a tailor-made solution for the everyday millionaire

Get the service that you deserve

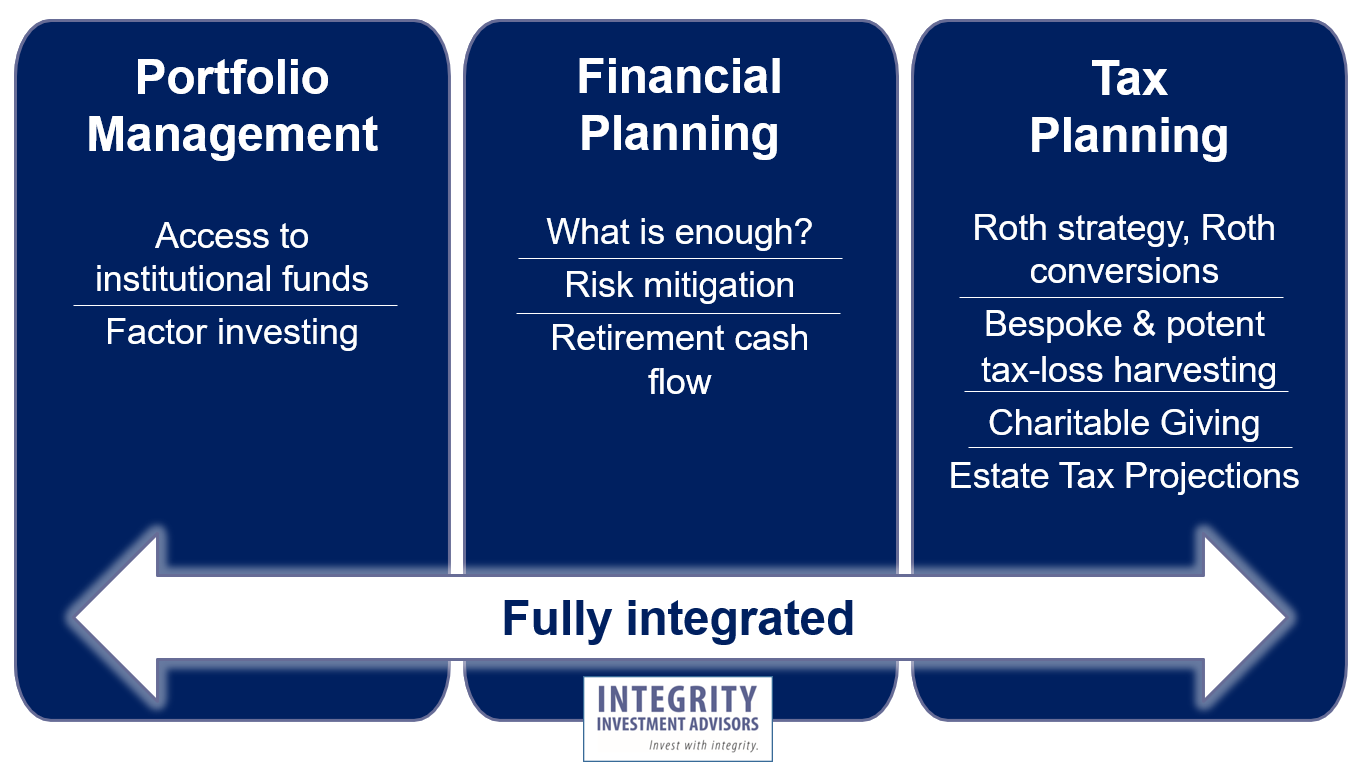

managing the full picture – not just your investment portfolio

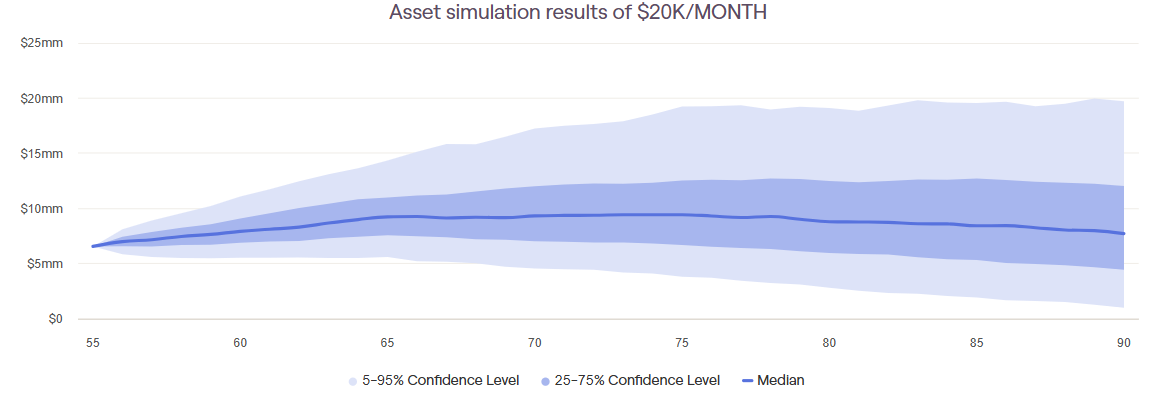

get confidence about your overall plan

We do our best work for people who are:

