The end of a golden age of investing?

If you are saving for retirement and want to maintain your lifestyle in retirement, I may have some bad news for you. Expected returns over the next 20 years are significantly lower than the last 30 years. This has significant implications for your retirement. Most investors will need to do some or all of the below:

- Save more. We normally recommend saving 20%+ of your gross family income each year. This includes all sources (401k, company match, IRA, taxable savings, company stock). Your situation may be more or less. Related to this, most investors also need to control spending.

- Work longer. Many investors will need to work into their 70’s and should embrace life long learning to help with multiple careers. Medical enhancements will continue to extend productive lifespans. New anti-aging drugs are already starting human trials. These have the potential to dramatically reduce heart disease, cancer, diabetes and cognitive decline. Kids born today may live to 110 or 120.

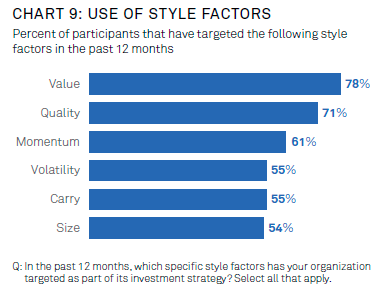

- Invest better. I strongly urge all investors to only work with a low cost, fee only advisor who is a fiduciary for you 100% of the time. This is a HUGE deal. Get your advisor to sign this pledge or find a new advisor. We believe in building globally diversified portfolios that have factor tilts toward value companies, small cap companies, companies with high profitability, companies with good momentum, high quality bonds and potential hedging strategies to reduce risk. See below example of how this adds value.

- Investors may need to reduce their lifestyle in retirement. Obviously this is a last resort but if you don’t take action, this may be the outcome.

If you find this article of value, please forward to your family and friends. Their retirement will thank you!

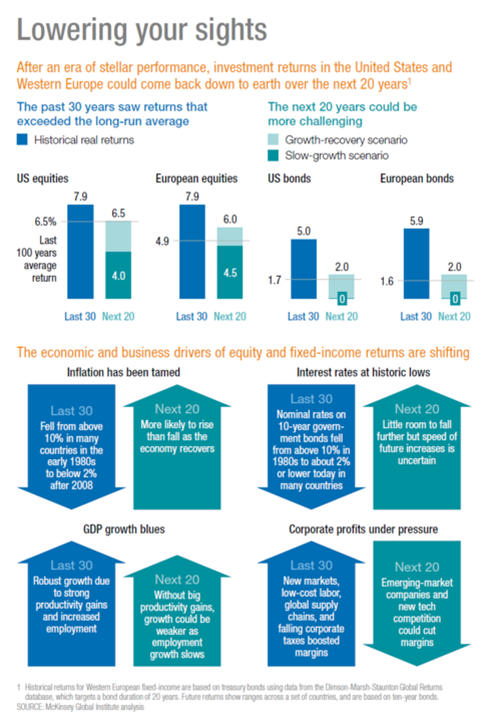

Here is the recent study from McKinsey Global. Real returns (adjusted for inflation) have been very high over the last 30 years. Future expected real returns are much lower. McKinsey – MGI-Diminishing-returns-Full-report-May-2016

The interesting thing about this data is that we have actually had very low real returns since 2000! Since 1/1/2000 through 3/31/2016, inflation has averaged 2.16% per year. Below are the real returns for the period. Past returns do not guarantee future success but you can see that over the period, factor tilts like value, small cap and high profit enhanced returns. Shockingly, over the 16+ years, the real return for the S&P500 index was only 1.92% per year. A standard 60/40 Vanguard index only had a real return of 2.41% per year.

| Data Series (Monthly: 01/2000 – 03/2016) | Annualized Real Return (%) |

| S&P 500 Index | 1.92 |

| Barclays US Aggregate Bond Index | 3.32 |

| Russell 1000 Index | 2.23 |

| Russell 2000 Index | 4.24 |

| DFA US Micro Cap Portfolio Class I | 6.77 |

| DFA US Small Cap Portfolio Class I | 6.44 |

| DFA Real Estate Securities Portfolio Class I | 10.05 |

| DFA US Large Cap Value Portfolio Class I | 5.38 |

| DFA US Small Cap Value Portfolio Class I | 8.11 |

| DFA 60/40 | 5.60 |

| DFA International Small Cap Value Portfolio Class I | 7.54 |

| DFA Emerging Markets Small Cap Portfolio Class I | 6.59 |

| Vangaurd Life strategy 60/40 (VSMGX) | 2.41 |

The main problem for future expected returns from 2016 forward is bonds. As of today, the US 10 year bond has a yield of 1.78%. McKinsey suggests that real returns for bonds will be between 0% and 2% for the next 20 years! Ouch! Over the last 30 years, bonds had a real return of 5%. Since 2000, they had a real return of 3.3%. I suggest that investors need a more optimal strategy. This is why we implement factor investing and other strategies.

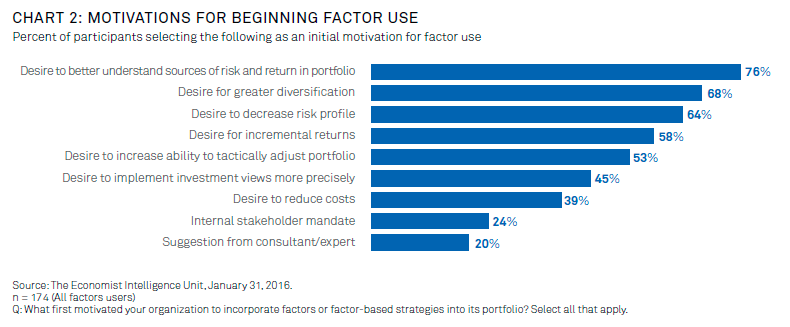

There was a recent study of 200 large institutional investors. Here is why they use factors. If you want more information, please give us a call or email.

Here is the full report if you want to take a look. McKinsey – MGI-Diminishing-returns-Full-report-May-2016

Please Remember: Past performance may not be indicative of future results. Moreover, no current or prospective investor should assume that future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in any general informational materials or educational sessions, will be profitable or equal any corresponding indicated historical performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for an investor’s retirement portfolio. Moreover, you should not assume that any discussion or information contained in this website serves as the receipt of, or as a substitute for, personalized investment advice from Integrity Investment Advisors, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing.

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/