Brexit: What should you do?

The United Kingdom last Thursday voted to leave the European Union. British Prime Minister David Cameron, who instigated the referendum as an election pledge and campaigned vigorously for remaining in the EU, resigned on Friday in the aftermath of the exit vote. The “BREXIT” decision was not anticipated by major polls and futures markets, so it sparked massive upheaval in global stock, bond, and currency markets on Friday. The fallout included: a 9% drop in the British Pound which fell to a 31-year low against the U.S. dollar; 7% stock market selloffs in Europe, Japan, and Britain; a comparatively milder but still significant 4% decline for the U.S. stock market; and falling government bond yields in major countries amid “safe haven” buying.

Today, on Monday, the SP500 was down -1.8% and Europe was down about -3%.

Here are some thoughts and considerations:

- The Brexit vote shows the fragility of the EU and responsible countries (and citizens) supporting the less responsible.

- It shows the anger against bloated government and bureaucracy. It will be interesting to see if this transfers over to the US elections.

- It will be interesting if the EU can survive long-term and if Germany gets tired of carrying the remaining burden.

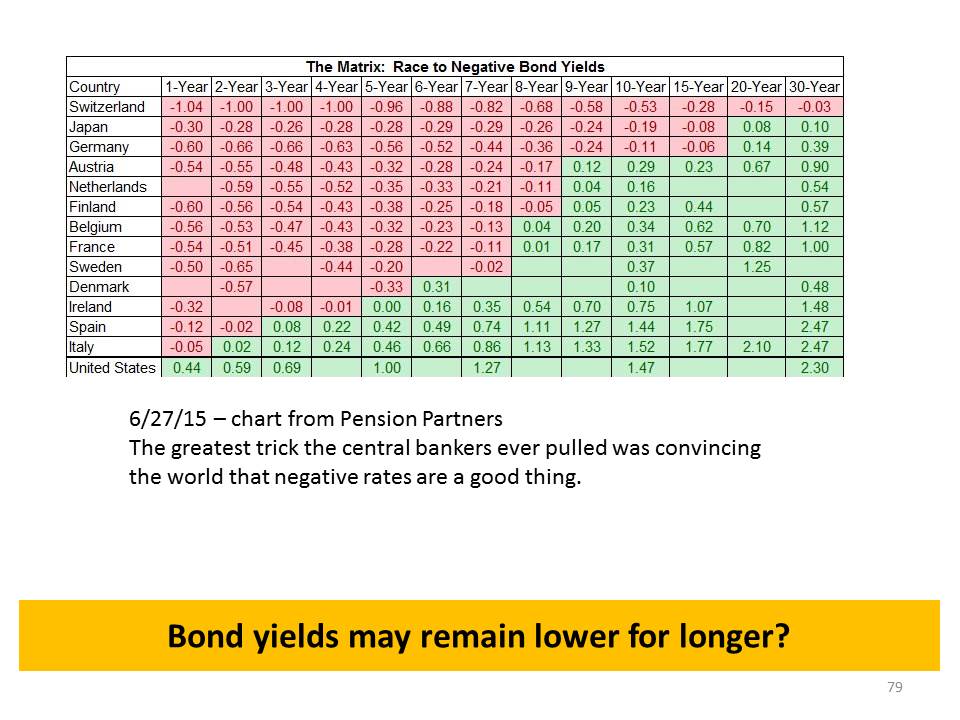

- Look at the slide below regarding bond yields. (not a rational market)

- Central banks will react and try to push further on a string.

- The Fed will be in an even smaller box because of global uncertainty. Rates may remain lower for longer.

- Eventually, low global bond yields will push investors into stocks. This has not happened yet. This has been one of the most hated bull markets in history and may go on longer than people expect. (even if we have pullbacks of 10% to 20%).

- Right now, 309 out of the S&P 500 trade with yields higher than the 10-year treasury. This is normally a good sign for stocks.

- Global growth may be slower.

- US corporate profits will be challenged because of currency headwinds.