On either side of Retirement

key strategies for the 5-10 year window on either side of retirement

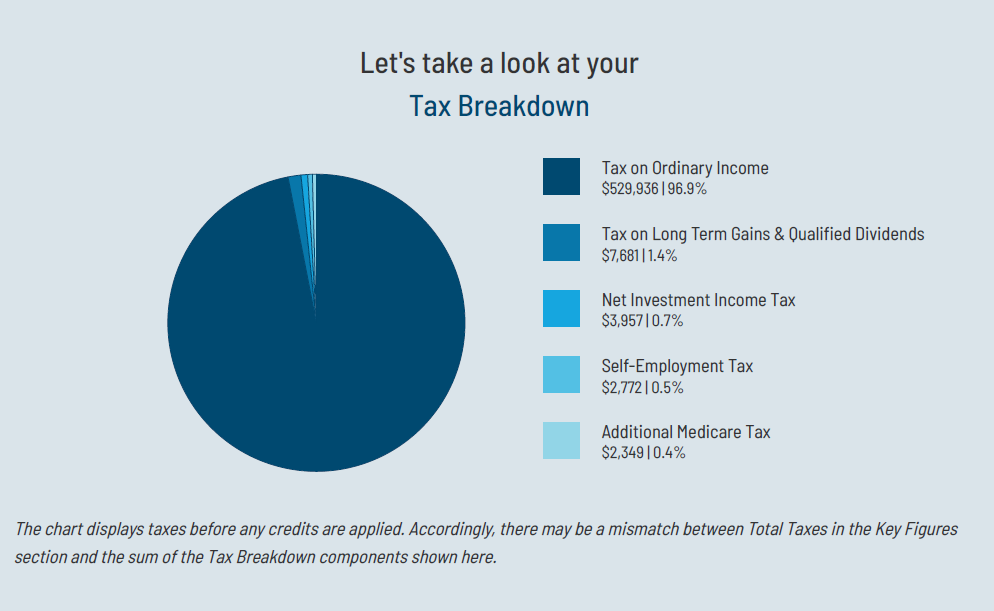

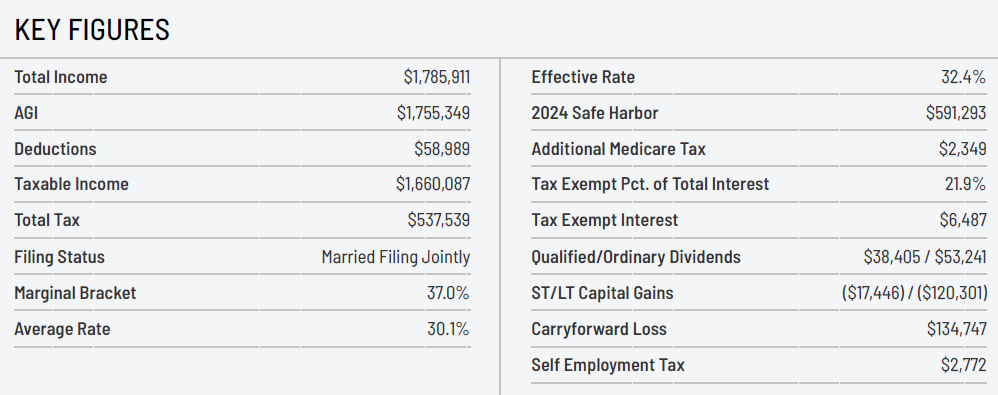

Planning for Large Taxable Events

potent solutions for selling a business, real estate, RSU’s, and concentrated positions

