Just because you need high returns, it doesn’t mean the market will provide them for you. Peter Bernstein quote: “The market’s not a very accommodating machine; it won’t provide high returns just because you need them.”

Flat = S&P 500 was slightly down for the year based on price. When you include dividends, it was up 1.3%

Narrow = very few strategies and stocks were positive for the year.

As I mentioned in a previous post, Average is Not Normal, over the last 89 years:

- The S&P 500 is positive 78.6% of the time and negative 21.4% of the time.

- The average return is about 12% per year over the 89 years

- The average return over the last 10 years about 9.5% per year, average over the last 15 years is 6% per year, average over the last 20 years is 11.75% per year.

- However, only about 5.6% of the years have a return of between 8% and 12%. Shockingly, 53% of the years have returns above 12%.

- The S&P 500 return in 2015 was + 1.3%

- However, without Microsoft (+37%), Amazon (+117%), Facebook (+34%) and Google (+45%), the S&P 500 would have been down -2.55.

- The average stock in the S&P 500 was down -3.78% in 2015

- MSCI all cap world index was down about -2.2% in 2015

- A standard 60/40 Vanguard portfolio with no advisor fees was down -.57% for 2015

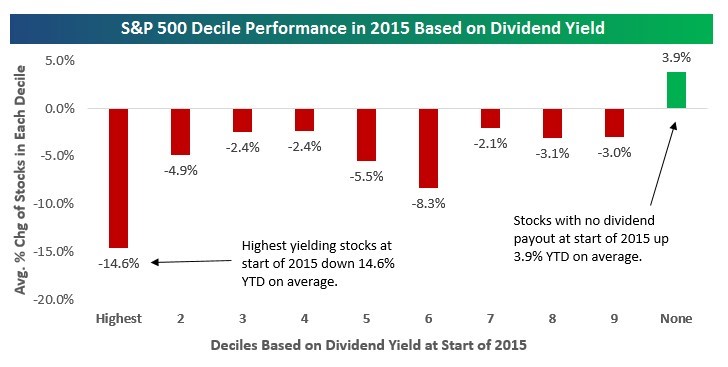

- 2015 was the year of Mega Cap US stocks with high growth, no dividends, and little profit. High quality bonds and some hedging strategies also did well.

We will be publishing our detailed analysis in the next few weeks but it is important to note that although the S&P 500 had its 7th year of gains, future stock market gains will most likely be below their historical averages for both stocks and bonds. It is important to have a solid philosophy, strategy and process for your portfolio. Monitor your spending, save more for retirement and be prepared for more volatility.

If you need help, give us a call at 303-549-4720. Click here to subscribe to my blog or email us for a free 2nd Opinion about your portfolio

Source: Bespoke

Part 2: What strategy should I use?

Successful investing is about Philosophy, Strategy and Process.

Dividend stocks and high dividend funds have become much too popular over the last several years (especially for retirees). My point in the post from 7/2014 is that chasing high dividends is dangerous! What investors should desire is the “value factor” and they shouldn’t care if there is a dividend or not. My point from the post at the beginning of this thread is that successful investors may want to incorporate other factors into their investing strategy than just dividend yield.

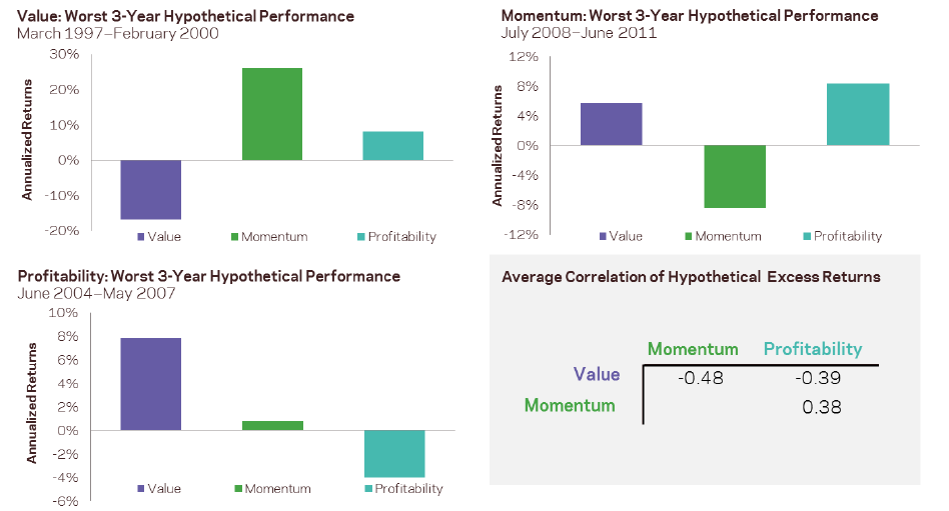

I suggest that rather than just using dividend yield, investors should incorporate other factors (like price to book, price to sales, shareholder yield, momentum and company profitability). These factors may enhance returns over time.

The Explanatory Power Of Dividends (via Larry Swedroe)

“For the past 20 years, the workhorse model in finance has been what is generally referred to as the Fama-French four-factor model—the four factors being beta, size, value and momentum. The model explains the vast majority—more than 90 percent—of the differences in returns of diversified portfolios.

If dividends played an important role in determining returns, then the four-factor model wouldn’t work as well as it does, since dividends are not one of the factors. If, in fact, dividends added explanatory power beyond those of these factors, we would have a factor model that included dividends as one of the factors. But we don’t. This has important implications because 60% of US Stocks and 40% of international stocks don’t pay a dividend.”

Does a high-dividend strategy help or hurt returns? – CBS News

Why chasing dividends is a mistake – CBS News

Why a High-Dividend Stock Strategy Isn’t a Good Approach – CBS News

The data suggests that Value factors (price to book, price to sales, price to earnings- not dividends) is negatively correlated to Profitability and to Momentum. Thus, you get diversification among factors. When Value has a bad year like 2015, there is a chance that momentum and profitability are positive. Ideally, you want to own companies that are cheap, highly profitable and have positive momentum. See chart below. If you need help contact us.

Good luck to all,

Todd

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/