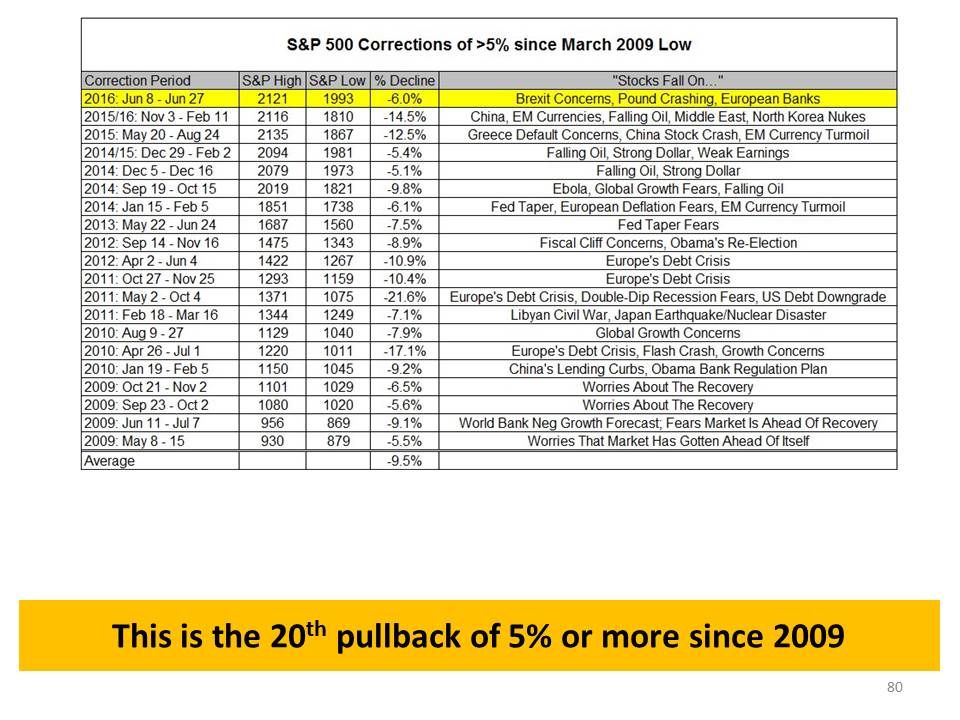

- Equity markets may continue to be volatile. This is very normal.

- It is important to realize that equities are for long term appreciation above the rate of inflation. This is money that you may not need for 7 to 10 years+ or even 30 or 40 years.

