Investors hate uncertainty but that is why you get paid to invest for the long term.

The return from equities is actually called the equity risk premium. Over long periods of time, equities should return more than the risk free rate.

What is your Plan?

- Are you saving 20%+ of your gross income?

- Is your spending under control?

- Are you prepared for more volatility and the next recession?

- Can you maintain your lifestyle in retirement?

- Do you have enough money to live to 95 or 100?

Next month, Americans will head to the polls to elect the next president of the United States.

While the outcome is unknown, one thing is for certain: There will be a steady stream of opinions from pundits and prognosticators about how the election will impact the stock market. As we explain below, investors would be well‑served to avoid the temptation to make significant changes to a long‑term investment plan based upon these sorts of predictions.

SHORT-TERM TRADING AND PRESIDENTIAL ELECTION RESULTS

Trying to outguess the market is often a losing game. Current market prices offer an up-to-the-minute snapshot of the aggregate expectations of market participants. This includes expectations about the outcome and impact of elections. While unanticipated future events—surprises relative to those expectations—may trigger price changes in the future, the nature of these surprises cannot be known by investors today. As a result, it is difficult, if not impossible, to systematically benefit from trying to identify mispriced securities. This suggests it is unlikely that investors can gain an edge by attempting to predict what will happen to the stock market after a presidential election.