Running a Highly Profitable Business

maximize the business you’ve built and make the most of your cash flow

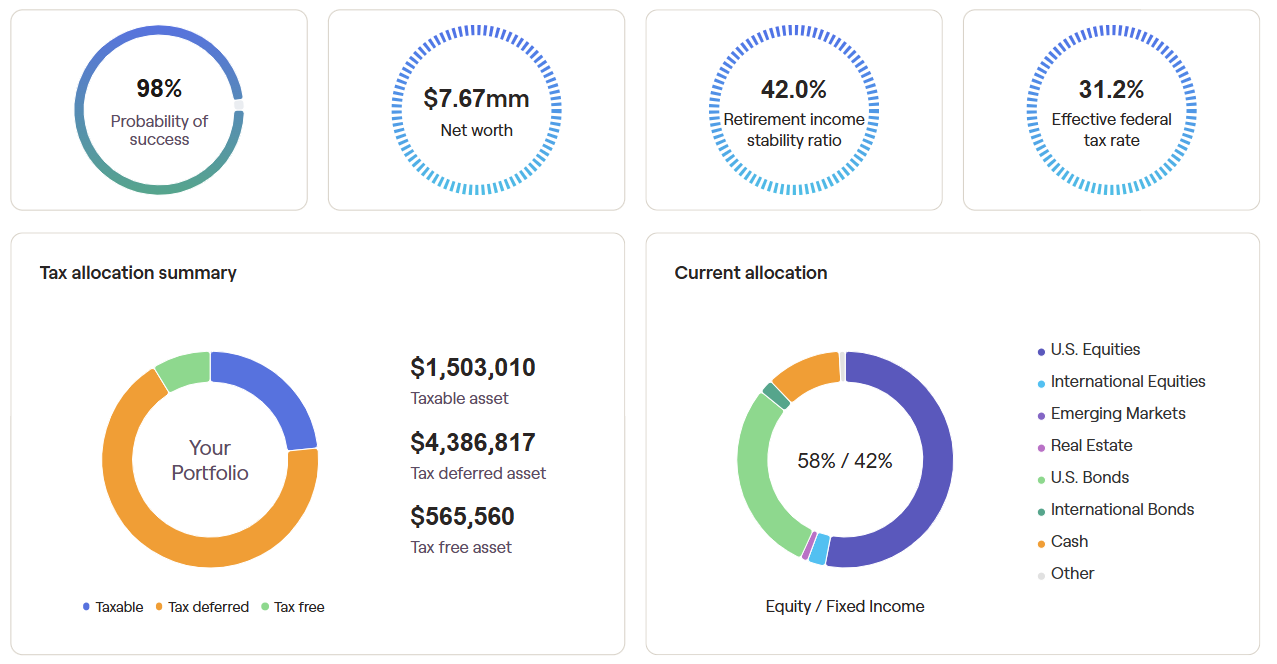

Top tier tech to provide you a top tier experience

Portfolio insights, in-depth planning, and tax strategy

All at your fingertips

As well as personable, kind, honest people that you can call, text, or email. No chat bots. No busy phone lines.

What else makes us different?

✅ A fair price with our fees start at 0.7% and then decline thereafter. For example, a $3M portfolio is only 0.50%

✅ A holistic approach with a focus on lowering fees and taxes

✅ data-driven investing and portfolio construction

✅ cutting edge solutions for key taxable events, much better than direct indexing

Get a 2nd opinion

Trust, but verify.

Get feedback on red flags in your portfolio, total fees in dollars and percentages, Roth conversion & Roth strategy, social security optimization, key tax moves you are missing, and more

Fort Collins Based, Fee-Only Compensation, Invest with Integrity (we work with clients on a national basis)

This model minimizes conflicts of interest.

A Fee-Only financial advisor charges clients directly for his or her advice and/or ongoing management. No other financial incentive is provided, directly or indirectly, by any other institution. Fee-Only financial advisors do not sell anything. They add value with their Philosophy, Strategy, Process, Transparency and Ongoing Coaching.

We strongly encourage you to work with a fee-only Advisor. We are a low cost DFA Advisor firm.

Like What You’ve Read?

If so, click here to sign up for our blog to get timely and valuable information about the markets. Your retirement will thank you!

Subscribe To Our Blog! We helpClients retire without getting killed in taxes!

Free tools & Checklists! Your Retirement will thank you!

Free & valuable information to help you maintain your lifestyle in retirement. We cover Vanguard indexing, DFA and factor investing (value, small cap, high profit, momentum). Free tools & market insights.

See why you may need a low-cost, fee only Advisor who is a fiduciary for you 100% of the time.

You have successfully subscribed. Thank you! Here are some free resources - Video - A note from your future self - https://youtu.be/HKMYTLyhOGU 5 Free Checklists That May Save You Thousands – Really! Countless people need help in these areas. Checklists include: end of year tax planning, funding a child's college education, caring for aging parents, items to consider before you retire, critical documents to keep on file. Please like & share with family & friends. You can download the PDFs for free. https://www.integrityia.com/5-free-checklists-that-may-save-you-thousands-really/