Are You Ready for Fed Liftoff?

I don’t know if the Fed will actually raise interest rates next week or not. I hope they do but you never can tell. Advice to current clients, move forward but with caution. We anticipate that future expected returns for both stocks and bonds will be lower than historical averages. This means that we may need to save more, spend less, work longer or reduce your lifestyle in retirement. If you need help, give us a call at 303-549-4720. Click here to subscribe to my blog or email us for a free 2nd Opinion about your portfolio

Here are some key points to consider:

- The stock market is up 250% to 300% from the market lows of March 2009

- Unemployment was 10%+ and is now at 5%.

- If you have a college degree, unemployment is at 2.5%

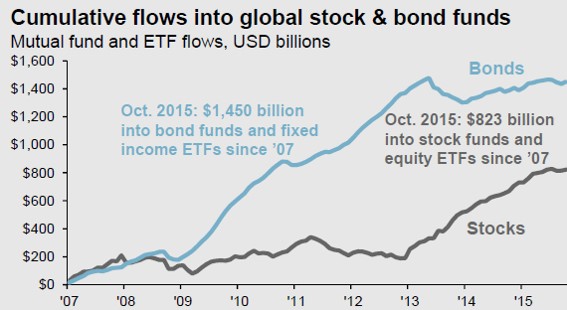

- This has been one of the most hated bull markets in history. Look at the chart 1 below for cumulative mutual fund flows into stocks and bonds since 2007. $1.45 Trillion into bonds and only $823 Billion into stocks.

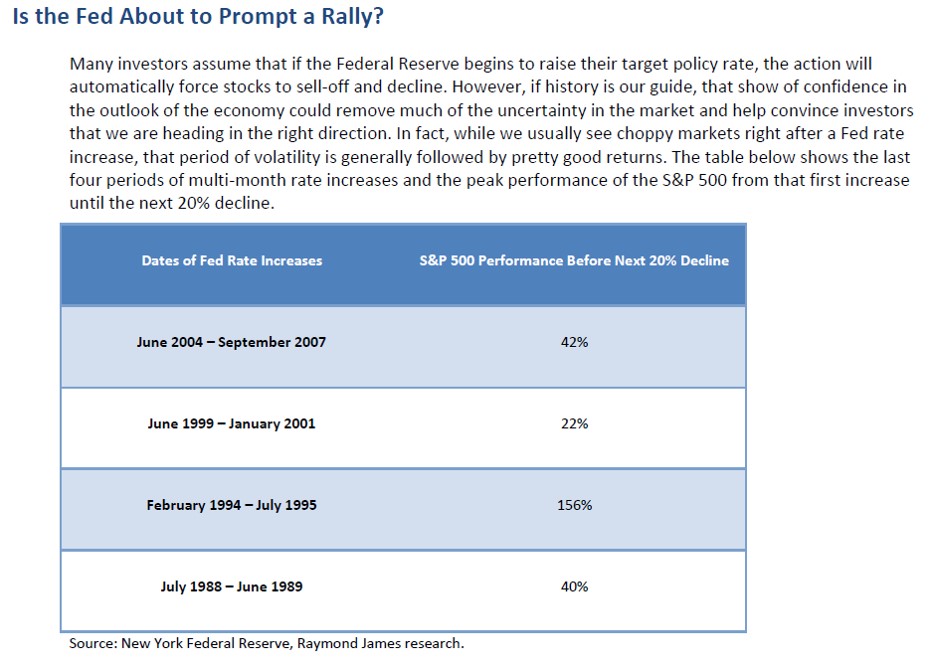

- Many people assume that when the Fed raises interest rates, stocks will decline. However, as you can see in chart 2 below, that is not the case over the last 4 rate increase cycles.