LONG-TERM INVESTING: BULLS & BEARS ≠ DONKEYS & ELEPHANTS

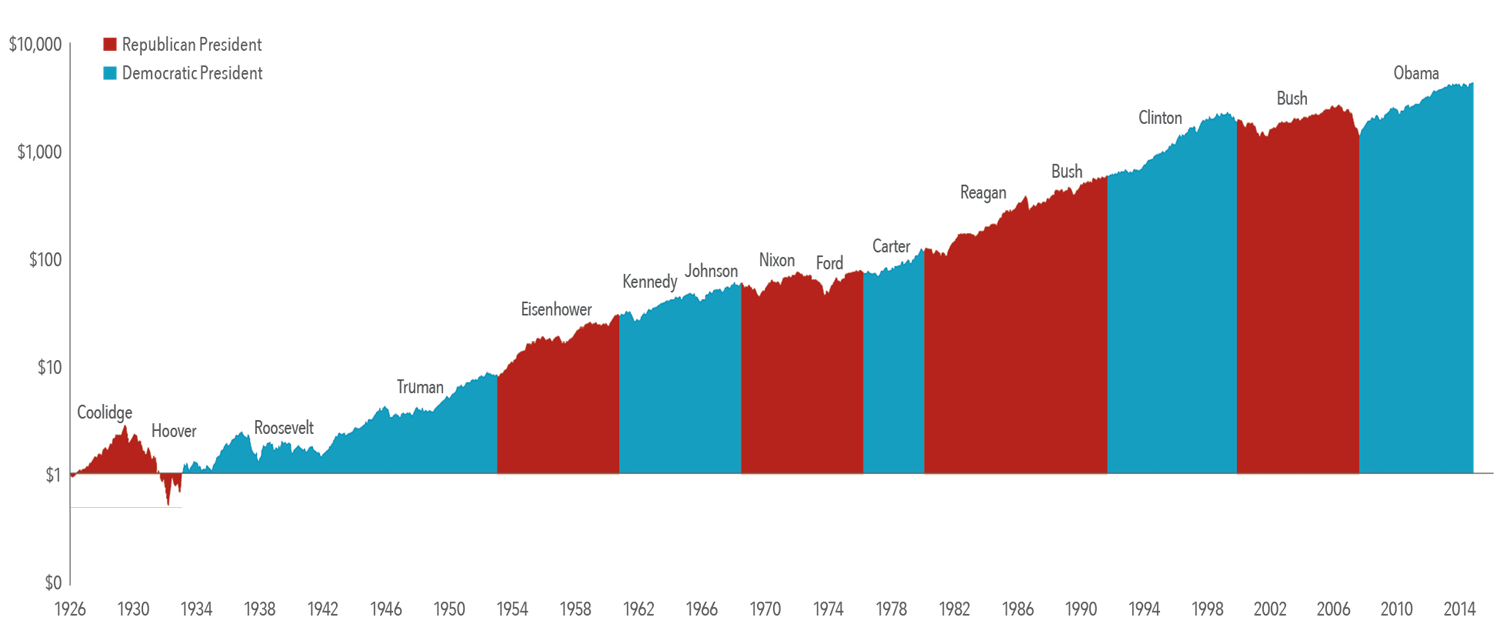

Predictions about presidential elections and the stock market often focus on which party or candidate will be “better for the market” over the long run. Exhibit 1 shows the growth of one dollar invested in the S&P 500 Index over nine decades and 15 presidencies (from Coolidge to Obama). This data does not suggest an obvious pattern of long-term stock market performance based upon which party holds the Oval Office. The key takeaway here is that over the long run, the market has provided substantial returns regardless of who controlled the executive branch.

Exhibit 1: Growth of a Dollar Invested in the S&P 500, January 1926–June 2016

Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. The S&P data is provided by Standard & Poor’s Index Services Group.

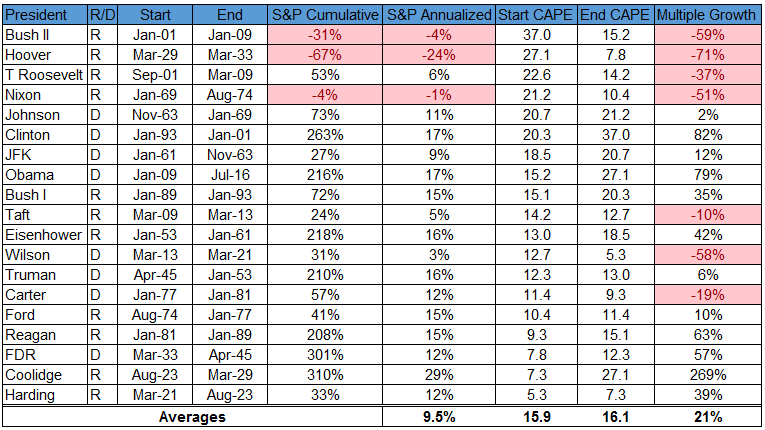

Starting valuations matter. The current CAPE ratio is 27.1. This is higher than 90% of history and suggests that returns may be lower for both stocks and bonds in the future. See chart below from Pension Partners blog on 8/4/16. 3 out of the top 4 CAPE ratios had negative returns.

Keep your focus on the long term. Any money you need in the next 5 years should not be in stocks. Stocks can be highly volatile in the short term but tend to appreciate over long periods of time. The odds are high that 7 to 10 years from now that stocks will be higher. Make sure you manage the risk in your portfolio. If stocks drop 20% or 30%, will you be prepared to buy more?

CONCLUSION

Equity markets can help investors grow their assets, but investing is a long-term endeavor. Trying to make investment decisions based upon the outcome of presidential elections is unlikely to result in reliable excess returns for investors. At best, any positive outcome based on such a strategy will likely be the result of random luck. At worst, it can lead to costly mistakes. Accordingly, there is a strong case for investors to rely on patience and portfolio structure, rather than trying to outguess the market, in order to pursue investment returns.

If you need help, give us a call.

- The Perfect Storm May be Brewing

- Risk Happens Fast!

- Keep Calm or Freak Out?

- The Pledge Most Advisors Won’t Sign!

Post Via Dimensional Fund Advisors LP

Please Remember: Past performance may not be indicative of future results. Moreover, no current or prospective investor should assume that future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in any general informational materials or educational sessions, will be profitable or equal any corresponding indicated historical performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for an investor’s retirement portfolio. Moreover, you should not assume that any discussion or information contained in this website serves as the receipt of, or as a substitute for, personalized investment advice from Integrity Investment Advisors, LLC and Integrity Investment Advisors, LLC is not providing services in jurisdictions that the firm is not registered or acting under an exemption to registration. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing.

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/