2/17/2016 – This was our first 3 day rally of 2016!

Will it continue or are we stuck in a negative cycle? Time will tell but there is never a good time to have a less than optimal portfolio. Do you have too much risk in your portfolio? If you have over $500k in a portfolio, give us a call or email us and get a free 2nd opinion about your strategy. If you have any friends or family who need help, please forward this blog.

Long-term investing is about philosophy, strategy, process and discipline. Market timing does NOT work. Speculating on individual stocks does not work. I suggest that investors need a solid plan!

Most investors would be wise to turn off the financial news (they tend to only sell fear), focus on your savings rate (15% to 20% of gross income), focus on controlling your spending, make sure you have a low-cost advisor who is a fiduciary for you 100% of the time and make sure you have an optimal investing strategy that is aligned with your goals. These are factors you can control. Keep in mind, the odds are very high that the stock market will be higher 7 years from now.

“The essence of portfolio management is the management of ‘risks,’ not the management of ‘returns’. All good portfolio management begins and ends with this tenet!” — Benjamin Graham

See our previous blogs:

- Risk Happens Fast!

- The Average Stock is Already in a Bear Market!

- Keep Calm or Freak Out?

- The Pledge Most Advisors Won’t Sign!

Click here to subscribe to my blog or email us for a free 2nd Opinion about your portfolio.

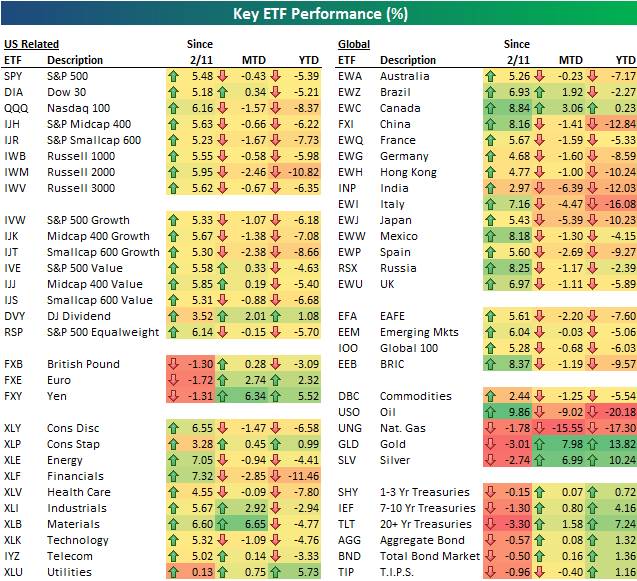

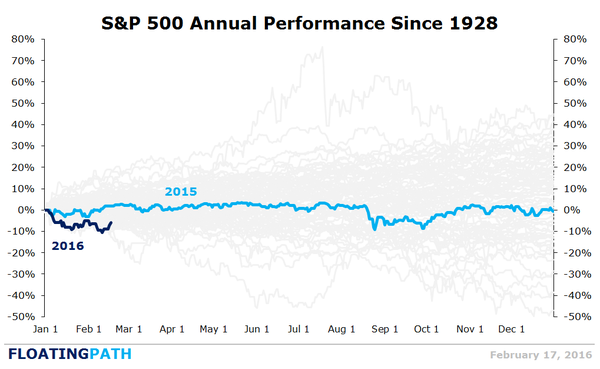

The S&P 500 (SPY) ETF is up 5.48% since last Thursday’s close. Below we provide a boatload of charts and tables highlighting where equity markets currently stand. (charts are from Bespoke as of 2/17/2016)

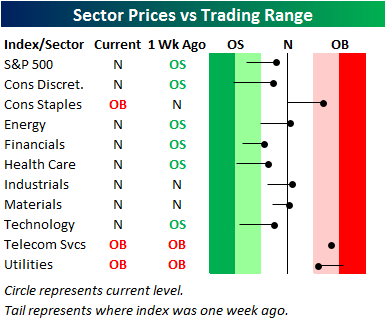

Even after a 5%+ rally, the S&P 500 and four of ten sectors remain below their 50-day moving averages. Check out Energy, though. The sector has moved back above its 50-day (for the first time since December 2nd).

The S&P 500 remains down 5.7% year-to-date, but six of ten sectors are outperforming, including Energy which is now down just 3.6% YTD. The three defensive sectors remain the only sectors in the black for the year, while Financials is down by far the most at -11.8%.

Looking at underlying breadth, 97% of Utilities stocks are above their 50-days, with Consumer Staples the next closest at 76%. Financials, Health Care and Technology have the longest road to recovery.

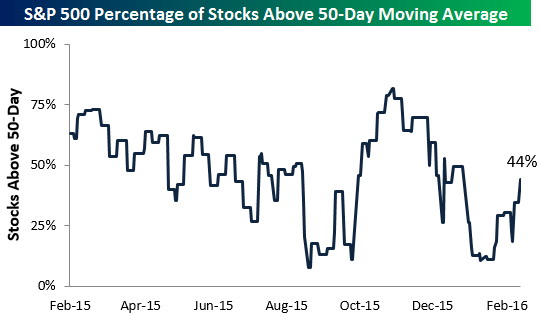

Below is a chart showing the percentage of S&P 500 stocks above their 50-days over the last year:

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/