When you invest in the stock market, average is Not Normal.

The S&P 500 has been up each of the last 6 years and as of 10/13/15 is down -1% for 2015. We will see if we can get another positive year.

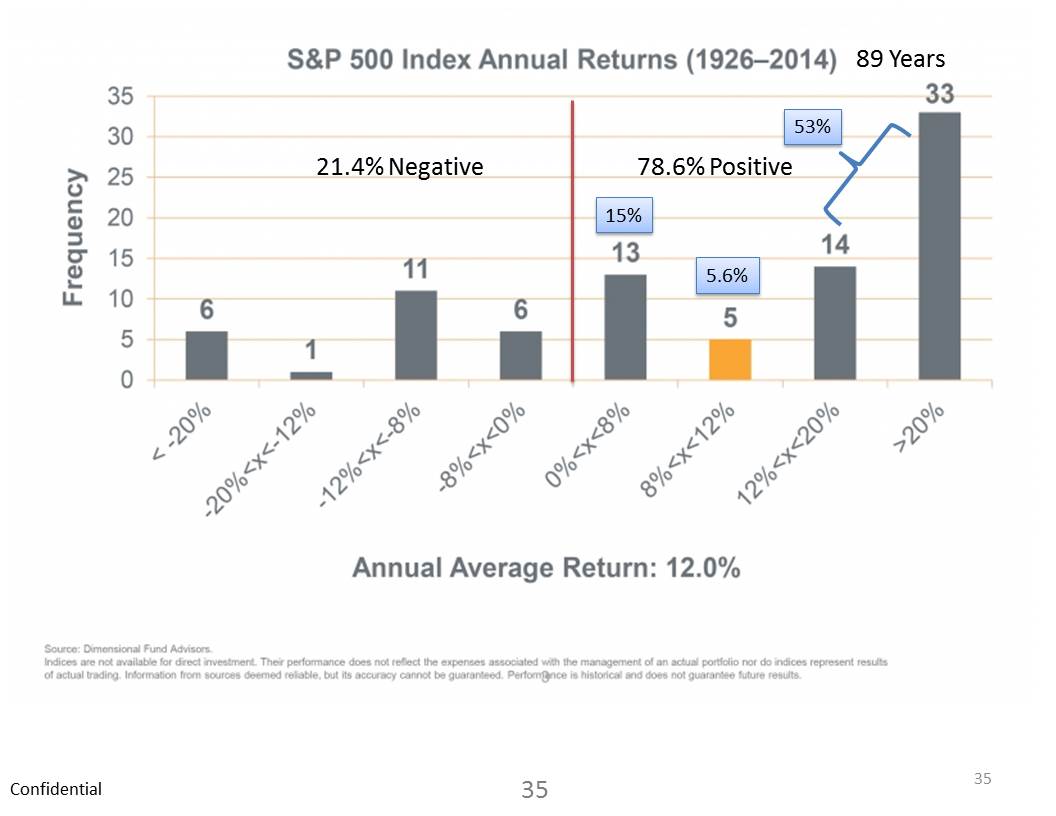

Since 1926 (89 years):

- The S&P 500 is positive 78.6% of the time and negative 21.4% of the time.

- The average return is about 12% per year over the 89 years

- The average return over the last 10 years about 9.5% per year, average over the last 15 years is 6% per year, average over the last 20 years is 11.75% per year.

However, only about 5.6% of the years have a return of between 8% and 12%. Shockingly, 53% of the years have returns above 12%.

Successful investing is about Philosophy, Strategy and Process.

Investing is about having a plan and sticking to it. Investing is about process and discipline. It is perfectly normal for stocks to go up and down 5% to 25% in a very short period of time. Focus on the long-term… 10 years, 20 years, 30 years, 40 years+

We believe in low cost investing and if you hire an Advisor, they should be a fiduciary for you 100% of the time.

Your net returns will be primarily driven by the following:

1) Investor behavior (do you panic and sell at market lows)

2) Asset allocation (your mix of stocks/bonds/alternatives). We believe in tilting a portfolio toward value companies, smaller companies and companies with high profit. See why we use Dimensional Funds vs. Vanguard Funds

3) Fees and transaction costs (the lower the better)

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/