assume that future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in any general informational materials or educational sessions, will be profitable or equal any corresponding indicated historical performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for an investor’s retirement portfolio. Moreover, you should not assume that any discussion or information contained in this website serves as the receipt of, or as a substitute for, personalized investment advice from Integrity Investment Advisors, LLC and Integrity Investment Advisors, LLC is not providing services in jurisdictions that the firm is not registered or acting under an exemption to registration. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing.

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/