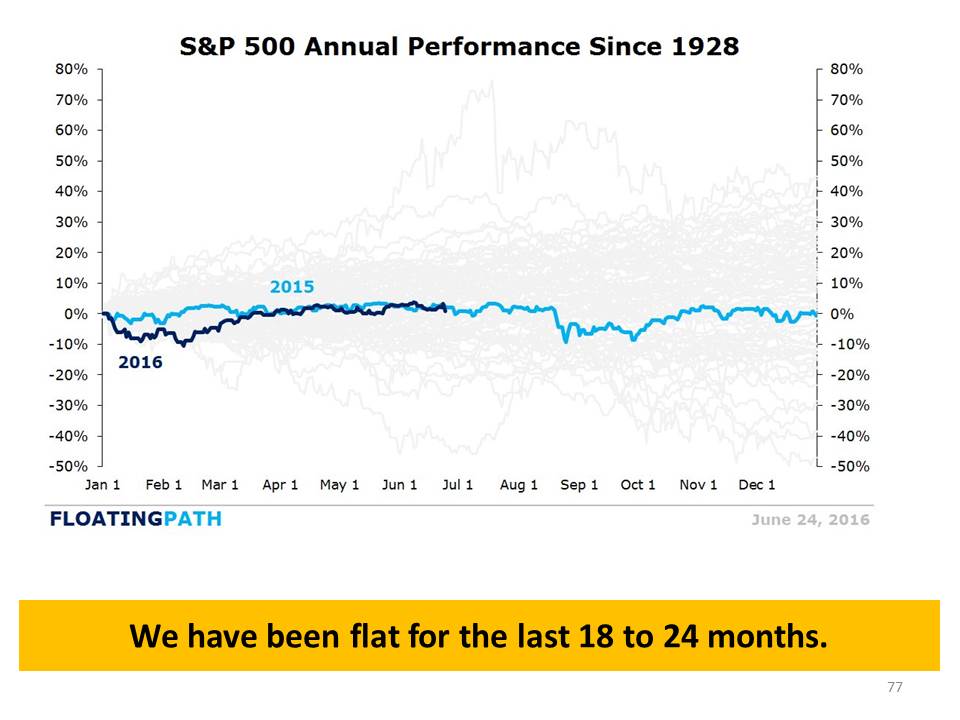

- We are still above the lows in February 2016. See chart below.

- See – Risk Happens Fast!

- See – Keep Calm or Freak Out? Read why I don’t panic and sell in a time of crisis.

- This is not a Lehman moment that will crash the entire financial system. The Brexit vote is a referendum and is not binding. It may be changed or revised. It may be an orderly transition that will take years. There are a lot of unknowns and the markets have reacted to reduce prices.

- Successful investing is about Philosophy, Strategy and Process. Have a plan and stick to it. If you need professional help, give us a call or email.

- Keep calm and enjoy your summer.

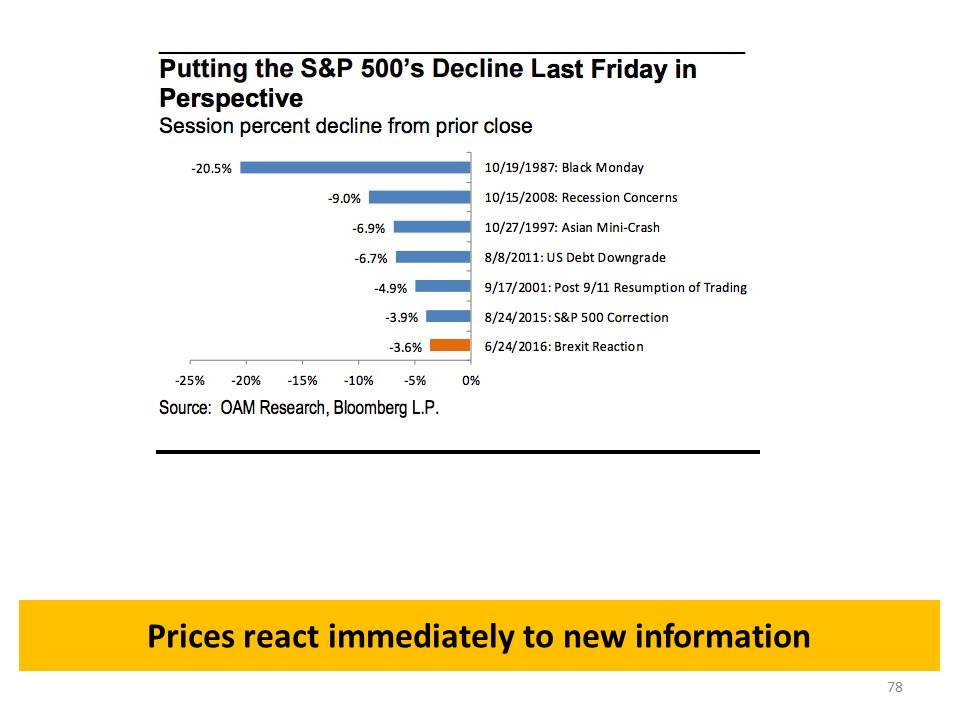

To put in perspective. S&P 500 Daily Return:

- 9/11= -4.9%

- Lehman= -4.7%

- Flash Crash= -3.2%

- US Debt Downgrade= -6.7%

- #Brexit= -3.0%

Please Remember: Past performance may not be indicative of future results. Moreover, no current or prospective investor should assume that future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in any general informational materials or educational sessions, will be profitable or equal any corresponding indicated historical performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for an investor’s retirement portfolio. Moreover, you should not assume that any discussion or information contained in this website serves as the receipt of, or as a substitute for, personalized investment advice from Integrity Investment Advisors, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing.

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/