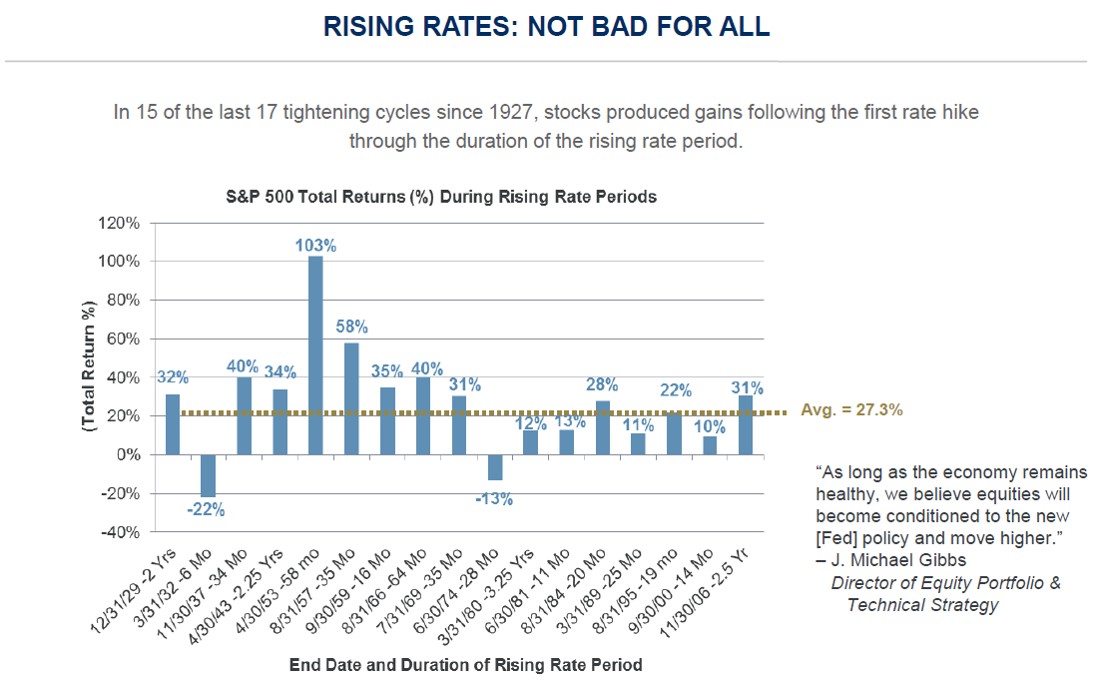

- In fact, 15 of the last 17 tightening cycles have produced gains after the first rate hike. See chart 3. Average of a 27% gain.

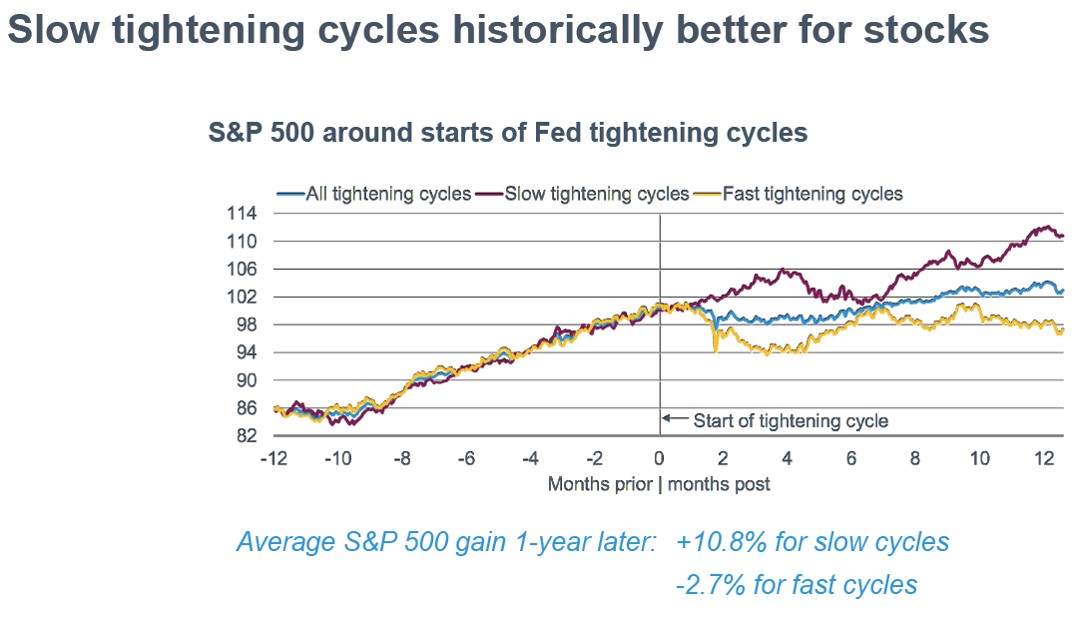

- Low and slow is typically better for stocks — see chart 4 (+10% in the first year)

- Read – the below

Keep Calm or Freak Out?

Average is Not Normal

Will You Run Out of Money?

Chart 1 (source JP Morgan)

Chart 2

Chart 3 (source Raymond James, Institutional Research)

Chart 4 (source NDR)

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/